BioGaia’s New Probiotic Breakthrough Might Change The Case For Investing In BioGaia (OM:BIOG B)

Reviewed by Sasha Jovanovic

- BioGaia AB recently announced the publication of its new patented probiotic strain, L. reuteri BG-R46®, in the journal Beneficial Microbes, developed in partnership with the Swedish University of Agricultural Sciences and featuring enhanced bile tolerance and adenosine production to support gut health and anti-inflammatory benefits.

- This scientific advancement highlights BioGaia’s ongoing commitment to microbiome research and strengthens its reputation as an innovator in the probiotics industry.

- We'll examine how BioGaia’s latest patented strain may shift the outlook for innovation and scientific strength in its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BioGaia Investment Narrative Recap

To become a BioGaia shareholder, you have to believe in the company's ability to translate breakthrough science, like the new L. reuteri BG-R46® announcement, into commercial success, while managing risks from swelling operating expenses and product concentration. Although this latest innovation strengthens the company's scientific edge, it is not expected to materially impact near-term earnings drivers or the immediate pressure on cash flow and net margins, both of which remain the most significant short-term catalysts and risks for investors.

Among BioGaia’s recent announcements, the launch of Prodentis FRESH BREATH in the US stands out as a relevant step in expanding the company's adult health offerings, aligning with efforts to diversify beyond its pediatric-focused revenue base. Introduction of new, clinically-backed products supports management’s push toward broader product categories, a factor closely watched in balancing profit growth against heavy investment in new markets and direct sales operations.

In contrast, investors should be aware that if investments in science and direct sales fail to deliver rapid payback, pressure on margins could persist into the coming quarters...

Read the full narrative on BioGaia (it's free!)

BioGaia's narrative projects SEK2.0 billion revenue and SEK562.0 million earnings by 2028. This requires 11.5% yearly revenue growth and a SEK275.4 million earnings increase from SEK286.6 million today.

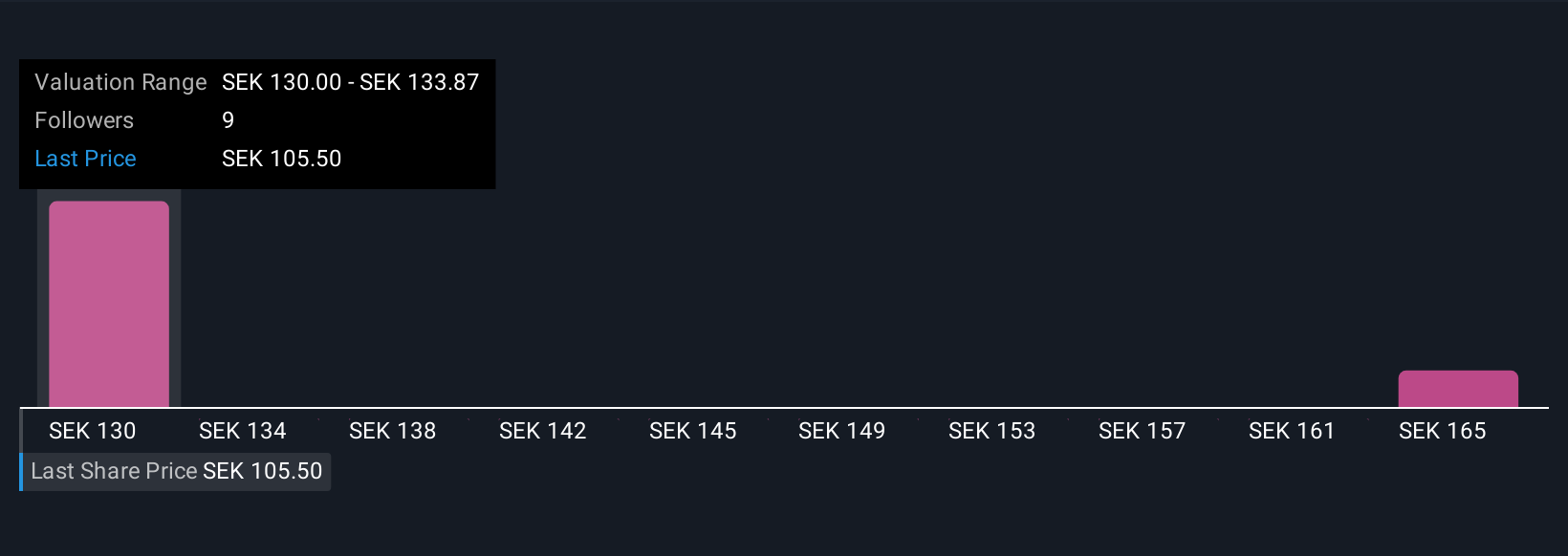

Uncover how BioGaia's forecasts yield a SEK130.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community value BioGaia between SEK130 and SEK168.90, based on two distinct fair value estimates. With margin pressure and a need for innovation defining near-term sentiment, explore how your view aligns with these varied expectations.

Explore 2 other fair value estimates on BioGaia - why the stock might be worth as much as 61% more than the current price!

Build Your Own BioGaia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BioGaia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BioGaia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BioGaia's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives