- Sweden

- /

- Entertainment

- /

- OM:SF

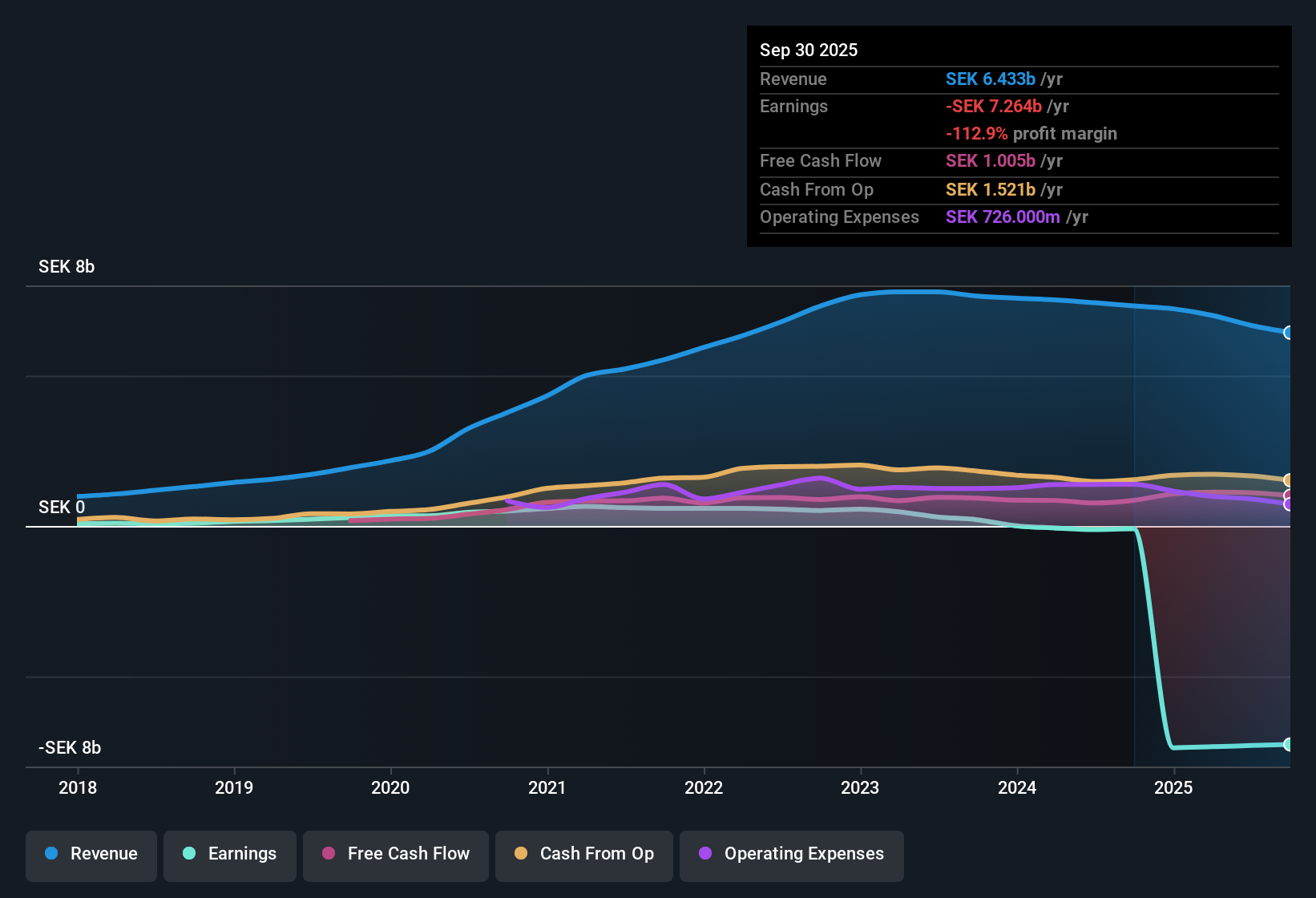

Stillfront Group (OM:SF): Losses Accelerate 89.7% Per Year as Valuation Highlights Recovery Potential

Reviewed by Simply Wall St

Stillfront Group (OM:SF) remains in the red, with losses having increased by 89.7% per year over the past five years. Looking ahead, the company is forecast to grow earnings at an impressive 59.36% per year and is expected to reach profitability within the next three years. With revenue also projected to rise 3.8% annually, slightly outpacing the Swedish market, the setup for long-term investors could catch some eyes.

See our full analysis for Stillfront Group.Next up, we will see how these latest results measure up against the narratives that matter most to investors in the stock, highlighting where conventional wisdom holds and where it might get turned on its head.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Sets Undervaluation Case

- Stillfront trades at a Price-to-Sales ratio of 0.5x, which is lower than the broader Swedish Entertainment industry average (0.7x) and also stands at a considerable discount to the peer group (2.5x).

- The difference between the current share price of SEK6.29 and the DCF fair value of SEK23.78 suggests the stock is priced well below what models estimate to be its intrinsic value.

- This valuation disconnect directly supports claims that Stillfront offers compelling value, particularly for investors interested in recovery stories or those seeking potential bargains in the entertainment sector.

- The wide margin compared to both the industry and peer multiples further reinforces the prevailing view that the market might be underestimating Stillfront’s upside if growth forecasts are realized.

Loss Trajectory Balanced by Profitability Timeline

- Losses have increased at an average of 89.7% per year over the last five years, but the company is forecast to reach profitability within the next three years, which is considered an above-average pace against the market backdrop.

- Despite this challenging loss trajectory, current expectations are for the company’s earnings forecast to improve at a rapid 59.36% per year going forward.

- The forecasted swing into profit aligns with views that operational momentum could help reverse recent years’ trends much quicker than many would expect.

- However, the scale of past losses shows that management’s ability to tighten up execution remains absolutely critical for any bullish case to develop.

Revenue Growth Nudges Ahead of Market

- Stillfront’s revenue is projected to grow 3.8% annually, slightly edging out the Swedish market average of 3.6%. This is a modest but positive sign.

- This mild outperformance fits with expectations that sector consolidation and new game launches could drive incremental upside, though the forecast remains measured rather than transformative.

- Progress that exceeds the general market will be key for justifying any valuation rerating, particularly in a consolidating industry.

- Steady top-line improvement also supports the prevailing perspective that Stillfront has attractive long-term growth levers at work, absent any risk flags undermining the story.

If you want the full story on where analysts see the company going and how it stacks up across the bull-bear spectrum, don’t miss the in-depth community view: 📊 Read the full Stillfront Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Stillfront Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Stillfront’s steep losses over recent years highlight the risk that inconsistent performance and lack of financial stability could weigh on long-term prospects.

For a smoother ride, check out stable growth stocks screener (2090 results) to find companies delivering consistent earnings and revenue growth regardless of the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SF

Stillfront Group

Designs, develops, markets, publishes, and sells digital games in Europe, North America, the Middle East and North Africa, and the Asia-Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives