Devyser Diagnostics (OM:DVYSR): Five-Year Losses Worsen, But 31% Annual Revenue Growth Sets Up Earnings Season

Reviewed by Simply Wall St

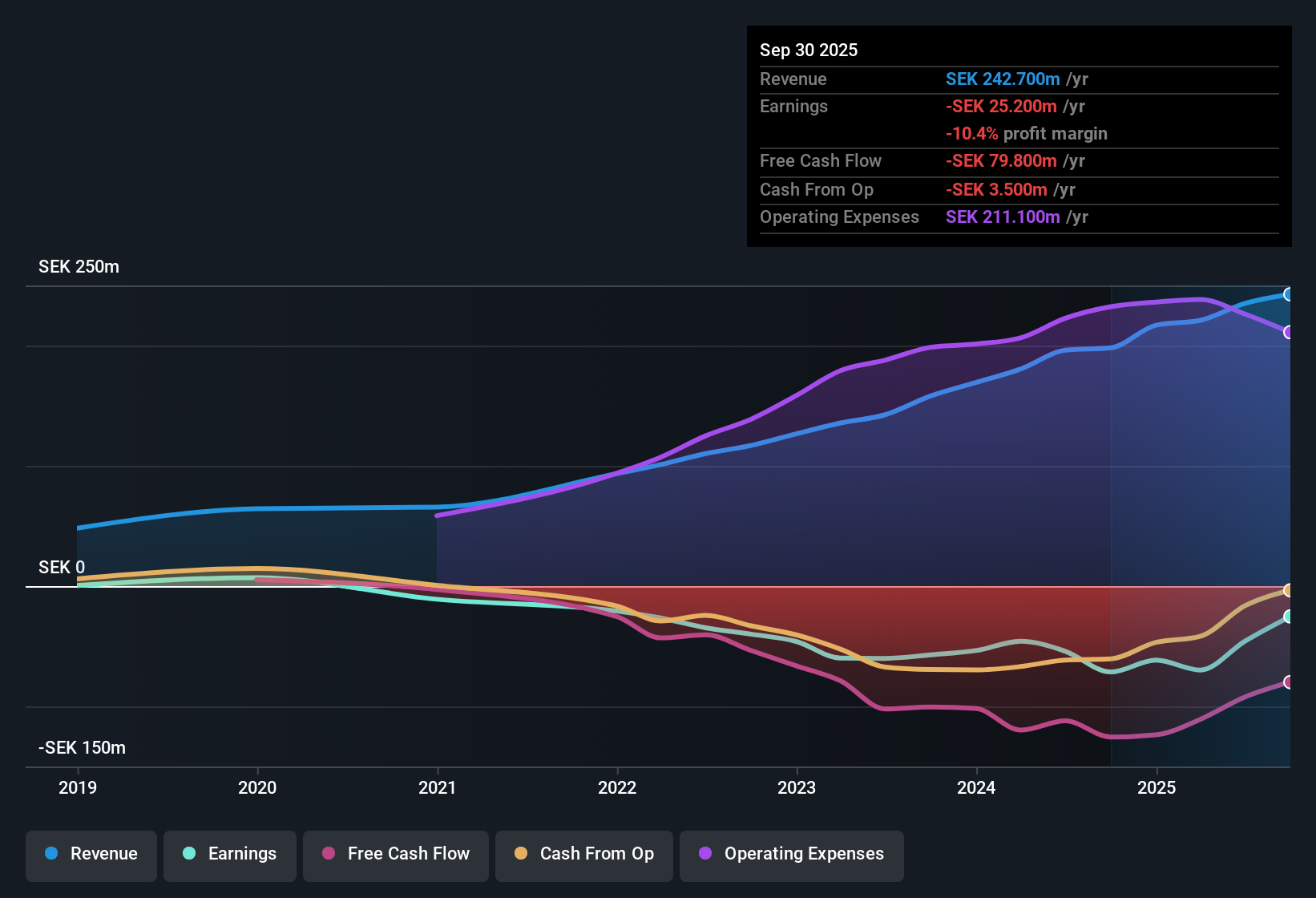

Devyser Diagnostics (OM:DVYSR) remains unprofitable, with losses deepening at an annual rate of 16.9% over the past five years. However, revenue is forecast to surge by 31.1% per year, outpacing the Swedish market’s 3.7% per year projected growth, and earnings are expected to rise sharply by 119.62% per year with profitability anticipated within the next three years. With the share price trading at SEK 115, well below the estimated fair value of SEK 583.07, investors are likely to focus on the combination of rapid growth potential, improving earnings trajectory, and favorable valuation multiples.

See our full analysis for Devyser Diagnostics.Now, let's see how these fresh results stack up against the current market narratives and expectations. Some stories may be confirmed, while others could face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Persist Despite Revenue Strength

- Annual net losses have expanded at a rate of 16.9% over the past five years, underscoring ongoing negative earnings quality and net profit margin for Devyser Diagnostics.

- This trend supports the optimistic view that rapid projected earnings growth, forecast at 119.62% per year, could soon reverse these repeated losses.

- Projected profitability within three years contrasts with longstanding unprofitability, suggesting a potential turning point that has not yet appeared on the income statement.

- Optimistic investors will focus on this forecast acceleration, arguing that downside risk may be less significant while top-line momentum continues.

Share Price Trades Far Below DCF Fair Value

- The SEK 115 share price currently sits 80% below the DCF fair value estimate of SEK 583.07, creating an unusually wide valuation gap that is not reflected by most sector peers.

- This significant discount presents an argument for upside potential that challenges concerns about overvaluation.

- The Price-To-Sales ratio of 7.9x is well below the peer average of 32.2x and also undercuts the broader industry average of 8.7x, so the claim that the stock is already "priced for perfection" is not reflected in current figures.

- Critics expecting an immediate correction would need to see either a sharp deterioration in growth forecasts or a market-wide rerating to challenge this margin of safety.

Growth Premium Versus Swedish Peers

- Revenue is forecast to grow at 31.1% per year, far exceeding the Swedish market average of 3.7% per year and outpacing typical diagnostics sector trends.

- The potential for a sustained growth premium remains a key point, with analysis indicating that this strong growth trajectory

- could attract investors even before positive net margins are reached, especially as current sector optimism in diagnostics prioritizes expansion and technological leadership over near-term profits.

- The absence of newly identified risk factors further supports the position that Devyser's momentum may help it achieve sector leadership in both revenue growth and valuation re-rating.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Devyser Diagnostics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive revenue projections, Devyser Diagnostics remains unprofitable with persistent annual losses. This highlights a lack of steady, proven earnings expansion.

If consistent results matter to you, use our stable growth stocks screener (2082 results) to discover companies delivering reliable growth and performance year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DVYSR

Devyser Diagnostics

Engages in the development, manufacture, and sale of diagnostic kits and solutions for DNA testing within hereditary diseases, oncology, and post-transplantation monitoring in Sweden, rest of Europe, the Middle East, Africa, North and South America, and Asia.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives