Hansa Biopharma AB (publ) (STO:HNSA) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Hansa Biopharma AB (publ) (STO:HNSA) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

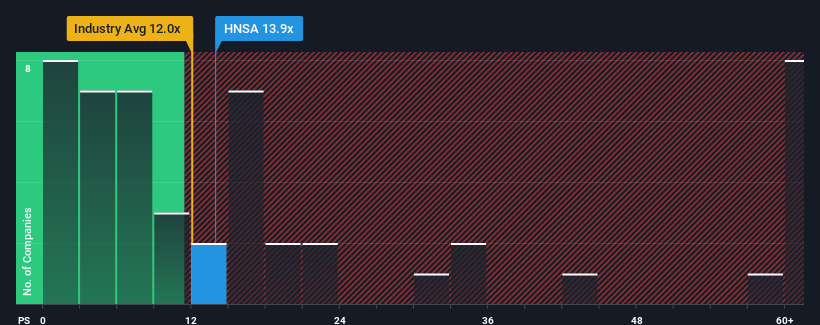

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Hansa Biopharma's P/S ratio of 13.9x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in Sweden is also close to 12x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hansa Biopharma

What Does Hansa Biopharma's Recent Performance Look Like?

Recent times have been advantageous for Hansa Biopharma as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Hansa Biopharma will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Hansa Biopharma?

The only time you'd be comfortable seeing a P/S like Hansa Biopharma's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 65% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 70% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 78% each year, which is not materially different.

In light of this, it's understandable that Hansa Biopharma's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Its shares have lifted substantially and now Hansa Biopharma's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Hansa Biopharma maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It is also worth noting that we have found 5 warning signs for Hansa Biopharma (1 is a bit unpleasant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hansa Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HNSA

Hansa Biopharma

A biopharmaceutical company, engages in development and commercialization of treatments for patients with rare immunological conditions in Sweden, North America, and rest of Europe.

High growth potential with slight risk.

Market Insights

Community Narratives