- Sweden

- /

- Interactive Media and Services

- /

- OM:TOURN

Take Care Before Jumping Onto Tourn International AB (publ) (STO:TOURN) Even Though It's 28% Cheaper

Tourn International AB (publ) (STO:TOURN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

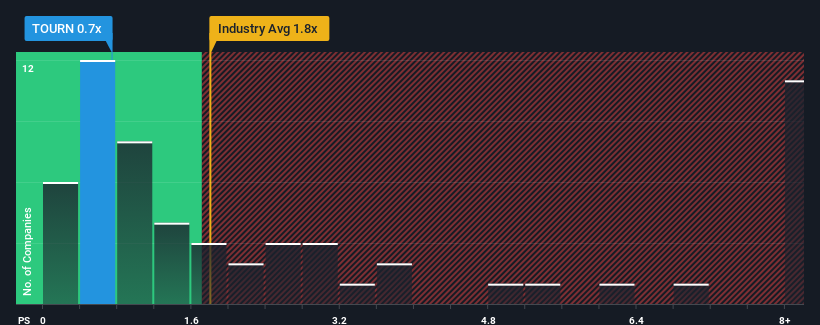

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Tourn International's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Interactive Media and Services industry in Sweden is also close to 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Tourn International

What Does Tourn International's P/S Mean For Shareholders?

Tourn International could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Tourn International's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tourn International's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 57% over the next year. With the industry only predicted to deliver 24%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Tourn International's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Tourn International's P/S

Following Tourn International's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Tourn International currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 2 warning signs for Tourn International (1 shouldn't be ignored!) that you should be aware of.

If you're unsure about the strength of Tourn International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tourn International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TOURN

Tourn International

Offers advertising services for brands and influencers.

Slight with mediocre balance sheet.

Market Insights

Community Narratives