Is Karo Pharma AB (publ)'s (STO:KARO) 1.5% ROE Worse Than Average?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). By way of learning-by-doing, we'll look at ROE to gain a better understanding of Karo Pharma AB (publ) (STO:KARO).

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Karo Pharma

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Karo Pharma is:

1.5% = kr83m ÷ kr5.6b (Based on the trailing twelve months to December 2020).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every SEK1 worth of equity, the company was able to earn SEK0.01 in profit.

Does Karo Pharma Have A Good Return On Equity?

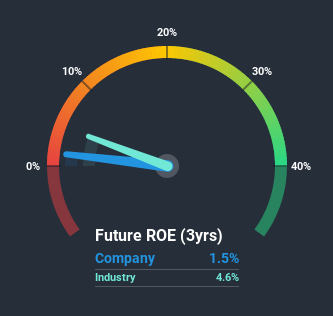

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As is clear from the image below, Karo Pharma has a lower ROE than the average (4.6%) in the Pharmaceuticals industry.

That certainly isn't ideal. Although, we think that a lower ROE could still mean that a company has the opportunity to better its returns with the use of leverage, provided its existing debt levels are low. A high debt company having a low ROE is a different story altogether and a risky investment in our books. To know the 3 risks we have identified for Karo Pharma visit our risks dashboard for free.

The Importance Of Debt To Return On Equity

Most companies need money -- from somewhere -- to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. That will make the ROE look better than if no debt was used.

Combining Karo Pharma's Debt And Its 1.5% Return On Equity

Karo Pharma clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.12. With a fairly low ROE, and significant use of debt, it's hard to get excited about this business at the moment. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Conclusion

Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have the same ROE, then I would generally prefer the one with less debt.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. Check the past profit growth by Karo Pharma by looking at this visualization of past earnings, revenue and cash flow.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

When trading Karo Pharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Karo Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:KARO

Karo Pharma

Karo Pharma AB (publ) develops and markets prescription drugs and over-the-counter products for pharmacies and retail sector in Sweden, Norway, Denmark, Finland, France, Germany, Italy, rest of Europe, the United States, and internationally.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives