- Sweden

- /

- Interactive Media and Services

- /

- OM:BUSER

More Unpleasant Surprises Could Be In Store For Bambuser AB (publ)'s (STO:BUSER) Shares After Tumbling 31%

To the annoyance of some shareholders, Bambuser AB (publ) (STO:BUSER) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

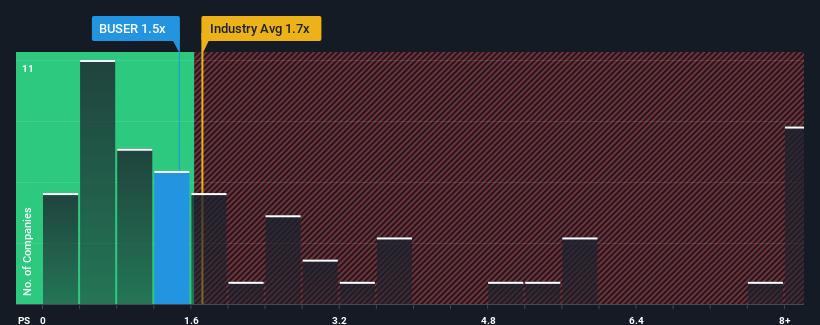

In spite of the heavy fall in price, there still wouldn't be many who think Bambuser's price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in Sweden's Interactive Media and Services industry is similar at about 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Bambuser

How Has Bambuser Performed Recently?

While the industry has experienced revenue growth lately, Bambuser's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bambuser will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Bambuser would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to slump, contracting by 3.4% during the coming year according to the sole analyst following the company. That's not great when the rest of the industry is expected to grow by 20%.

In light of this, it's somewhat alarming that Bambuser's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Bambuser's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Bambuser looks to be in line with the rest of the Interactive Media and Services industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears that Bambuser currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It is also worth noting that we have found 2 warning signs for Bambuser that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bambuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BUSER

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives