- Sweden

- /

- Life Sciences

- /

- NGM:LEVBIO

Do Its Financials Have Any Role To Play In Driving AlphaHelix Molecular Diagnostics AB (publ)'s (NGM:ALPH) Stock Up Recently?

Most readers would already be aware that AlphaHelix Molecular Diagnostics' (NGM:ALPH) stock increased significantly by 75% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Particularly, we will be paying attention to AlphaHelix Molecular Diagnostics' ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for AlphaHelix Molecular Diagnostics

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for AlphaHelix Molecular Diagnostics is:

51% = kr1.5m ÷ kr3.0m (Based on the trailing twelve months to December 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every SEK1 worth of equity, the company was able to earn SEK0.51 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

AlphaHelix Molecular Diagnostics' Earnings Growth And 51% ROE

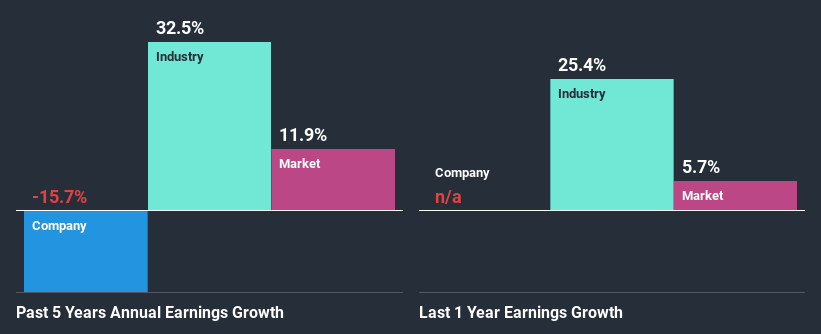

To begin with, AlphaHelix Molecular Diagnostics has a pretty high ROE which is interesting. Secondly, even when compared to the industry average of 23% the company's ROE is quite impressive. For this reason, AlphaHelix Molecular Diagnostics' five year net income decline of 16% raises the question as to why the high ROE didn't translate into earnings growth. We reckon that there could be some other factors at play here that are preventing the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

So, as a next step, we compared AlphaHelix Molecular Diagnostics' performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 33% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is AlphaHelix Molecular Diagnostics fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is AlphaHelix Molecular Diagnostics Using Its Retained Earnings Effectively?

Conclusion

In total, it does look like AlphaHelix Molecular Diagnostics has some positive aspects to its business. However, given the high ROE and high profit retention, we would expect the company to be delivering strong earnings growth, but that isn't the case here. This suggests that there might be some external threat to the business, that's hampering its growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 3 risks we have identified for AlphaHelix Molecular Diagnostics.

If you’re looking to trade AlphaHelix Molecular Diagnostics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:LEVBIO

Level Bio

Manufactures and distributes cutting-edge and diagnostic solutions in the Nordic region and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives