- Poland

- /

- Food and Staples Retail

- /

- WSE:DNP

European Growth Companies With High Insider Ownership In September 2025

Reviewed by Simply Wall St

In September 2025, the European markets have been navigating a complex economic landscape, with the pan-European STOXX Europe 600 Index ending slightly lower amid a series of monetary policy decisions. As investors assess these developments, growth companies with high insider ownership can offer unique insights into market confidence and potential resilience during such fluctuating times.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.8% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 91% |

| KebNi (OM:KEBNI B) | 38% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 13.3% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's review some notable picks from our screened stocks.

Oryzon Genomics (BME:ORY)

Simply Wall St Growth Rating: ★★★★★☆

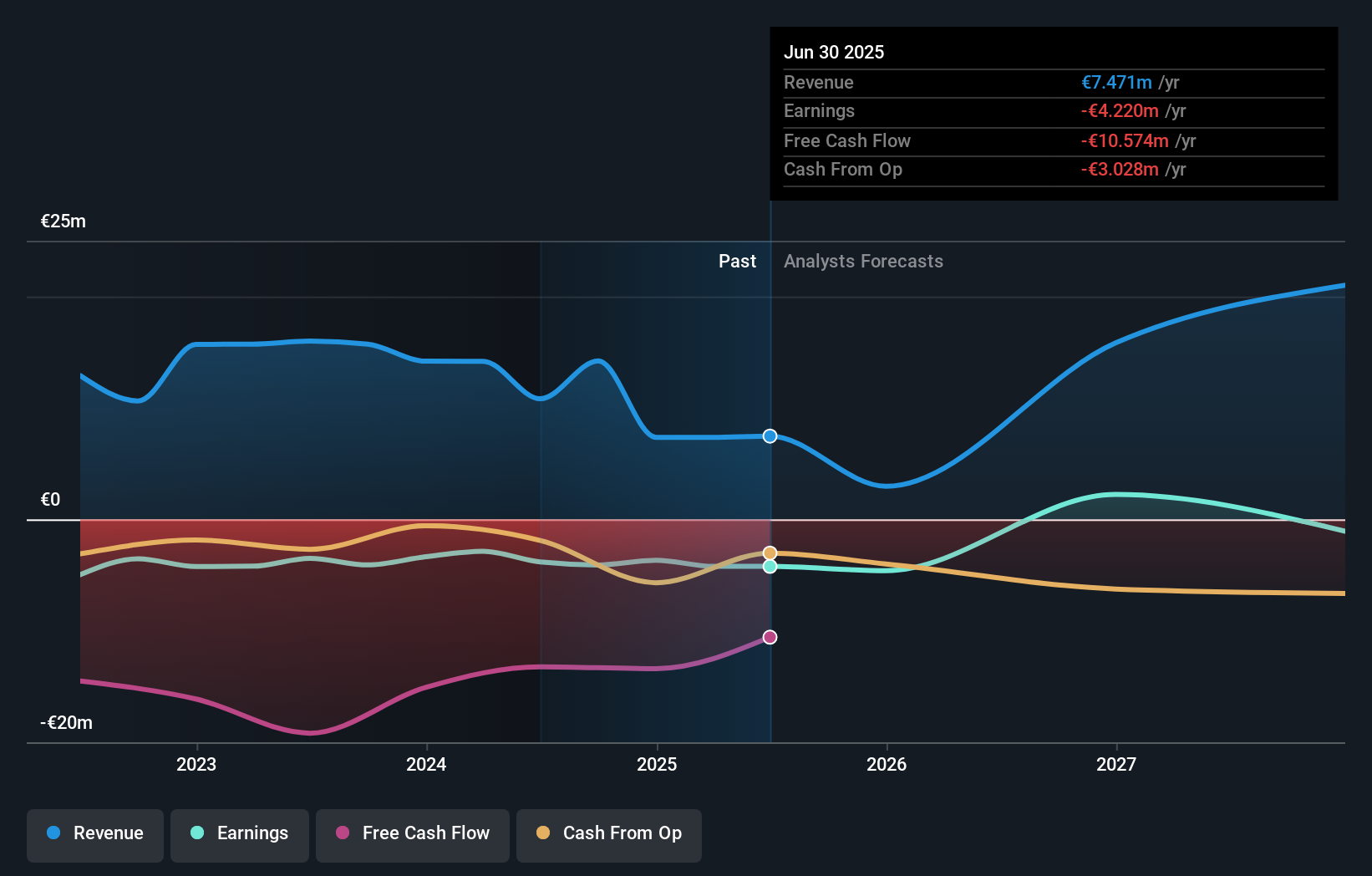

Overview: Oryzon Genomics S.A. is a clinical stage biopharmaceutical company focused on developing epigenetics-based therapeutics for cancer and CNS disorders, with a market cap of approximately €259.43 million.

Operations: The company's revenue is primarily generated from its biotechnology segment, amounting to €7.47 million.

Insider Ownership: 16.9%

Oryzon Genomics, recently added to the S&P Global BMI Index, is poised for significant growth with revenue expected to increase by 56% annually, outpacing the Spanish market. Despite a net loss of €1.59 million in H1 2025 and past shareholder dilution, its strategic focus on innovative treatments like iadademstat for sickle cell disease and oncology trials highlights strong potential. The company's high insider ownership aligns interests with shareholders amid volatile share prices.

- Unlock comprehensive insights into our analysis of Oryzon Genomics stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Oryzon Genomics shares in the market.

Devyser Diagnostics (OM:DVYSR)

Simply Wall St Growth Rating: ★★★★★☆

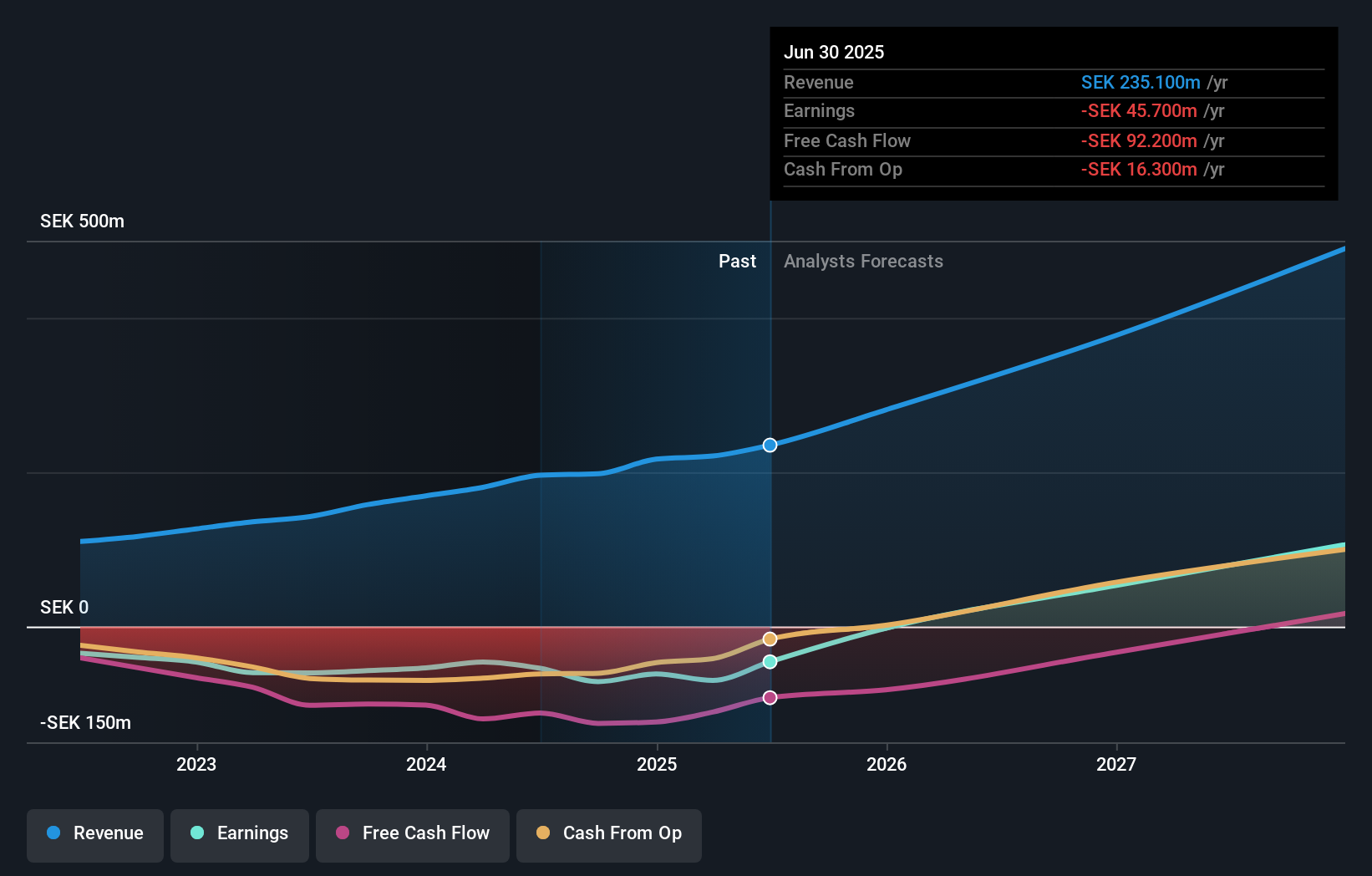

Overview: Devyser Diagnostics AB (publ) develops, manufactures, and sells diagnostic kits and solutions for DNA testing in areas such as hereditary diseases, oncology, and post-transplantation monitoring across various regions including Sweden, Europe, the Middle East, Africa, the Americas, and Asia with a market cap of SEK2.61 billion.

Operations: The company's revenue is primarily generated from the sale of diagnostic kits and equipment, amounting to SEK235.10 million.

Insider Ownership: 35.1%

Devyser Diagnostics is set for robust growth with expected annual revenue increases of 27.9%, surpassing the Swedish market average. Recent earnings show a turnaround, moving from a net loss to a net income in Q2 2025, indicating improving financial health. The launch of advanced genomic blood typing and HLA loss detection products underscores its innovation in molecular diagnostics. High insider ownership suggests aligned interests with shareholders as the company targets profitability within three years.

- Click here to discover the nuances of Devyser Diagnostics with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Devyser Diagnostics' current price could be inflated.

Dino Polska (WSE:DNP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dino Polska S.A. operates a network of mid-sized grocery supermarkets under the Dino brand in Poland, with a market cap of PLN45.13 billion.

Operations: Dino Polska generates revenue primarily through its retail network and online sales, amounting to PLN31.09 billion.

Insider Ownership: 30.7%

Dino Polska's strong growth trajectory is highlighted by its earnings, which grew 11% last year and are expected to increase significantly over the next three years, surpassing Polish market averages. The company reported robust sales of PLN 8.62 billion for Q2 2025, up from PLN 7.24 billion a year prior. Trading at a substantial discount to estimated fair value and with high insider ownership, Dino Polska aligns shareholder interests with its promising financial outlook.

- Take a closer look at Dino Polska's potential here in our earnings growth report.

- According our valuation report, there's an indication that Dino Polska's share price might be on the cheaper side.

Taking Advantage

- Embark on your investment journey to our 217 Fast Growing European Companies With High Insider Ownership selection here.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DNP

Dino Polska

Operates a network of medium-sized grocery supermarkets under the Dino brand in Poland.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives