Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding MedCap (STO:MCAP).

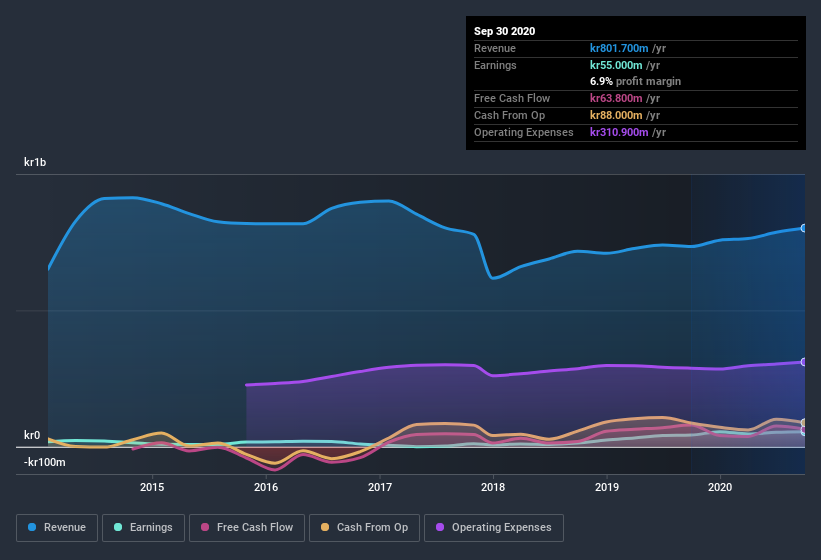

It's good to see that over the last twelve months MedCap made a profit of kr55.0m on revenue of kr801.7m. As you can see in the chart below, it has grown its profits over the last three years, despite the fact its revenue has been steady.

View our latest analysis for MedCap

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. In this article we'll look at how MedCap is impacting shareholders by issuing new shares. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, MedCap increased the number of shares on issue by 10.0% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out MedCap's historical EPS growth by clicking on this link.

How Is Dilution Impacting MedCap's Earnings Per Share? (EPS)

As you can see above, MedCap has been growing its net income over the last few years, with an annualized gain of 586% over three years. In comparison, earnings per share only gained 556% over the same period. And at a glance the 28% gain in profit over the last year impresses. But in comparison, EPS only increased by 23% over the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if MedCap can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On MedCap's Profit Performance

MedCap shareholders should keep in mind how many new shares it is issuing, because, dilution clearly has the power to severely impact shareholder returns. Therefore, it seems possible to us that MedCap's true underlying earnings power is actually less than its statutory profit. But the good news is that its EPS growth over the last three years has been very impressive. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into MedCap, you'd also look into what risks it is currently facing. In terms of investment risks, we've identified 1 warning sign with MedCap, and understanding it should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of MedCap's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade MedCap, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:MCAP

MedCap

A private equity firm specializing in investments in secondary direct, later stage, industry consolidation, add-on acquisitions, growth capital, middle market, mature, turnarounds, buyout.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives