Investors Appear Satisfied With Camurus AB (publ)'s (STO:CAMX) Prospects

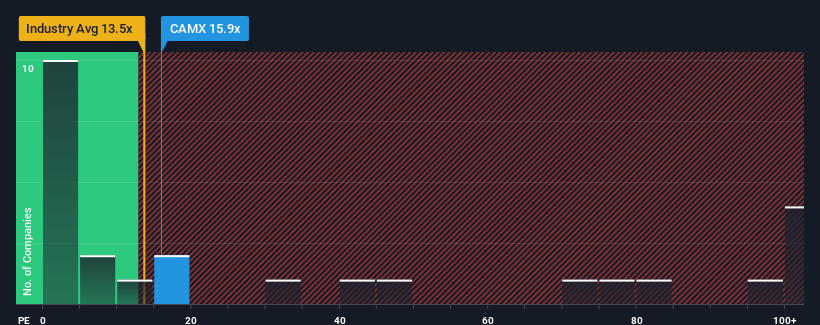

There wouldn't be many who think Camurus AB (publ)'s (STO:CAMX) price-to-sales (or "P/S") ratio of 15.9x is worth a mention when the median P/S for the Pharmaceuticals industry in Sweden is similar at about 13.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Camurus

How Has Camurus Performed Recently?

With revenue growth that's inferior to most other companies of late, Camurus has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Camurus' future stacks up against the industry? In that case, our free report is a great place to start.How Is Camurus' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Camurus' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 80%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 37% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 35% per year, which is not materially different.

With this information, we can see why Camurus is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Camurus' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Pharmaceuticals industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Camurus that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CAMX

Camurus

A biopharmaceutical company, develops and commercializes medicines for severe and chronic diseases in Europe, Africa, the Middle East, North America, and Asia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives