- Sweden

- /

- Entertainment

- /

- OM:EG7

There's Reason For Concern Over Enad Global 7 AB (publ)'s (STO:EG7) Price

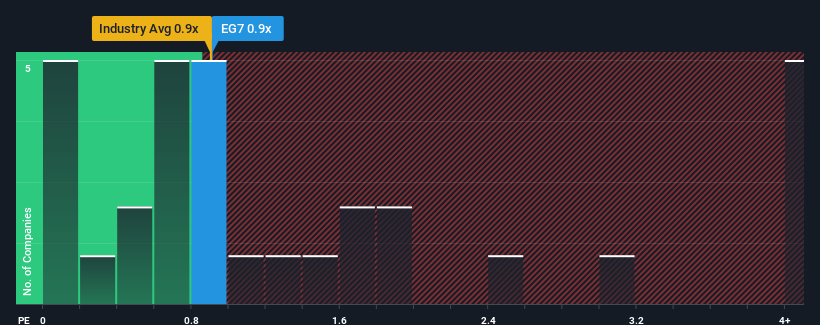

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Entertainment industry in Sweden, you could be forgiven for feeling indifferent about Enad Global 7 AB (publ)'s (STO:EG7) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Enad Global 7

What Does Enad Global 7's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Enad Global 7 has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Enad Global 7.Is There Some Revenue Growth Forecasted For Enad Global 7?

Enad Global 7's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 4.6% as estimated by the dual analysts watching the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Enad Global 7's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Enad Global 7's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Enad Global 7's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You always need to take note of risks, for example - Enad Global 7 has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Enad Global 7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EG7

Enad Global 7

Develops, publishes, markets, and distributes games in PC, console, and mobile platforms in Sweden, rest of Europe, North America, South America, Asia, Africa, and the Oceania.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives