It's Down 26% But Hansa Biopharma AB (publ) (STO:HNSA) Could Be Riskier Than It Looks

Hansa Biopharma AB (publ) (STO:HNSA) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

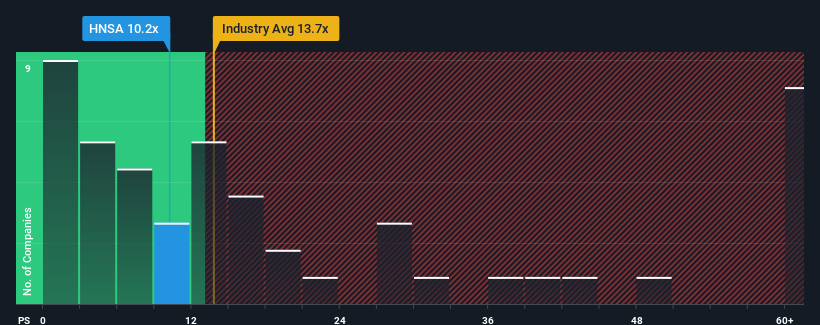

Following the heavy fall in price, Hansa Biopharma may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 10.2x, since almost half of all companies in the Biotechs industry in Sweden have P/S ratios greater than 13.7x and even P/S higher than 31x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Hansa Biopharma

What Does Hansa Biopharma's Recent Performance Look Like?

Recent times have been advantageous for Hansa Biopharma as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Hansa Biopharma's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Hansa Biopharma's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 83% per year as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 46% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Hansa Biopharma's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The southerly movements of Hansa Biopharma's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Hansa Biopharma's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Hansa Biopharma is showing 5 warning signs in our investment analysis, and 2 of those are concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hansa Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HNSA

Hansa Biopharma

A biopharmaceutical company, engages in development and commercialization of treatments for patients with rare immunological conditions in Sweden, North America, and rest of Europe.

High growth potential with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026