The Bull Case For Bonesupport Holding (OM:BONEX) Could Change Following CERAMENT G’s Zero Re-Infection Study Results

Reviewed by Simply Wall St

- Bonesupport Holding recently announced positive results from a clinical study at the EBJIS annual meeting, showing that CERAMENT® G significantly improved patient-reported outcomes and resulted in zero re-infections over 24 months for hip periprosthetic joint infection in a single-stage revision surgery.

- This study suggests CERAMENT® G could address a significant unmet need by reducing the typical two-stage approach to a one-stage procedure, potentially lowering the historically high reinfection risk seen in hip revision surgeries.

- We will explore how these clinical results reporting zero re-infections at two years may influence Bonesupport’s investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bonesupport Holding Investment Narrative Recap

Bonesupport Holding’s long-term appeal as an investment rests on its ability to deliver clinical innovation in bone infection treatment and convert positive trial data into commercial adoption and reimbursement. The latest two-year clinical data on CERAMENT G may strengthen the company’s case for broader procedure adoption, supporting the largest near-term catalyst, continued US launch momentum, while also helping address concerns about reliance on two-stage procedures; however, immediate financial impact will likely depend on reimbursement decisions and market access, particularly in Germany and the U.K., where staffing constraints remain a pressing risk.

Among recent developments, the April submission for CERAMENT V’s market authorization in the US stands out. Although separate in indication, this regulatory milestone may become more impactful if positive CERAMENT G data accelerates physician and payer confidence, supporting the broader adoption of Bonesupport’s product suite and amplifying growth prospects in infection management.

On the other hand, investors should be aware that, despite the clinical progress, risks such as regional reimbursement delays in key European markets could still...

Read the full narrative on Bonesupport Holding (it's free!)

Bonesupport Holding's narrative projects SEK2.6 billion revenue and SEK843.6 million earnings by 2028. This requires 35.2% yearly revenue growth and a SEK695.6 million earnings increase from SEK148.0 million.

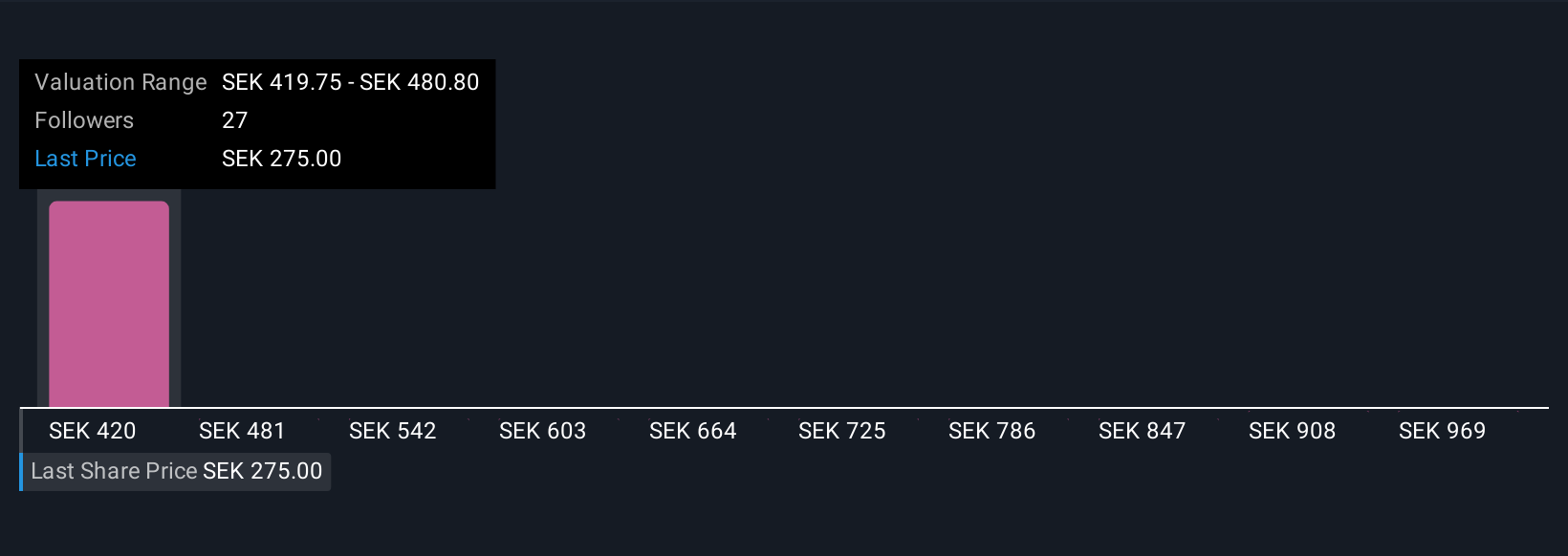

Uncover how Bonesupport Holding's forecasts yield a SEK419.75 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from SEK419.75 to SEK1,030.25, reflecting substantial variability among retail analysts. While many see strong future growth, European market access challenges remain a key issue shaping Bonesupport Holding’s trajectory, giving you several alternative outlooks to consider.

Explore 5 other fair value estimates on Bonesupport Holding - why the stock might be worth over 3x more than the current price!

Build Your Own Bonesupport Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bonesupport Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bonesupport Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bonesupport Holding's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonesupport Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONEX

Bonesupport Holding

An orthobiologics company, develops and sells injectable bio-ceramic bone graft substitutes in Europe, North America, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives