- Sweden

- /

- Entertainment

- /

- OM:EG7

Even after rising 12% this past week, Enad Global 7 (STO:EG7) shareholders are still down 80% over the past five years

While not a mind-blowing move, it is good to see that the Enad Global 7 AB (publ) (STO:EG7) share price has gained 15% in the last three months. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 81%. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The real question is whether the business can leave its past behind and improve itself over the years ahead. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

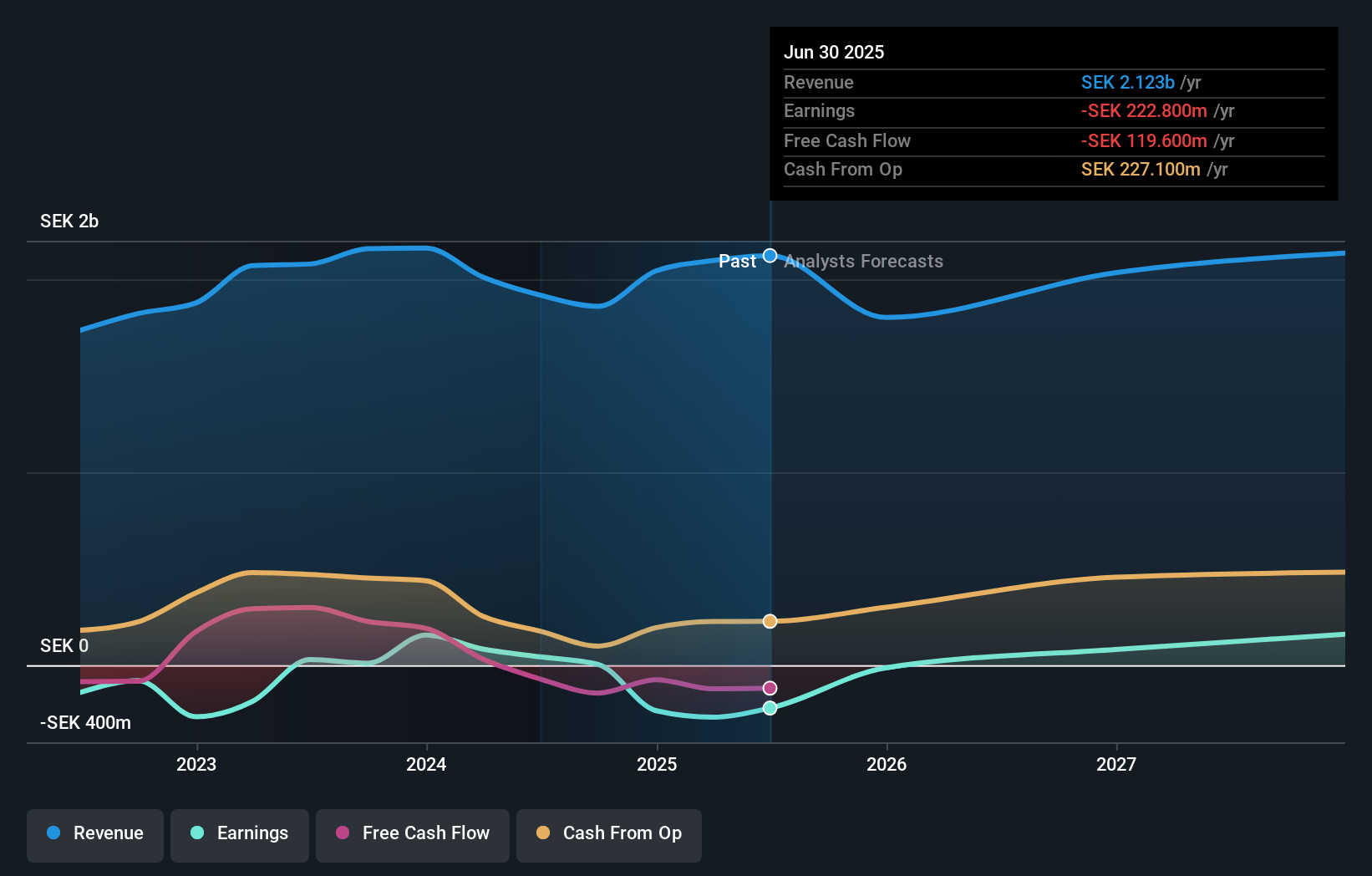

Because Enad Global 7 made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, Enad Global 7 grew its revenue at 21% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 13% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Enad Global 7's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Enad Global 7 shareholders have received a total shareholder return of 10% over one year. There's no doubt those recent returns are much better than the TSR loss of 12% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before spending more time on Enad Global 7 it might be wise to click here to see if insiders have been buying or selling shares.

But note: Enad Global 7 may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enad Global 7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EG7

Enad Global 7

Develops, publishes, markets, and distributes games in PC, console, and mobile platforms in Sweden, rest of Europe, North America, South America, Asia, Africa, and the Oceania.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives