Did You Participate In Any Of Karo Pharma's (STO:KARO) Fantastic 144% Return ?

Karo Pharma AB (publ) (STO:KARO) shareholders might be concerned after seeing the share price drop 22% in the last quarter. But the silver lining is the stock is up over five years. In that time, it is up 79%, which isn't bad, but is below the market return of 88%.

See our latest analysis for Karo Pharma

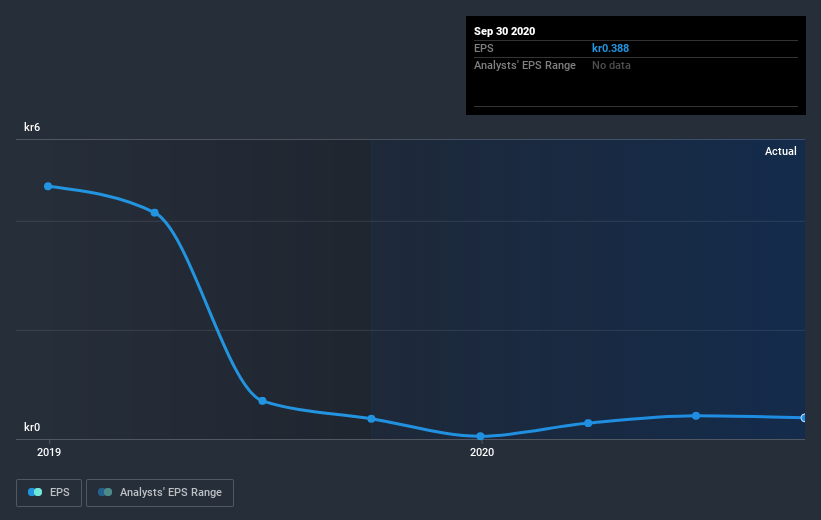

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Karo Pharma became profitable. That would generally be considered a positive, so we'd expect the share price to be up.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Karo Pharma's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Karo Pharma's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Karo Pharma shareholders, and that cash payout contributed to why its TSR of 144%, over the last 5 years, is better than the share price return.

A Different Perspective

Karo Pharma provided a TSR of 11% over the last twelve months. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 20% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Karo Pharma (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

We will like Karo Pharma better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Karo Pharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Karo Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:KARO

Karo Pharma

Karo Pharma AB (publ) develops and markets prescription drugs and over-the-counter products for pharmacies and retail sector in Sweden, Norway, Denmark, Finland, France, Germany, Italy, rest of Europe, the United States, and internationally.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives