Bonesupport Holding (OM:BONEX) Valuation in Focus After Record Q2 Results and Anticipated Q3 Update

Reviewed by Kshitija Bhandaru

Bonesupport Holding (OM:BONEX) is drawing extra attention as it prepares to announce its Q3 2025 interim report. This comes after record profits and a 40% jump in Q2 sales, mainly powered by CERAMENT G growth in the US market.

See our latest analysis for Bonesupport Holding.

The stock’s latest moves reflect that momentum is still very much in play, with anticipation around the upcoming Q3 report coming on the heels of a strong Q2 and expansion plans for the US spine market. While Bonesupport’s 1-year total shareholder return is down 23.8%, five-year investors are still sitting on impressive triple-digit gains. This suggests that the long-term growth story may not be over, even as the recent share price has faced short-term headwinds.

If you want to see what else is rising to the top in high-growth medtech and pharma, discovering See the full list for free. is the next logical step.

The question now is whether the market’s recent caution has set up Bonesupport as a compelling value, or if its strong clinical and commercial progress is already fully reflected in the price. This could mean there is limited upside ahead.

Most Popular Narrative: 38.8% Undervalued

With Bonesupport Holding closing at SEK257 and the most widely followed narrative suggesting fair value is significantly higher, all eyes are on whether the market is overlooking robust growth expectations and upcoming catalysts.

"The launch momentum for CERAMENT G in the U.S. is accelerating, with a notable trend of high repeat usage and expansion into additional indications among existing customers. This is expected to positively impact future revenue growth. The submission of the CERAMENT V application to the FDA and potential NTAP reimbursement provide future catalysts for revenue growth and improved margins once approved and implemented."

Want to know why analysts are betting on a dramatic profit transformation and bullish margin forecasts for Bonesupport? The narrative’s fair value is built on aggressive, high-conviction numbers few would expect. Find out which growth levers and market dynamics could push the share price sharply higher.

Result: Fair Value of SEK419.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp currency swings and regulatory setbacks in European markets could quickly undermine Bonesupport’s bullish earnings outlook if these issues are not addressed.

Find out about the key risks to this Bonesupport Holding narrative.

Another View: What Do the Multiples Say?

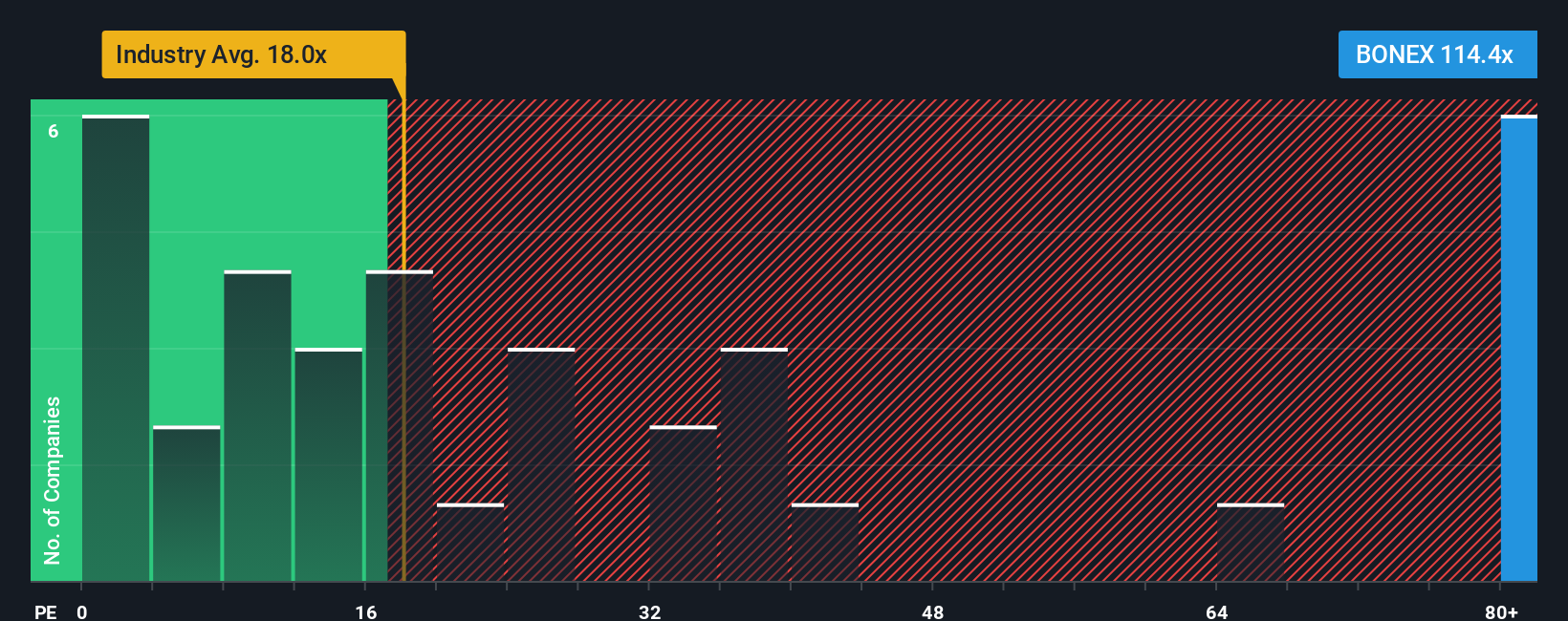

While the primary view sees Bonesupport as undervalued based on future earnings growth, the current valuation tells a different story. The share trades at a price-to-earnings ratio of 114.4x, which is much higher than both the industry average of 18x and the peer average of 32.5x. Even compared to the fair ratio estimate of 66.7x, this represents a significant premium. Elevated multiples like these suggest plenty of optimism may already be reflected in the price, raising questions about whether the upside is as clear cut as it first appears.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bonesupport Holding Narrative

If you want to dig deeper or believe there’s another angle to Bonesupport’s story, you can shape your own narrative in just a few minutes, your way by choosing Do it your way.

A great starting point for your Bonesupport Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for the usual choices? Smart investors are spotting tomorrow’s winners in the most overlooked corners of the market with powerful new screeners.

- Unlock big income opportunities by starting with these 18 dividend stocks with yields > 3%, which offers stable yields above 3% for your portfolio.

- Tap into rapid innovation and growth by following these 24 AI penny stocks, positioned to benefit from artificial intelligence breakthroughs across industries.

- Find value that others might be missing when you use these 878 undervalued stocks based on cash flows to identify strong companies trading for less than their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonesupport Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONEX

Bonesupport Holding

An orthobiologics company, develops and sells injectable bio-ceramic bone graft substitutes in Europe, North America, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives