- France

- /

- Entertainment

- /

- ENXTPA:BOL

Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and political uncertainties, small-cap stocks have notably underperformed, with the Russell 2000 Index dipping into correction territory. In this challenging environment, identifying high-growth tech stocks that can navigate such volatility becomes crucial; these stocks often demonstrate robust innovation and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.58% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.58% | 61.86% | ★★★★★★ |

| Initiator Pharma | 1.82% | 0.25% | ★★☆☆☆☆ |

Click here to see the full list of 1223 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across multiple continents including Europe, the Americas, Asia, Oceania, and Africa with a market cap of €16.45 billion.

Operations: The company generates significant revenue from its communications segment, amounting to €14.86 billion, followed by Bolloré Energy at €2.75 billion and the industry sector at €353 million.

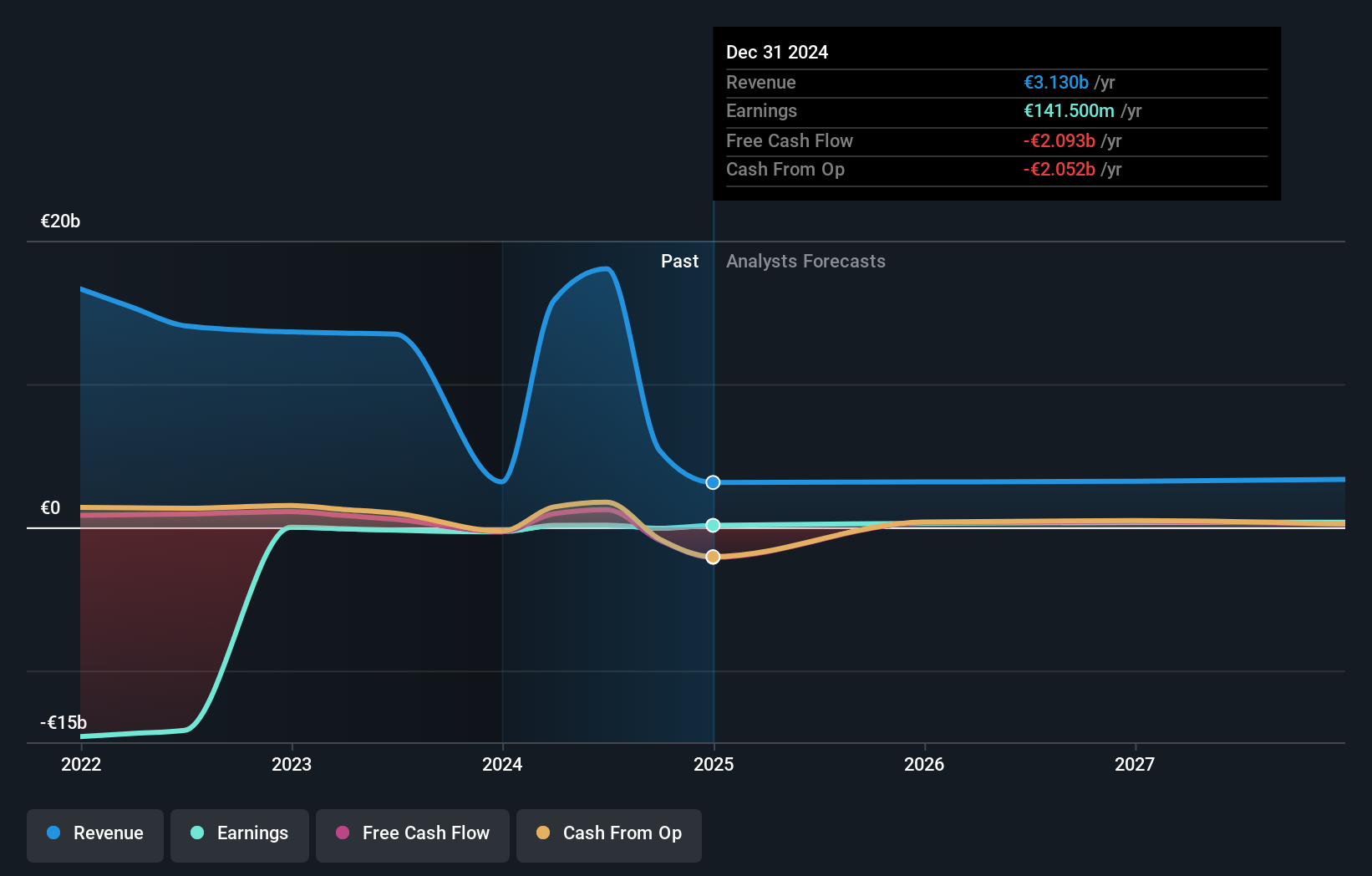

Bolloré SE has demonstrated robust financial performance, with third-quarter revenues soaring to EUR 5.56 billion from EUR 3.20 billion in the previous year, and a cumulative increase to EUR 16.15 billion over nine months. This growth is underscored by an annual revenue increase of 8.1% and an impressive earnings forecast of 32.7% per year, significantly outpacing the French market's average. Despite a lower projected Return on Equity at 4.9%, Bolloré's transition to profitability this past year and its strategic focus on high-quality earnings reflect a promising trajectory in the competitive tech landscape, where innovation and efficient market adaptation remain critical for sustained growth.

- Take a closer look at Bolloré's potential here in our health report.

Explore historical data to track Bolloré's performance over time in our Past section.

Embracer Group (OM:EMBRAC B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Embracer Group AB (publ) is a global developer and publisher of PC, console, mobile, VR, and board games with a market cap of approximately SEK40.32 billion.

Operations: Embracer Group generates revenue primarily from PC/console games, tabletop games, mobile games, and entertainment & services. The largest revenue stream comes from tabletop games at SEK14.41 billion, followed by PC/console games at SEK11.31 billion.

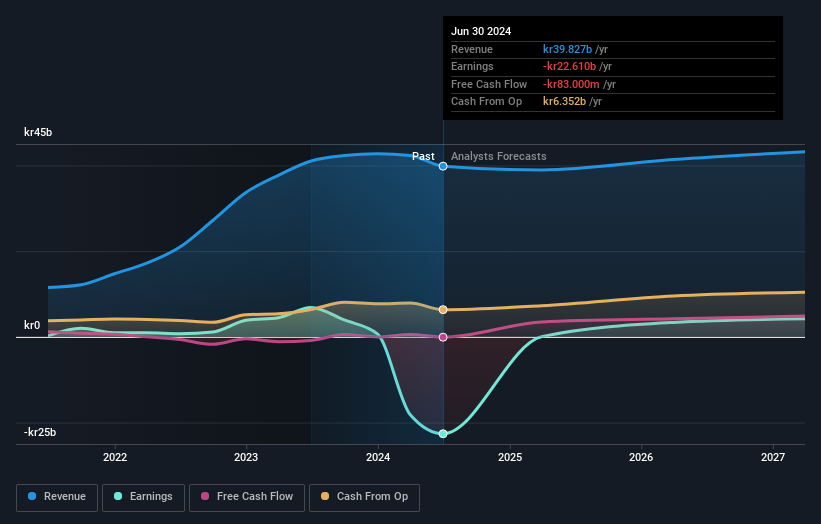

Embracer Group's recent strategic maneuvers, including a reverse share split and amendments to its bylaws, underscore its efforts to streamline operations amidst challenging financial performance. With second-quarter revenues down from SEK 10,962 million the previous year to SEK 8,659 million and a reduced net loss of SEK 391 million compared to last year's SEK 562 million, the company is navigating through turbulent waters. Despite these hurdles, Embracer is poised for recovery with an anticipated revenue growth of 2.9% per year and earnings forecasted to surge by an impressive 105.45% annually. These figures reflect not just resilience but also a potential turnaround driven by strategic restructuring and market adaptation strategies in the dynamic tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Embracer Group.

Gain insights into Embracer Group's historical performance by reviewing our past performance report.

Skyworth Digital (SZSE:000810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Skyworth Digital Co., Ltd. is engaged in the global production and sale of home video entertainment and intelligent connectivity solutions, with a market capitalization of CN¥13.55 billion.

Operations: Skyworth Digital focuses on manufacturing and selling home video entertainment systems and intelligent connectivity solutions globally. The company leverages its expertise in technology to drive revenue through these core product segments, contributing significantly to its market presence.

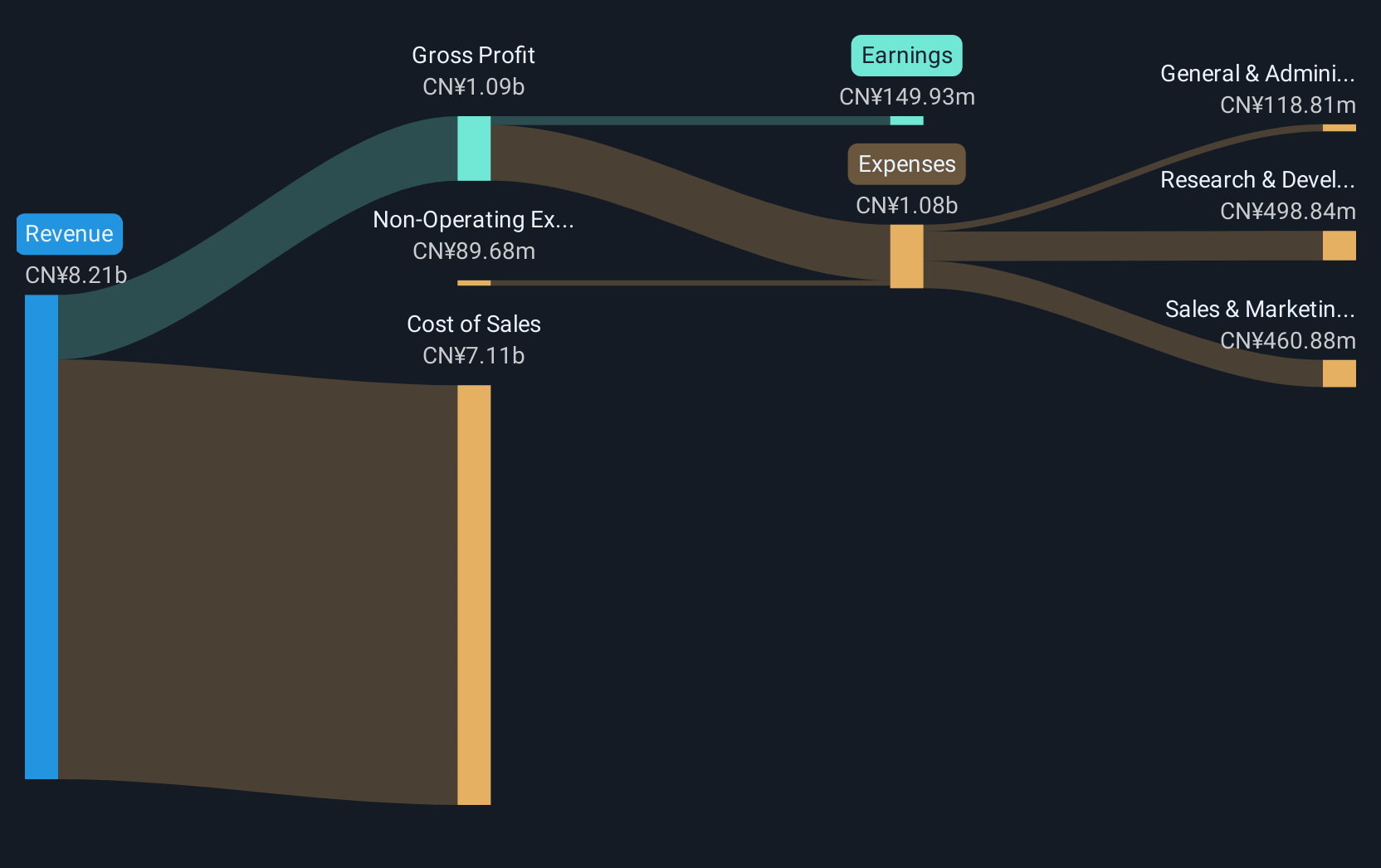

Skyworth Digital, amidst a challenging tech landscape, is navigating its growth trajectory with a notable 15.9% annual revenue increase and an impressive 30.4% surge in earnings projections per year, outpacing the CN market's average. The company's commitment to innovation is evident from its R&D investments, which are crucial for sustaining competitive advantage and fostering future growth. Recent affirmations of quarterly dividends suggest financial stability and confidence in ongoing profitability, reflecting a strategic approach to shareholder value amidst market volatility. This blend of financial health and strategic foresight positions Skyworth Digital as a resilient contender in the evolving tech sector.

Make It Happen

- Explore the 1223 names from our High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bolloré might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BOL

Bolloré

Engages in the transportation and logistics, communications, and industry businesses in France, rest of Europe, the Americas, Asia, Oceania, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives