Investors Who Bought Enzymatica (STO:ENZY) Shares A Year Ago Are Now Up 453%

It might be of some concern to shareholders to see the Enzymatica AB (STO:ENZY) share price down 18% in the last month. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In that time, shareholders have had the pleasure of a 453% boost to the share price. So it is not that surprising to see the stock retrace a little. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

Check out our latest analysis for Enzymatica

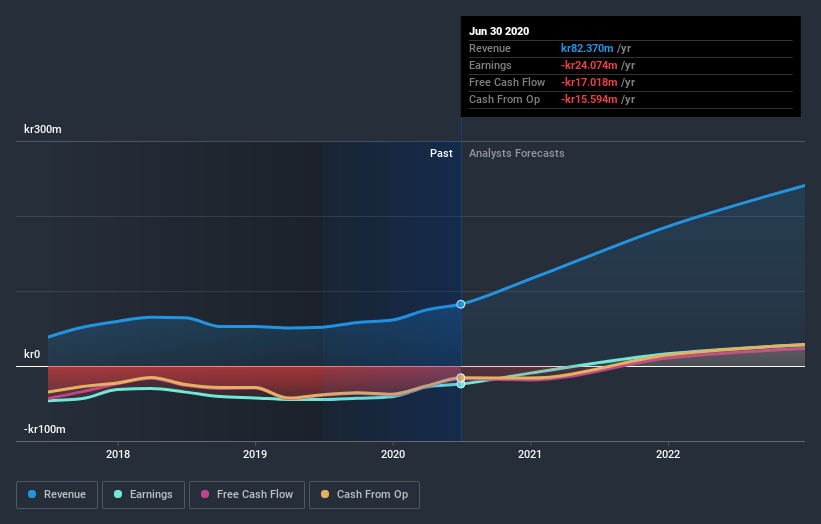

Because Enzymatica made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Enzymatica saw its revenue grow by 59%. That's a head and shoulders above most loss-making companies. But the share price has really rocketed in response gaining 453% as previously mentioned. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. So this looks like a great watchlist candidate for investors who look for high growth inflexion points.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Enzymatica will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Enzymatica's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Enzymatica hasn't been paying dividends, but its TSR of 453% exceeds its share price return of 453%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Enzymatica has rewarded shareholders with a total shareholder return of 453% in the last twelve months. That gain is better than the annual TSR over five years, which is 29%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Enzymatica you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you’re looking to trade Enzymatica, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enzymatica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:ENZY

Enzymatica

A life science company, develops and sells products that treat and alleviate infections and symptoms in the upper respiratory tract.

Medium-low with excellent balance sheet.

Market Insights

Community Narratives