High Growth Tech And 2 Other Promising Stocks For Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by volatility, with U.S. stocks experiencing fluctuations due to AI competition fears and mixed corporate earnings results. Amidst these dynamic conditions, identifying promising stocks can be challenging; however, focusing on companies that demonstrate strong innovation and adaptability in high-growth sectors like technology may provide potential opportunities for investors looking to navigate the current market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Hemnet Group (OM:HEM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden with a market capitalization of approximately SEK38.77 billion.

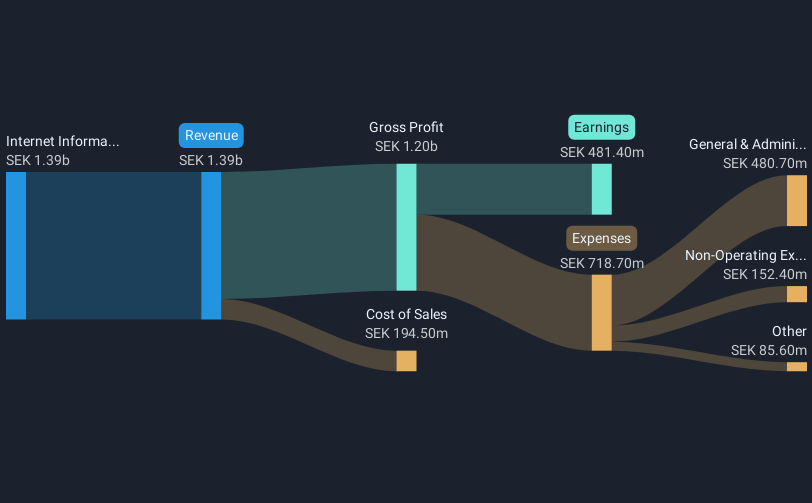

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to SEK1.39 billion.

Hemnet Group has demonstrated robust financial performance, with a notable 38.9% increase in annual revenue to SEK 1.4 billion and a significant rise in net income by 42.1% to SEK 481.4 million for the year ended December 31, 2024. This growth trajectory is underscored by strategic leadership changes, including the appointment of Jonas Gustafsson as CEO, poised to further drive digital transformation and expansion within the Interactive Media and Services industry where Hemnet already outpaces average industry earnings growth of 30.4%. The company also actively returned value to shareholders through a substantial share repurchase program, buying back shares worth SEK 264.2 million last year, showcasing confidence in its financial health and commitment to shareholder interests.

- Take a closer look at Hemnet Group's potential here in our health report.

Gain insights into Hemnet Group's historical performance by reviewing our past performance report.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures, trades in, and sells optical modules and systems integration products for smartphones and other mobile devices across several international markets, with a market cap of approximately HK$24.58 billion.

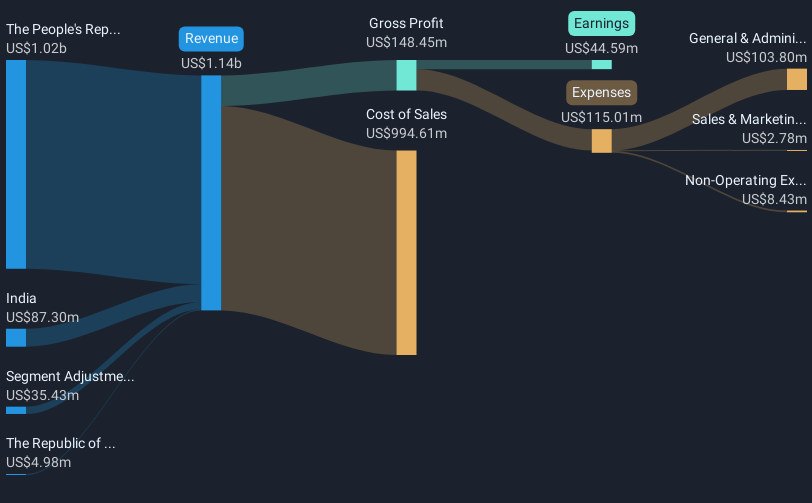

Operations: The company generates revenue primarily from the sale of photographic equipment and supplies, amounting to $1.14 billion. Its operations span across China, India, South Korea, and international markets.

Cowell e Holdings is navigating the competitive tech landscape with a robust growth strategy, evidenced by its impressive annual revenue growth of 27.4% and earnings surge of 30.5%. Despite a challenging year with a net profit margin drop to 3.9% from last year's 6.6%, the company's commitment to innovation is clear with significant investments in R&D, aligning well above industry norms. Looking ahead, Cowell e’s focus on expanding its technological capabilities and enhancing product offerings could set a strong foundation for sustained growth in an increasingly digital economy.

- Dive into the specifics of Cowell e Holdings here with our thorough health report.

Evaluate Cowell e Holdings' historical performance by accessing our past performance report.

Asiainfo Security TechnologiesLtd (SHSE:688225)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Asiainfo Security Technologies Co., Ltd. specializes in providing network security software both within China and internationally, with a market capitalization of CN¥8.74 billion.

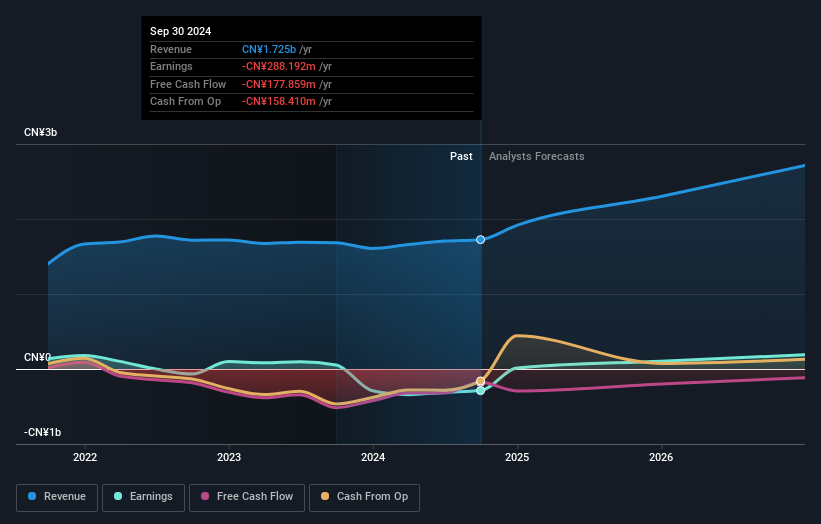

Operations: Asiainfo Security Technologies Co., Ltd. generates revenue primarily through its network security software offerings, catering to both domestic and international markets. The company's financial structure is characterized by its focus on software solutions in the cybersecurity domain, with a notable market presence reflected in its multi-billion CN¥ valuation.

Asiainfo Security TechnologiesLtd. is carving out a niche in the high-growth tech sector, underpinned by its forecasted revenue surge at 64.1% annually, significantly outstripping the Chinese market's average of 13.5%. Despite current unprofitability, the company's earnings are expected to catapult by an impressive 116.8% per year over the next three years, signaling potential for robust financial health ahead. This growth trajectory is complemented by substantial R&D investments that not only underscore its commitment to innovation but also align it with industry leaders who prioritize technological advancements to stay competitive. With such dynamic growth metrics and strategic focus on R&D, Asiainfo appears well-positioned to capitalize on future tech trends despite its present challenges and highly volatile share price.

- Get an in-depth perspective on Asiainfo Security TechnologiesLtd's performance by reading our health report here.

Understand Asiainfo Security TechnologiesLtd's track record by examining our Past report.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1223 more companies for you to explore.Click here to unveil our expertly curated list of 1226 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hemnet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEM

Outstanding track record with high growth potential.

Market Insights

Community Narratives