As global markets navigate the effects of rising U.S. Treasury yields and a cautious outlook on monetary policy, European stocks, including those in Sweden, have experienced some downward pressure. Despite these challenges, opportunities may exist for investors seeking undervalued stocks that are priced below their estimated value. In such an environment, identifying stocks with strong fundamentals and potential for growth can be key to capitalizing on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CTT Systems (OM:CTT) | SEK251.00 | SEK493.27 | 49.1% |

| Truecaller (OM:TRUE B) | SEK47.66 | SEK89.82 | 46.9% |

| TF Bank (OM:TFBANK) | SEK327.00 | SEK612.30 | 46.6% |

| DistIT (OM:DIST) | SEK3.80 | SEK7.00 | 45.7% |

| Tourn International (OM:TOURN) | SEK9.00 | SEK16.46 | 45.3% |

| Mentice (OM:MNTC) | SEK28.30 | SEK51.18 | 44.7% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

| IAR Systems Group (OM:IAR B) | SEK122.50 | SEK226.00 | 45.8% |

| Byggmax Group (OM:BMAX) | SEK44.36 | SEK84.85 | 47.7% |

| Bactiguard Holding (OM:BACTI B) | SEK44.60 | SEK82.83 | 46.2% |

Here we highlight a subset of our preferred stocks from the screener.

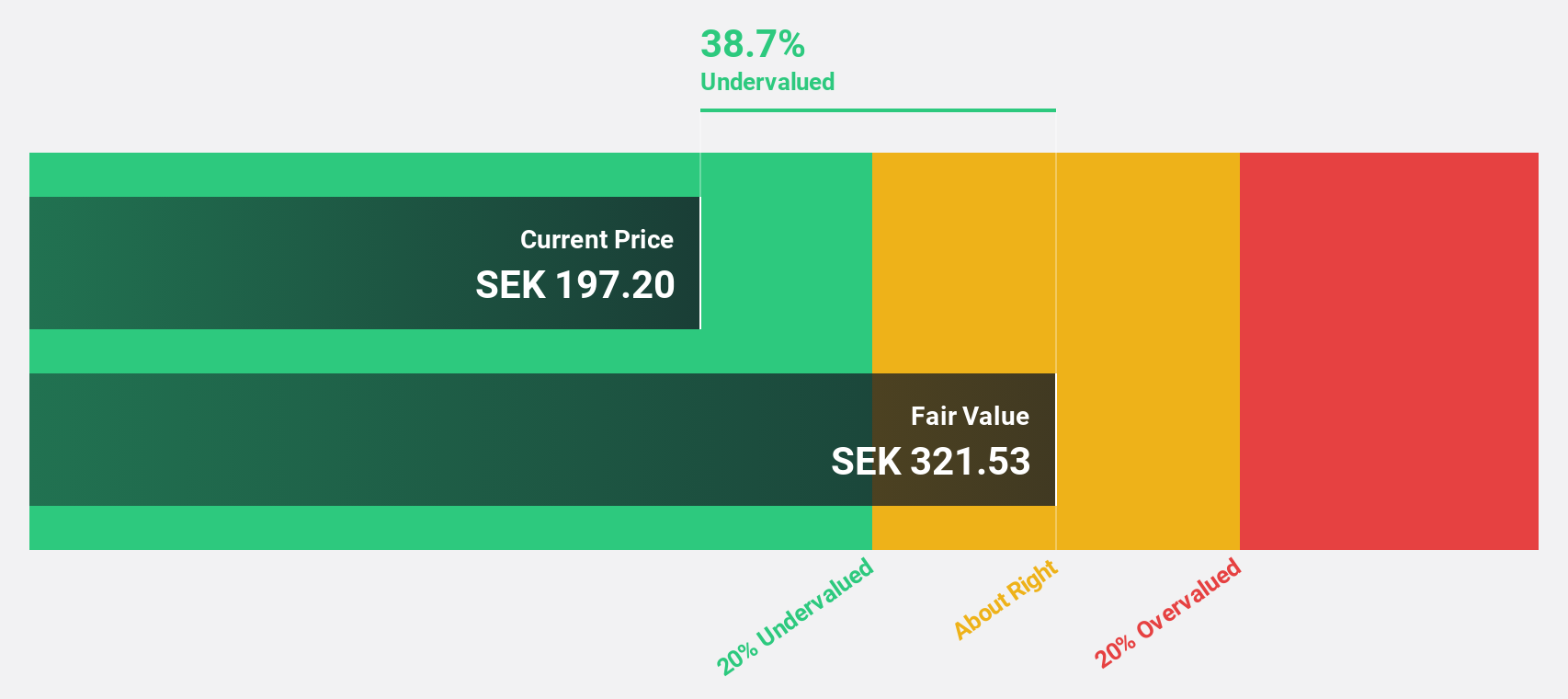

Bonesupport Holding (OM:BONEX)

Overview: Bonesupport Holding AB is an orthobiologics company that develops and commercializes injectable bio-ceramic bone graft substitutes globally, with a market cap of SEK22.37 billion.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to SEK814.46 million.

Estimated Discount To Fair Value: 13.2%

Bonesupport Holding is experiencing strong revenue growth, forecasted at 36.3% annually, outpacing the Swedish market. Despite a decline in net profit margins from last year, the stock trades at SEK340, below its estimated fair value of SEK391.6. Recent earnings showed increased sales but lower net income compared to last year. The SOLARIO study highlights their innovative antibiotic treatment's potential to reduce systemic antibiotic use and associated side effects significantly, enhancing patient outcomes and cost-efficiency.

- The growth report we've compiled suggests that Bonesupport Holding's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Bonesupport Holding.

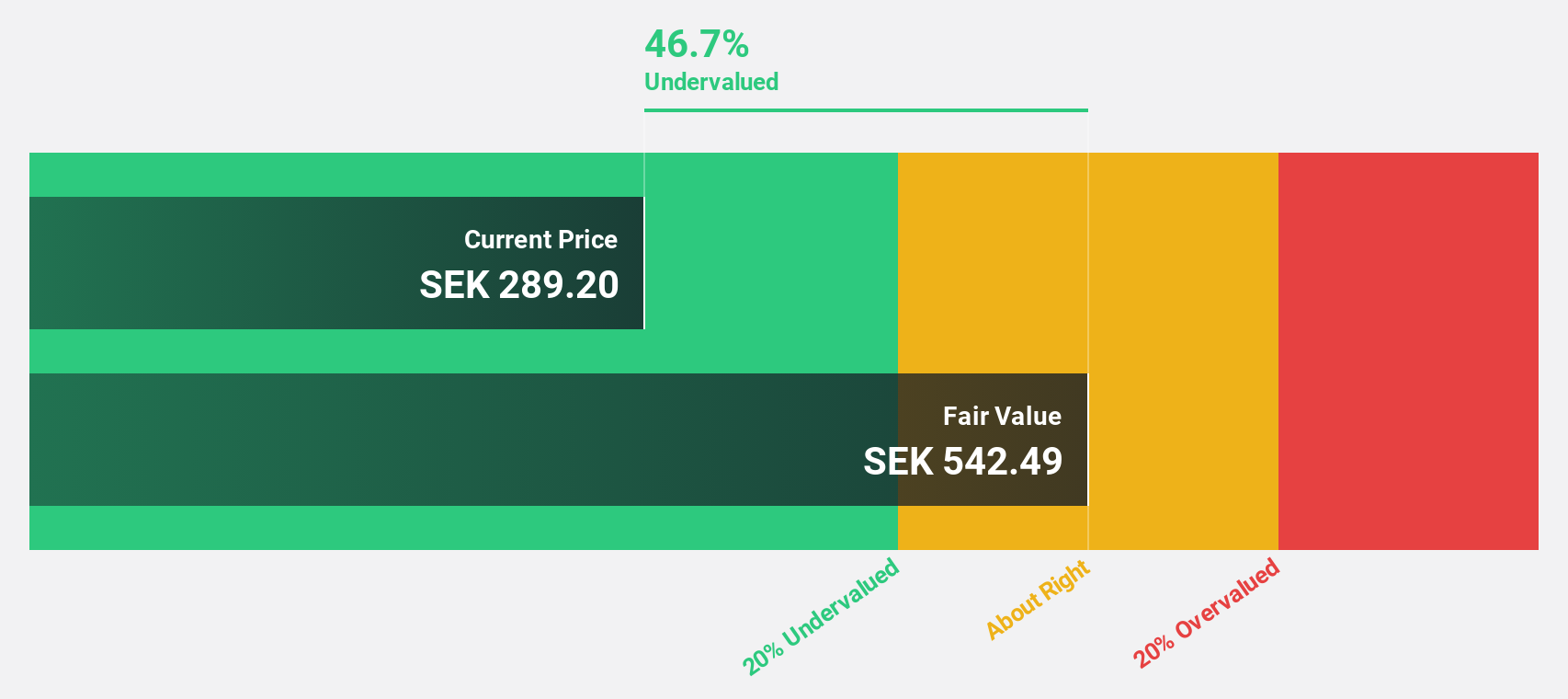

Electrolux Professional (OM:EPRO B)

Overview: Electrolux Professional AB (publ) offers food service, beverage, and laundry products and solutions to various sectors including restaurants, hotels, healthcare, and educational facilities with a market cap of SEK20.00 billion.

Operations: The company's revenue is derived from two main segments: Laundry, contributing SEK4.70 billion, and Food & Beverage, accounting for SEK7.53 billion.

Estimated Discount To Fair Value: 41.3%

Electrolux Professional is trading at SEK69.6, significantly below its estimated fair value of SEK118.56, indicating it may be undervalued based on cash flows. Recent Q3 earnings showed increased sales and net income year-over-year, with sales reaching SEK 2.93 billion and net income at SEK187 million. Despite high debt levels and a forecasted low return on equity of 18.1%, the company's innovative product launches like NeoBlue Touch could drive future growth in revenue and efficiency.

- According our earnings growth report, there's an indication that Electrolux Professional might be ready to expand.

- Unlock comprehensive insights into our analysis of Electrolux Professional stock in this financial health report.

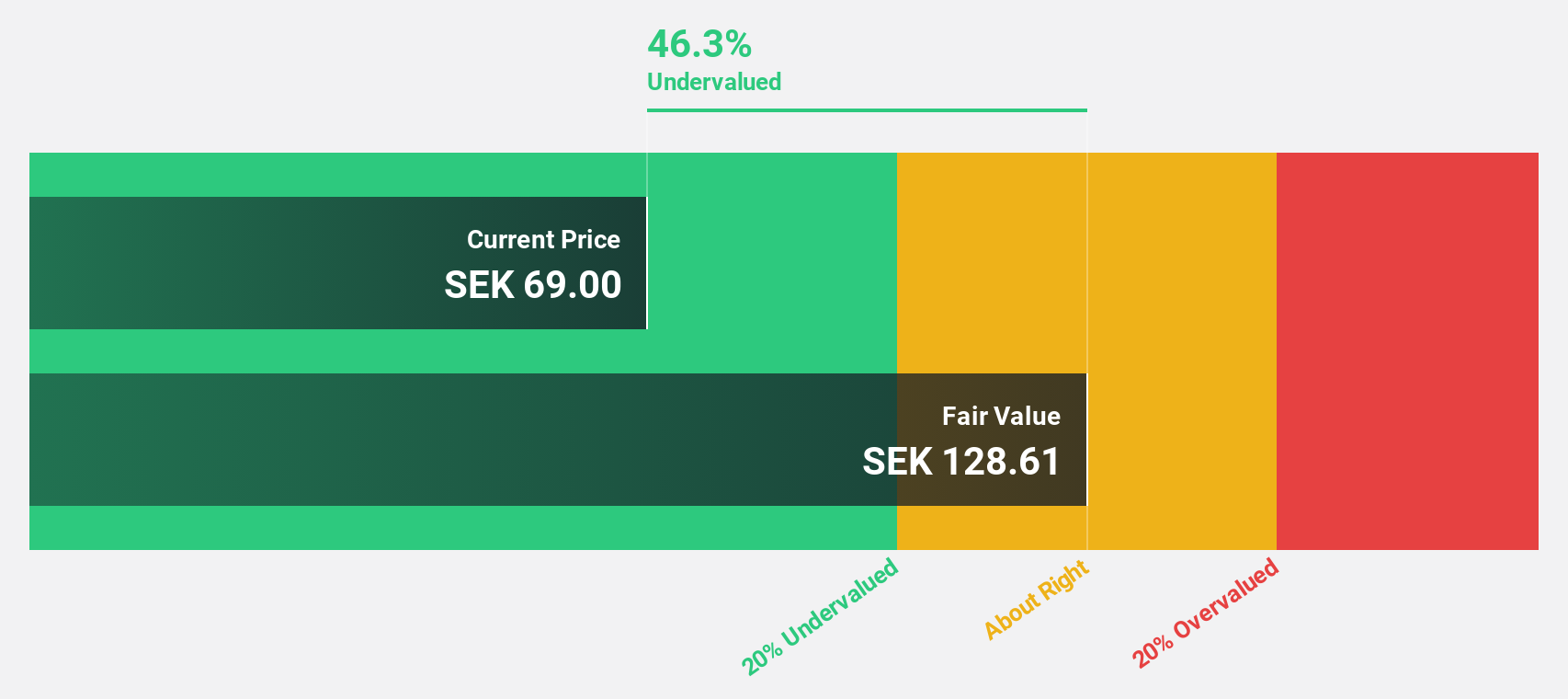

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions and special electronics to the security and defense sectors, with a market cap of SEK3.60 billion.

Operations: Revenue segments for MilDef Group AB (publ) encompass the development, manufacturing, and sale of rugged IT solutions and special electronics to the security and defense sectors.

Estimated Discount To Fair Value: 39.5%

MilDef Group is trading at SEK90.1, well below its estimated fair value of SEK149.02, suggesting it is undervalued based on cash flows. Recent Q3 earnings revealed sales of SEK249.9 million and net income of SEK17.2 million, both up from the previous year. The company is pursuing strategic acquisitions to enhance growth and market access while leveraging its robust defense technology portfolio to secure substantial contracts across Europe, including a significant order with Denmark's DALO worth SEK27.5 million.

- Insights from our recent growth report point to a promising forecast for MilDef Group's business outlook.

- Get an in-depth perspective on MilDef Group's balance sheet by reading our health report here.

Key Takeaways

- Access the full spectrum of 49 Undervalued Swedish Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrolux Professional might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPRO B

Electrolux Professional

Provides food service, beverage, and laundry products and solutions to restaurants, hotels, healthcare, educational, and other service facilities.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives