- Sweden

- /

- Entertainment

- /

- OM:EMBRAC B

Here's Why Embracer Group (STO:EMBRAC B) Has A Meaningful Debt Burden

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Embracer Group AB (publ) (STO:EMBRAC B) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Embracer Group's Net Debt?

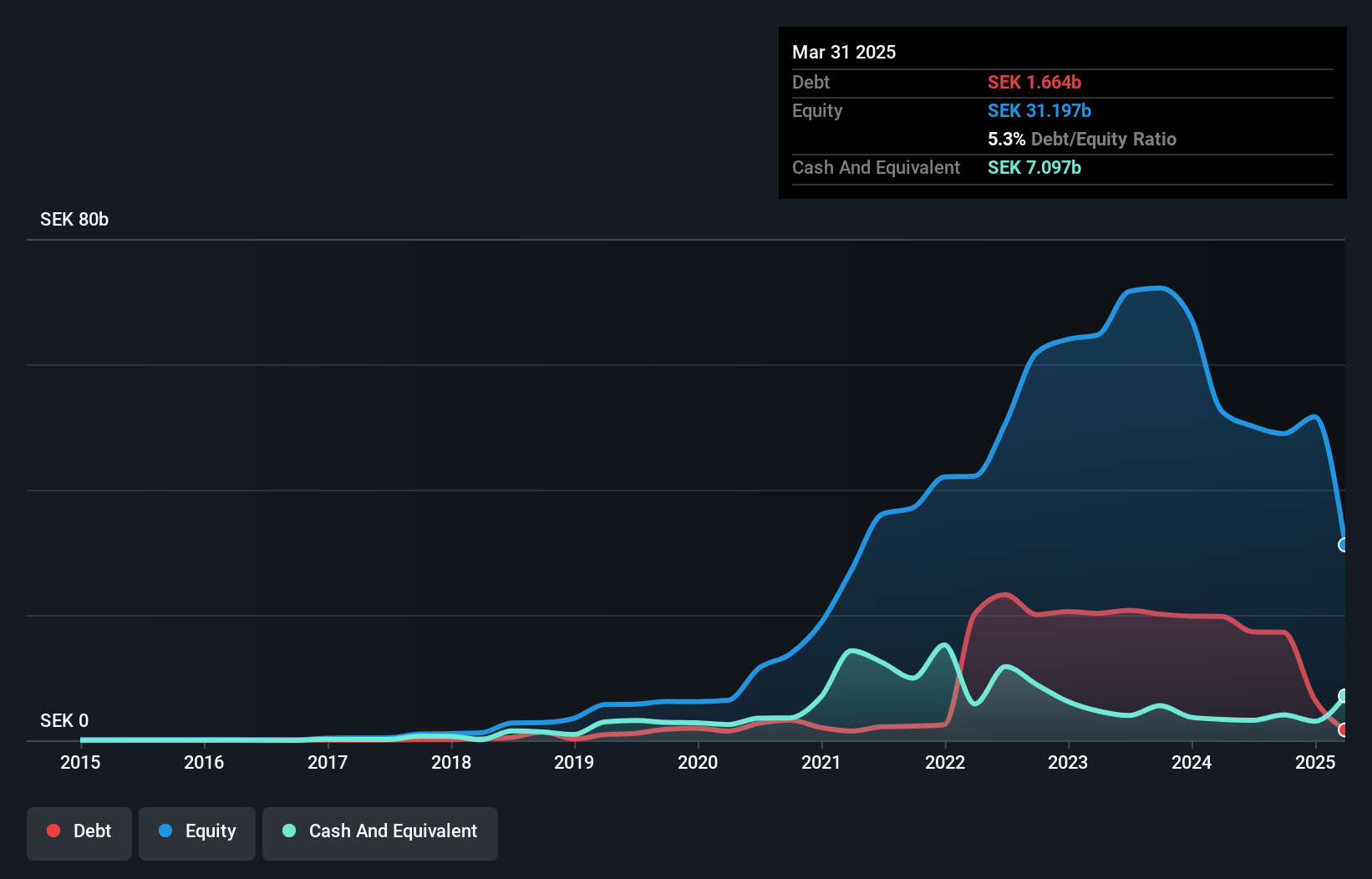

As you can see below, Embracer Group had kr1.66b of debt at March 2025, down from kr19.8b a year prior. But on the other hand it also has kr7.10b in cash, leading to a kr5.43b net cash position.

How Healthy Is Embracer Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Embracer Group had liabilities of kr6.36b due within 12 months and liabilities of kr4.58b due beyond that. Offsetting these obligations, it had cash of kr7.10b as well as receivables valued at kr3.63b due within 12 months. So these liquid assets roughly match the total liabilities.

Having regard to Embracer Group's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the kr22.9b company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, Embracer Group boasts net cash, so it's fair to say it does not have a heavy debt load!

View our latest analysis for Embracer Group

Importantly, Embracer Group's EBIT fell a jaw-dropping 27% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Embracer Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Embracer Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Embracer Group saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

We could understand if investors are concerned about Embracer Group's liabilities, but we can be reassured by the fact it has has net cash of kr5.43b. Despite its cash we think that Embracer Group seems to struggle to grow its EBIT, so we are wary of the stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Embracer Group you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Embracer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EMBRAC B

Embracer Group

Develops and publishes PC, console, mobile, VR, and board games for the games market worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success