- Switzerland

- /

- Building

- /

- SWX:ZEHN

European Stocks That May Be Trading Below Fair Value In November 2025

Reviewed by Simply Wall St

Amidst concerns over valuations in artificial intelligence-related stocks, European markets have seen a pullback, with major indices like Germany's DAX and France's CAC 40 experiencing declines. As the Bank of England holds its interest rates steady while leaving room for potential cuts, investors are keenly observing opportunities where stocks may be trading below their fair value. In such an environment, identifying undervalued stocks involves looking at companies with strong fundamentals that might be overlooked due to broader market sentiment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.048 | €5.98 | 49% |

| Vinext (BIT:VNXT) | €3.38 | €6.57 | 48.6% |

| Truecaller (OM:TRUE B) | SEK25.44 | SEK50.66 | 49.8% |

| STEICO (XTRA:ST5) | €20.40 | €39.84 | 48.8% |

| Roche Bobois (ENXTPA:RBO) | €35.20 | €69.45 | 49.3% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK126.60 | 49.9% |

| eDreams ODIGEO (BME:EDR) | €7.26 | €14.34 | 49.4% |

| Doxee (BIT:DOX) | €3.75 | €7.43 | 49.5% |

| Demant (CPSE:DEMANT) | DKK227.80 | DKK447.90 | 49.1% |

| Atea (OB:ATEA) | NOK150.60 | NOK300.13 | 49.8% |

Let's explore several standout options from the results in the screener.

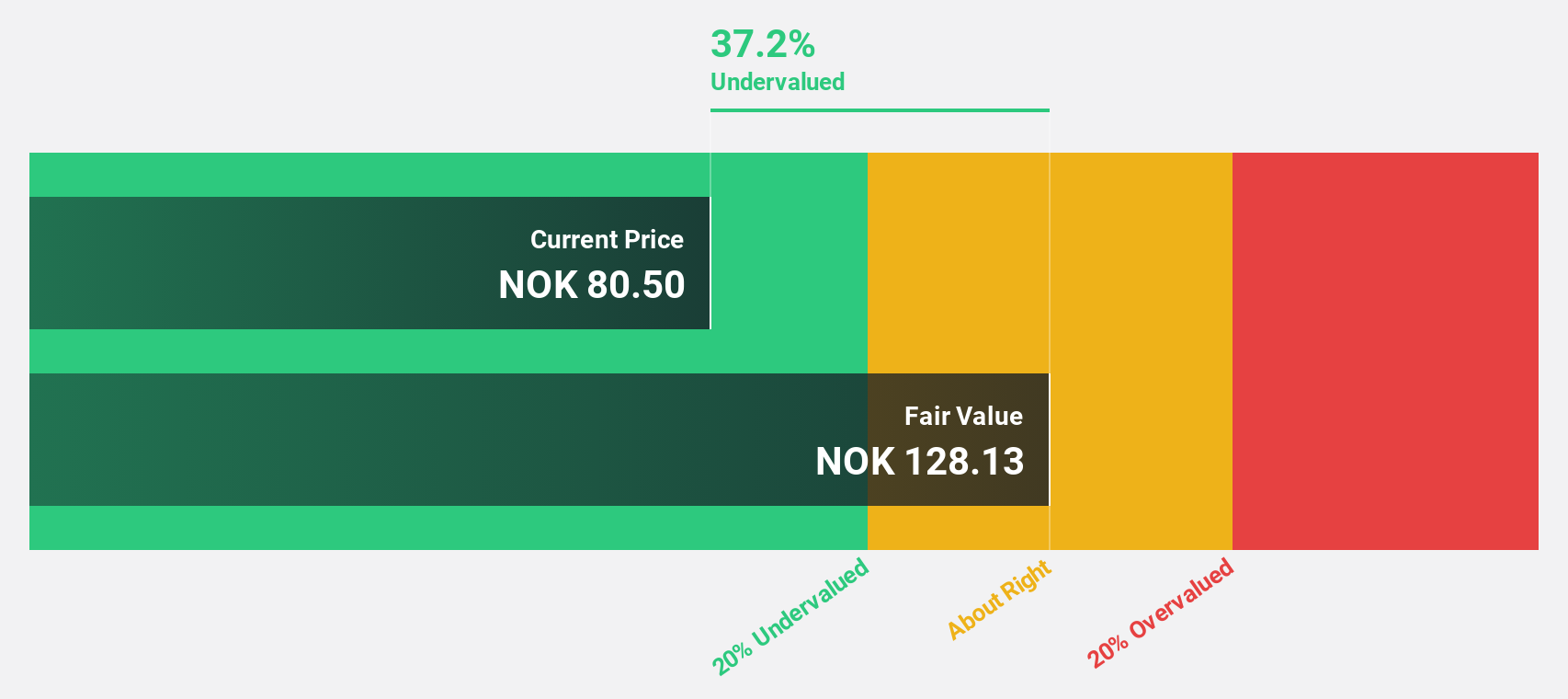

Europris (OB:EPR)

Overview: Europris ASA is a discount variety retailer operating in Norway with a market capitalization of NOK14.11 billion.

Operations: Europris ASA generates revenue primarily from its retail - variety stores segment, amounting to NOK14.65 billion.

Estimated Discount To Fair Value: 12.1%

Europris is trading at NOK 86.2, below its estimated fair value of NOK 98.05, indicating it may be undervalued based on cash flows despite high debt levels. Earnings are projected to grow at 18.3% annually, outpacing the Norwegian market's average growth rate. Recent expansions, including new stores and full ownership of OoB in Sweden, support future revenue streams while maintaining a reliable dividend yield of 4.06%.

- The growth report we've compiled suggests that Europris' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Europris.

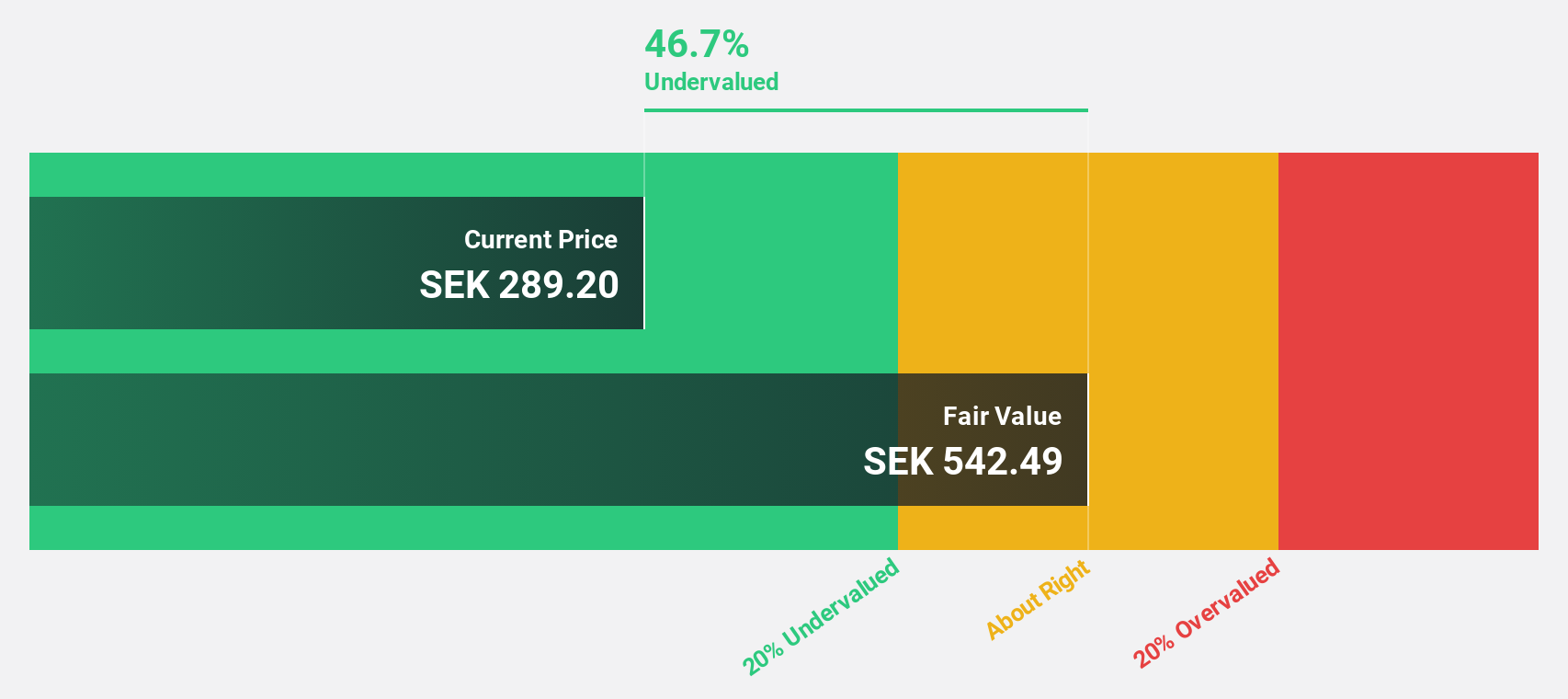

Bonesupport Holding (OM:BONEX)

Overview: Bonesupport Holding AB is an orthobiologics company that develops and sells injectable bio-ceramic bone graft substitutes across Europe, North America, and internationally, with a market cap of SEK13.94 billion.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to SEK1.12 billion.

Estimated Discount To Fair Value: 45.8%

Bonesupport Holding, trading at SEK 211.6, appears undervalued with a fair value estimate of SEK 390.2 and is priced 45.8% below this value based on cash flows. Earnings are projected to grow significantly at 49.7% annually, surpassing the Swedish market's growth rate of 12.7%. Recent Q3 results show sales increased to SEK 294.14 million from SEK 237.5 million last year, highlighting strong revenue performance and potential for future growth in the medical field.

- Upon reviewing our latest growth report, Bonesupport Holding's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Bonesupport Holding's balance sheet health report.

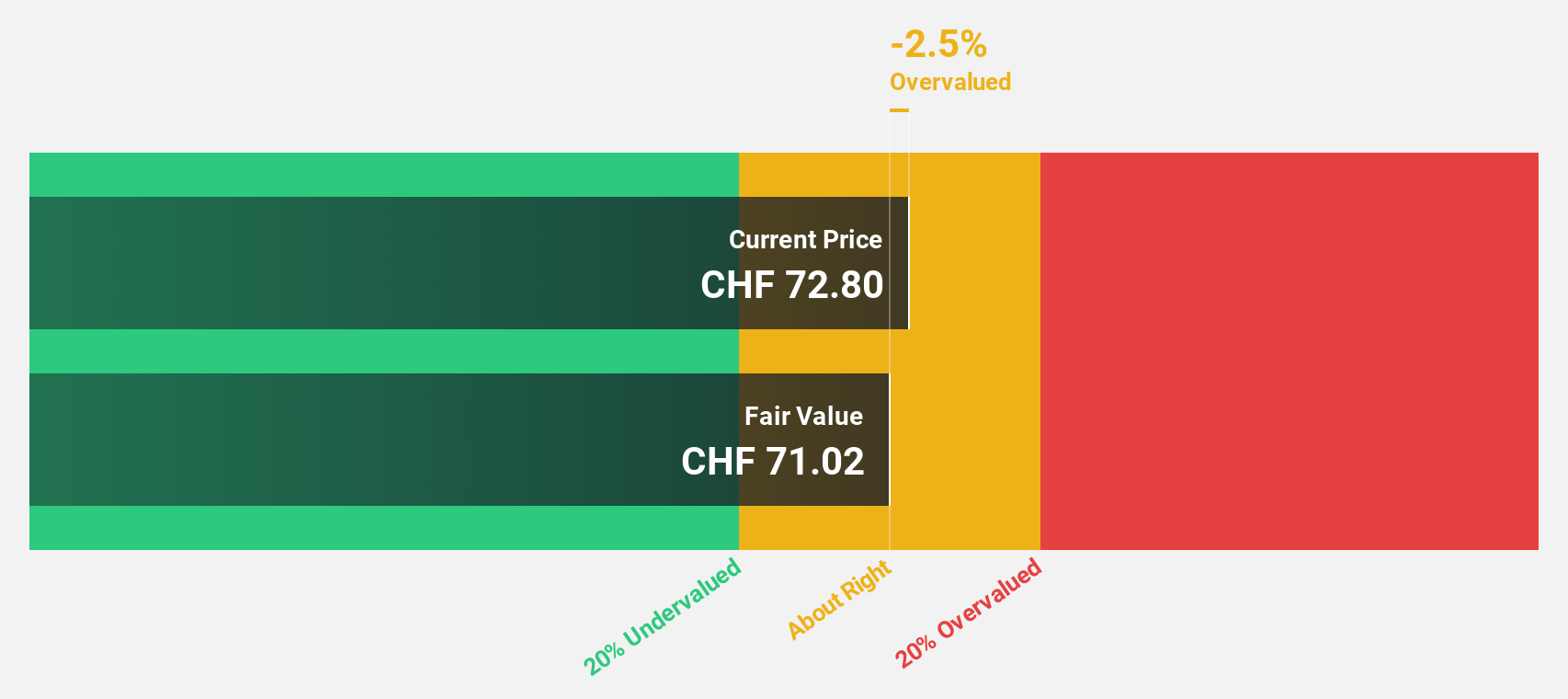

Zehnder Group (SWX:ZEHN)

Overview: Zehnder Group AG, with a market cap of CHF810.23 million, develops, manufactures, and sells indoor climate systems across Europe, North America, and China.

Operations: The company's revenue is primarily generated from its Ventilation segment, which accounts for €474.10 million, and its Radiators segment, contributing €269.80 million.

Estimated Discount To Fair Value: 19.7%

Zehnder Group, trading at CHF72.8, is undervalued with a fair value estimate of CHF90.7 and trades 19.7% below this value based on cash flows. Earnings are expected to grow significantly at 33.1% annually, outpacing the Swiss market's growth rate of 10.5%. However, large one-off items have impacted financial results, and while revenue growth is forecasted at 5.6%, it remains below the high-growth threshold of 20% per year.

- Insights from our recent growth report point to a promising forecast for Zehnder Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Zehnder Group.

Key Takeaways

- Click this link to deep-dive into the 195 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zehnder Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ZEHN

Zehnder Group

Develops, manufactures, and sells indoor climate systems in Europe, North America, and China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives