Amid cautious optimism in Europe, the pan-European STOXX Europe 600 Index managed a modest gain, reflecting investor reactions to U.S. trade policy developments and geopolitical efforts in Eastern Europe. As investors navigate these complex market conditions, penny stocks—often representing smaller or newer companies—continue to capture attention for their potential growth opportunities despite being somewhat of a niche investment area today. In this article, we explore three European penny stocks that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.92 | SEK293.94M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.958 | €32.08M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.50 | SEK244.2M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.68 | SEK223.89M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.74 | €53.82M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.47 | €25.46M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.195 | €96.26M | ★★★★★☆ |

| Deceuninck (ENXTBR:DECB) | €2.345 | €324.54M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.79 | PLN128.46M | ★★★★☆☆ |

Click here to see the full list of 425 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Nanoform Finland Oyj (HLSE:NANOFH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharmaceutical and biotech industries in Europe and the United States, with a market cap of €105.37 million.

Operations: The company generates €2.43 million in revenue from its expert services in nanotechnology and drug particle engineering.

Market Cap: €105.37M

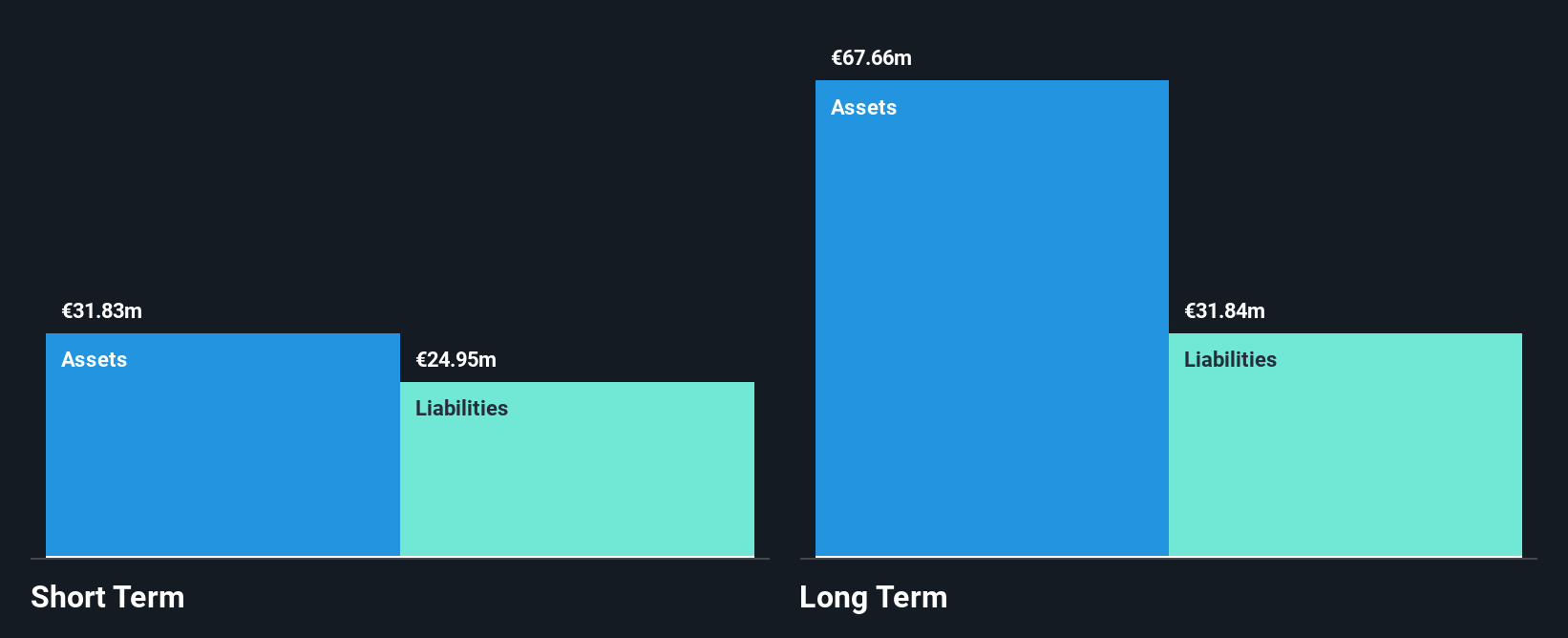

Nanoform Finland Oyj, with a market cap of €105.37 million, operates in the nanotechnology and drug particle engineering sector but remains unprofitable with losses increasing over recent years. Despite generating €2.43 million in revenue, it is not forecast to achieve profitability within the next three years. The company benefits from being debt-free and having a seasoned management team with an average tenure of 6.1 years, which may provide stability amid its volatile share price performance. Nanoform's short-term assets significantly cover its liabilities, offering some financial resilience as it continues to present at industry events like BioAsia 2025.

- Get an in-depth perspective on Nanoform Finland Oyj's performance by reading our balance sheet health report here.

- Gain insights into Nanoform Finland Oyj's outlook and expected performance with our report on the company's earnings estimates.

Nurminen Logistics Oyj (HLSE:NLG1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nurminen Logistics Oyj offers logistics services across Finland, Russia, and the Baltic countries with a market cap of €96.26 million.

Operations: The company's revenue is primarily generated from its Transportation - Trucking segment, which accounts for €118.19 million.

Market Cap: €96.26M

Nurminen Logistics Oyj, with a market cap of €96.26 million, is experiencing substantial growth in its earnings, which rose 150.4% over the past year and exceeded the logistics industry average. Despite trading at 67.5% below its estimated fair value, the company faces challenges with short-term liabilities exceeding assets by €1.5 million. However, it maintains a satisfactory net debt to equity ratio of 8.5%, and its interest payments are well covered by EBIT at 6.7 times coverage. The management team is experienced but must address an unstable dividend track record amid forecasts of declining earnings over the next three years.

- Take a closer look at Nurminen Logistics Oyj's potential here in our financial health report.

- Examine Nurminen Logistics Oyj's earnings growth report to understand how analysts expect it to perform.

Eniro Group (OM:ENRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eniro Group AB (publ) is a software-as-a-service company operating in Sweden, Norway, Denmark, and Finland with a market cap of SEK397.49 million.

Operations: The company's revenue is divided into two main segments: Dynava, generating SEK370 million, and Marketing Partner, contributing SEK581 million.

Market Cap: SEK397.49M

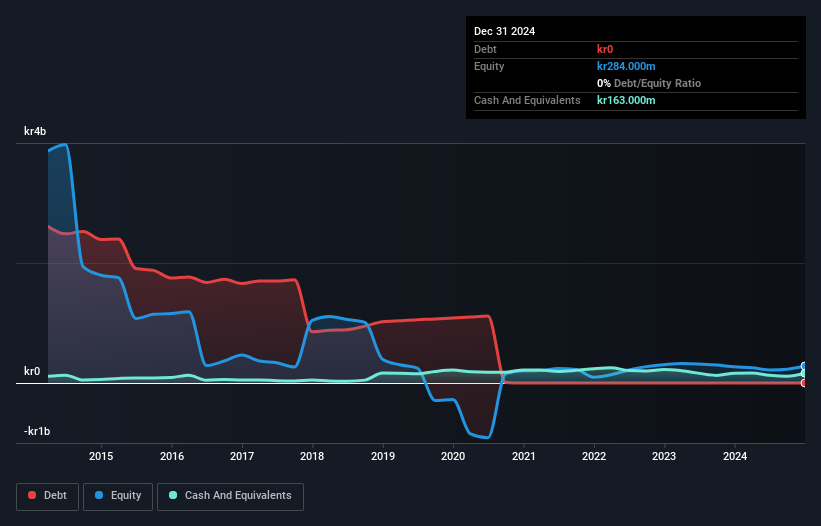

Eniro Group AB, with a market cap of SEK397.49 million, has shown financial resilience by becoming profitable in the past year. The company's strategic focus on separating Dynava for a potential independent listing aims to enhance shareholder value and optimize growth opportunities for its customer care segment. Despite stable weekly volatility at 5% and trading significantly below its estimated fair value, Eniro faces challenges with short-term liabilities exceeding assets by SEK33 million. Recent executive changes include appointing Stefan Liljedahl as interim CFO, while the board proposes an increased dividend reflecting improved earnings performance.

- Click to explore a detailed breakdown of our findings in Eniro Group's financial health report.

- Understand Eniro Group's track record by examining our performance history report.

Make It Happen

- Click this link to deep-dive into the 425 companies within our European Penny Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eniro Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ENRO

Eniro Group

Operates as a software-as-a-service company in Sweden, Norway, Denmark, and Finland.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives