- Sweden

- /

- Entertainment

- /

- OM:PDX

Paradox Interactive (OM:PDX) Margin Surge Reinforces Bullish Narratives Despite Premium Valuation

Reviewed by Simply Wall St

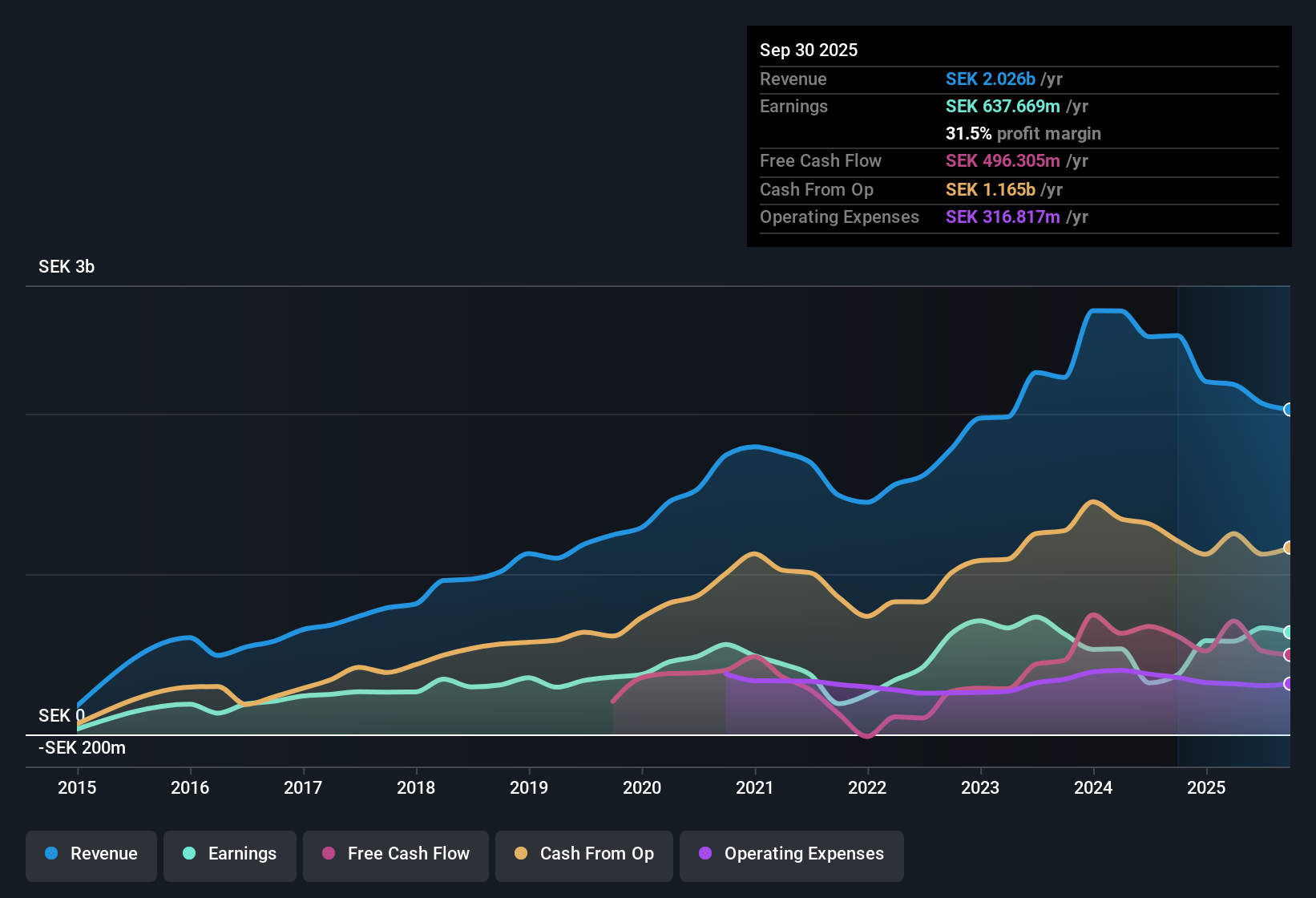

Paradox Interactive (OM:PDX) reported a sharp rise in profitability this period, with a net profit margin of 32.2% versus 13% a year earlier, and annual earnings growth soaring by 106.5%, dwarfing its five-year average of 7.4% per year. Looking forward, earnings are forecast to grow 30.86% per year and revenue is expected to rise at 8.1% annually, both well ahead of the broader Swedish market and industry averages. With profit and revenue growth firmly in view, investors may see these results as a strong signal, even as valuation multiples stay elevated.

See our full analysis for Paradox Interactive.Next, we will see how these headline figures compare with the narratives that have shaped Paradox Interactive’s story so far. This is where the numbers can either support or disrupt what investors believe.

See what the community is saying about Paradox Interactive

Margins Projected to Edge Higher

- Analysts expect Paradox Interactive's profit margins to rise from 32.2% now to 33.8% in three years, outpacing both the industry average margin and the broader Swedish market's trend.

- According to the analysts' consensus view, this margin expansion is anchored in:

- Major upcoming franchise releases and live-service updates, which are anticipated to drive recurring high-margin earnings and limit exposure to short-lived sales spikes.

- Cost efficiencies from digital distribution and AI-driven tools, which are forecast to support sustainable net income growth while minimizing increases in spending relative to rising revenue.

- Consensus narrative highlights how Paradox’s ability to leverage its "evergreen" franchises and reduce distribution costs is critical for keeping margins robust as the industry shifts toward live service and recurring models.

The latest results show Paradox’s profitability increasingly aligns with what analysts view as the company’s structural strengths, but attention remains on whether new launches can maintain this upswing.

📊 Read the full Paradox Interactive Consensus Narrative.

Premium Valuation with Limited Discount

- Paradox trades at a Price-to-Earnings ratio of 27.7x, which is higher than both the European entertainment industry average (16.3x) and peer average (16.7x). The current share price (SEK174.0) sits only modestly below the DCF fair value (SEK183.90).

- Analysts' consensus view is that:

- The gap between current price and DCF fair value signals the company is no longer deeply discounted, despite its strong growth outlook.

- Consensus price targets of SEK190.0 suggest only moderate upside, so future share gains may depend more heavily on Paradox hitting its bullish growth and margin forecasts than on any multiple expansion from today’s levels.

Dependence on Franchise Releases Brings Volatility

- Earnings estimates for 2028 reflect a wide possible range, with consensus expecting SEK1.0 billion but bearish analysts modeling as low as SEK833.4 million, underlining sensitivity to key game launches and expansion packs.

- Consensus narrative calls out this heavy dependence on established franchises and the timing of major releases, with:

- Potential for revenue and margin swings tied directly to new title performance, recently illustrated by a 20% year-over-year decline in revenue, bringing possible unpredictability to profits.

- Additional headwinds possible from rising development costs, project write-offs, and increasing global competition, all of which may challenge Paradox's ability to sustain high growth if core franchises underperform or market conditions tighten.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Paradox Interactive on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data another way? Share your perspective and build your own narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Paradox Interactive.

See What Else Is Out There

Paradox Interactive’s premium valuation and heavy reliance on major franchise releases create real uncertainty about consistent profit growth during unpredictable market cycles.

If you want steadier results, use stable growth stocks screener (2090 results) to discover companies that have shown reliable financial performance even when conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PDX

Paradox Interactive

Develops and publishes strategy and management games on PC and consoles in the United States, Rest of Europe, Sweden, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)