Revenues Tell The Story For Devyser Diagnostics AB (publ) (STO:DVYSR) As Its Stock Soars 31%

Devyser Diagnostics AB (publ) (STO:DVYSR) shares have continued their recent momentum with a 31% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

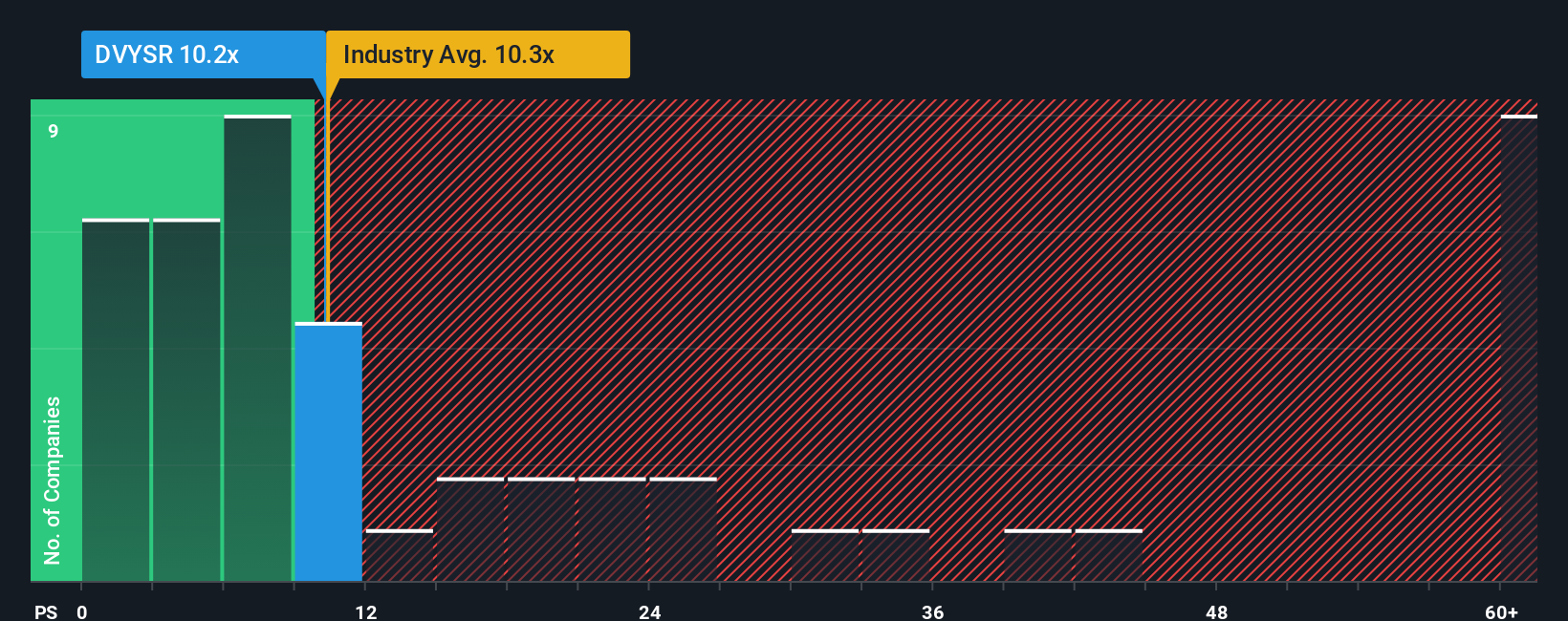

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Devyser Diagnostics' P/S ratio of 10.2x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in Sweden is also close to 10.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Devyser Diagnostics

How Devyser Diagnostics Has Been Performing

Recent times haven't been great for Devyser Diagnostics as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Devyser Diagnostics.How Is Devyser Diagnostics' Revenue Growth Trending?

Devyser Diagnostics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The latest three year period has also seen an excellent 113% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 39% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 41% per annum, which is not materially different.

In light of this, it's understandable that Devyser Diagnostics' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Devyser Diagnostics' P/S Mean For Investors?

Devyser Diagnostics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Devyser Diagnostics maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Devyser Diagnostics with six simple checks.

If you're unsure about the strength of Devyser Diagnostics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:DVYSR

Devyser Diagnostics

Engages in the development, manufacture, and sale of diagnostic kits and solutions for DNA testing within hereditary diseases, oncology, and post-transplantation monitoring in Sweden, rest of Europe, the Middle East, Africa, North and South America, and Asia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives