- Sweden

- /

- Life Sciences

- /

- OM:MCAP

Imagine Holding MedCap (STO:MCAP) Shares While The Price Zoomed 558% Higher

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the MedCap AB (publ) (STO:MCAP) share price has soared 558% over five years. If that doesn't get you thinking about long term investing, we don't know what will. In the last week the share price is up 1.5%.

It really delights us to see such great share price performance for investors.

See our latest analysis for MedCap

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

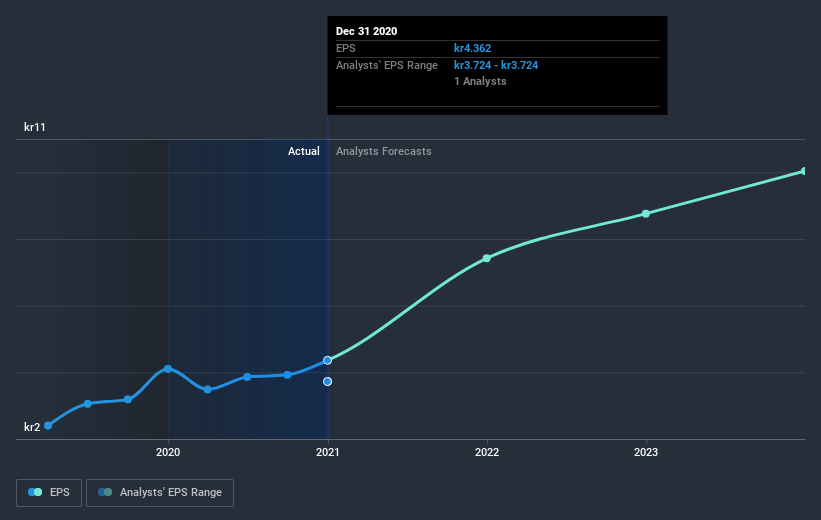

Over half a decade, MedCap managed to grow its earnings per share at 27% a year. This EPS growth is slower than the share price growth of 46% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 46.31.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how MedCap has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at MedCap's financial health with this free report on its balance sheet.

A Different Perspective

MedCap shareholders gained a total return of 58% during the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 46% per year over five year. It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand MedCap better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for MedCap you should be aware of.

But note: MedCap may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading MedCap or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:MCAP

MedCap

A private equity firm specializing in investments in secondary direct, later stage, industry consolidation, add-on acquisitions, growth capital, middle market, mature, turnarounds, buyout.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives