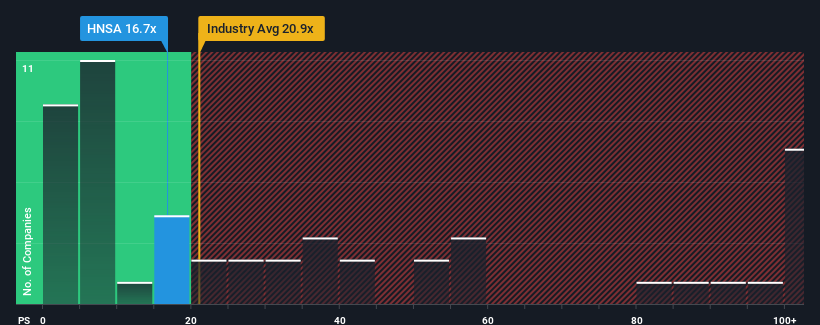

Hansa Biopharma AB (publ)'s (STO:HNSA) price-to-sales (or "P/S") ratio of 16.7x might make it look like a buy right now compared to the Biotechs industry in Sweden, where around half of the companies have P/S ratios above 20.9x and even P/S above 56x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Hansa Biopharma

How Hansa Biopharma Has Been Performing

Recent times haven't been great for Hansa Biopharma as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hansa Biopharma.Is There Any Revenue Growth Forecasted For Hansa Biopharma?

Hansa Biopharma's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 169% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 102% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 39% each year growth forecast for the broader industry.

With this information, we find it odd that Hansa Biopharma is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Hansa Biopharma's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Hansa Biopharma currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Hansa Biopharma that you should be aware of.

If you're unsure about the strength of Hansa Biopharma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hansa Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HNSA

Hansa Biopharma

A biopharmaceutical company, engages in development and commercialization of treatments for patients with rare immunological conditions in Sweden, North America, and rest of Europe.

High growth potential very low.

Market Insights

Community Narratives