We Discuss Why Karolinska Development AB (publ)'s (STO:KDEV) CEO Compensation May Be Closely Reviewed

Key Insights

- Karolinska Development to hold its Annual General Meeting on 15th of May

- CEO Viktor Drvota's total compensation includes salary of kr3.06m

- The total compensation is similar to the average for the industry

- Karolinska Development's EPS declined by 6.4% over the past three years while total shareholder loss over the past three years was 62%

Shareholders will probably not be too impressed with the underwhelming results at Karolinska Development AB (publ) (STO:KDEV) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 15th of May. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Karolinska Development

How Does Total Compensation For Viktor Drvota Compare With Other Companies In The Industry?

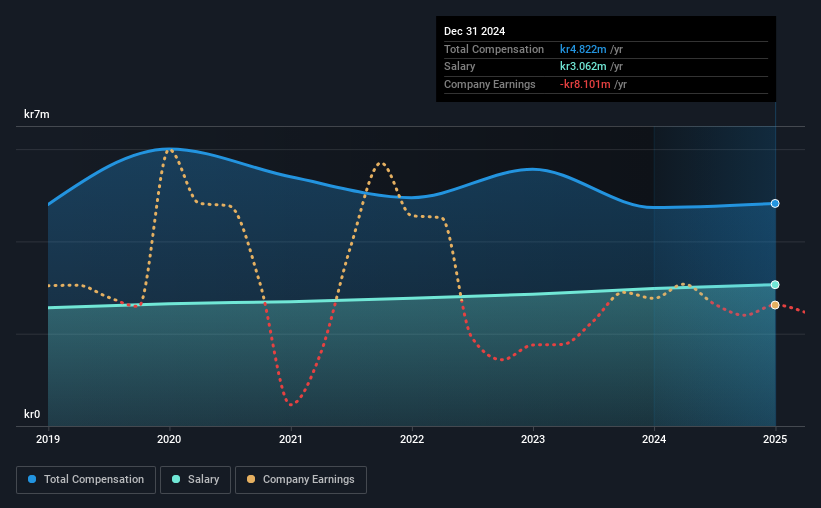

According to our data, Karolinska Development AB (publ) has a market capitalization of kr258m, and paid its CEO total annual compensation worth kr4.8m over the year to December 2024. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at kr3.06m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Swedish Pharmaceuticals industry with market capitalizations under kr1.9b, the reported median total CEO compensation was kr4.2m. This suggests that Karolinska Development remunerates its CEO largely in line with the industry average.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr3.1m | kr3.0m | 64% |

| Other | kr1.8m | kr1.8m | 36% |

| Total Compensation | kr4.8m | kr4.7m | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. Karolinska Development pays a modest slice of remuneration through salary, as compared to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Karolinska Development AB (publ)'s Growth Numbers

Karolinska Development AB (publ) has reduced its earnings per share by 6.4% a year over the last three years. In the last year, its revenue is down 1.7%.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Karolinska Development AB (publ) Been A Good Investment?

Few Karolinska Development AB (publ) shareholders would feel satisfied with the return of -62% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Karolinska Development (of which 2 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Karolinska Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:KDEV

Karolinska Development

A venture capital firm specializing in investments in growth capital, seed stage, and early stage companies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success