- Sweden

- /

- Interactive Media and Services

- /

- OM:BETCO

Not Many Are Piling Into Better Collective A/S (STO:BETCO) Stock Yet As It Plummets 42%

Better Collective A/S (STO:BETCO) shareholders that were waiting for something to happen have been dealt a blow with a 42% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

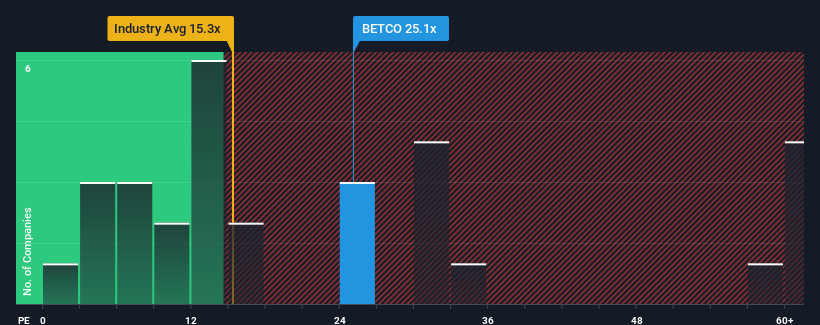

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Better Collective's P/E ratio of 25.1x, since the median price-to-earnings (or "P/E") ratio in Sweden is also close to 23x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Better Collective's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Better Collective

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Better Collective's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 53%. The last three years don't look nice either as the company has shrunk EPS by 4.4% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 46% each year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 19% per year growth forecast for the broader market.

In light of this, it's curious that Better Collective's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Better Collective's P/E

With its share price falling into a hole, the P/E for Better Collective looks quite average now. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Better Collective currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 5 warning signs for Better Collective (2 are a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Better Collective, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Better Collective might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BETCO

Better Collective

Operates as a digital sports media company in Europe, North America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives