- Poland

- /

- Electrical

- /

- WSE:COR

3 European Penny Stocks With At Least €6M Market Cap

Reviewed by Simply Wall St

As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index rising by 1.68%, investors are exploring diverse opportunities across various sectors. For those willing to look beyond established names, penny stocks—often representing smaller or newer companies—remain a compelling area of interest due to their affordability and potential for growth. While the term may seem outdated, these stocks can still offer significant value when supported by strong financials, and we'll explore three such promising options in this article.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.11 | €16.49M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.99 | €27.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.62 | DKK118.83M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.956 | €77.14M | ✅ 2 ⚠️ 4 View Analysis > |

| Faes Farma (BME:FAE) | €4.51 | €1.4B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.08 | €8.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.92 | €30.81M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 273 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Alpcot Holding (OM:ALPCOT B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alpcot Holding AB (publ) operates a digital platform for personal finance in Sweden's financial industry, with a market capitalization of SEK216.04 million.

Operations: Alpcot Holding's revenue primarily comes from its Asset Management segment, generating SEK128 million.

Market Cap: SEK216.04M

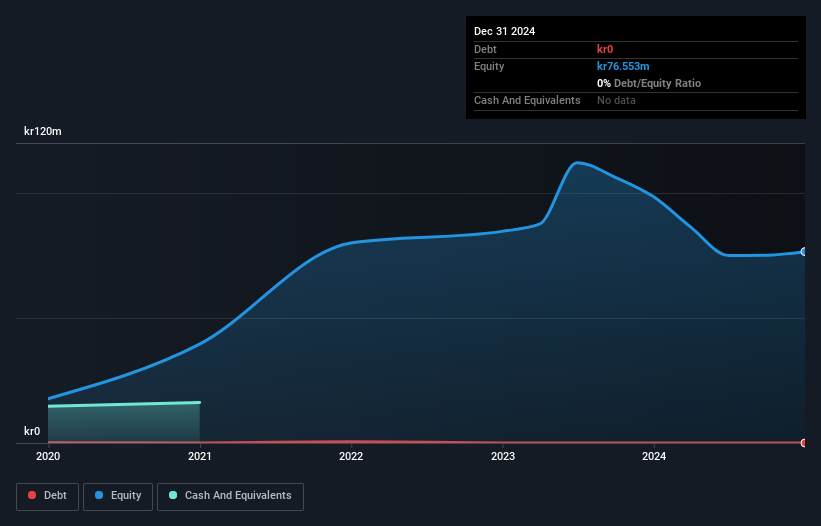

Alpcot Holding AB, with a market cap of SEK216.04 million, operates in Sweden's financial industry through its digital platform and has recently turned profitable. The company reported net income of SEK2.83 million for the first half of 2025, a significant improvement from the previous year's loss. Despite having low return on equity at 4.3%, Alpcot benefits from being debt-free and trading well below estimated fair value. Its short-term assets comfortably cover both short- and long-term liabilities, although its board and management team are relatively inexperienced with average tenures under three years.

- Dive into the specifics of Alpcot Holding here with our thorough balance sheet health report.

- Learn about Alpcot Holding's future growth trajectory here.

Kentima Holding (OM:KENH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kentima Holding AB (publ) develops, manufactures, and sells software and hardware products for the automation and security sectors in Sweden, with a market cap of SEK72.91 million.

Operations: The company generates revenue of SEK68.09 million from its Electronic Security Devices segment.

Market Cap: SEK72.91M

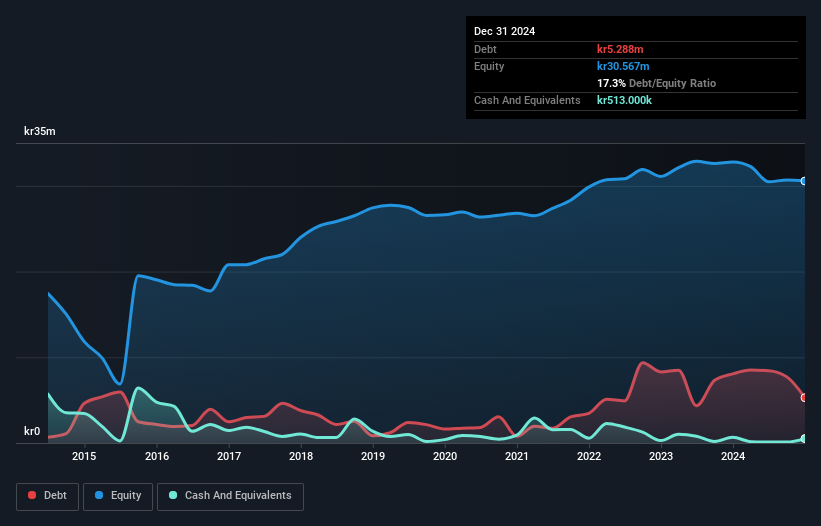

Kentima Holding AB, with a market cap of SEK72.91 million, has recently become profitable, reporting a net income of SEK2.46 million for the first half of 2025 compared to a loss previously. The company demonstrates high-quality earnings and satisfactory debt management with its net debt to equity ratio at 29.9%. Although its return on equity is low at 7.7%, Kentima's operating cash flow adequately covers its debt obligations. The seasoned board and management team bring stability despite the stock's higher volatility compared to most Swedish stocks. Its price-to-earnings ratio of 28.5x suggests it is reasonably valued within the industry context.

- Jump into the full analysis health report here for a deeper understanding of Kentima Holding.

- Evaluate Kentima Holding's historical performance by accessing our past performance report.

Corey Europe (WSE:COR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Corey Europe S.A. manufactures and supplies microgrid solutions and energy products, with a market cap of PLN27.89 million.

Operations: The company's revenue primarily comes from the Machinery & Industrial Equipment segment, totaling PLN0.11 million.

Market Cap: PLN27.89M

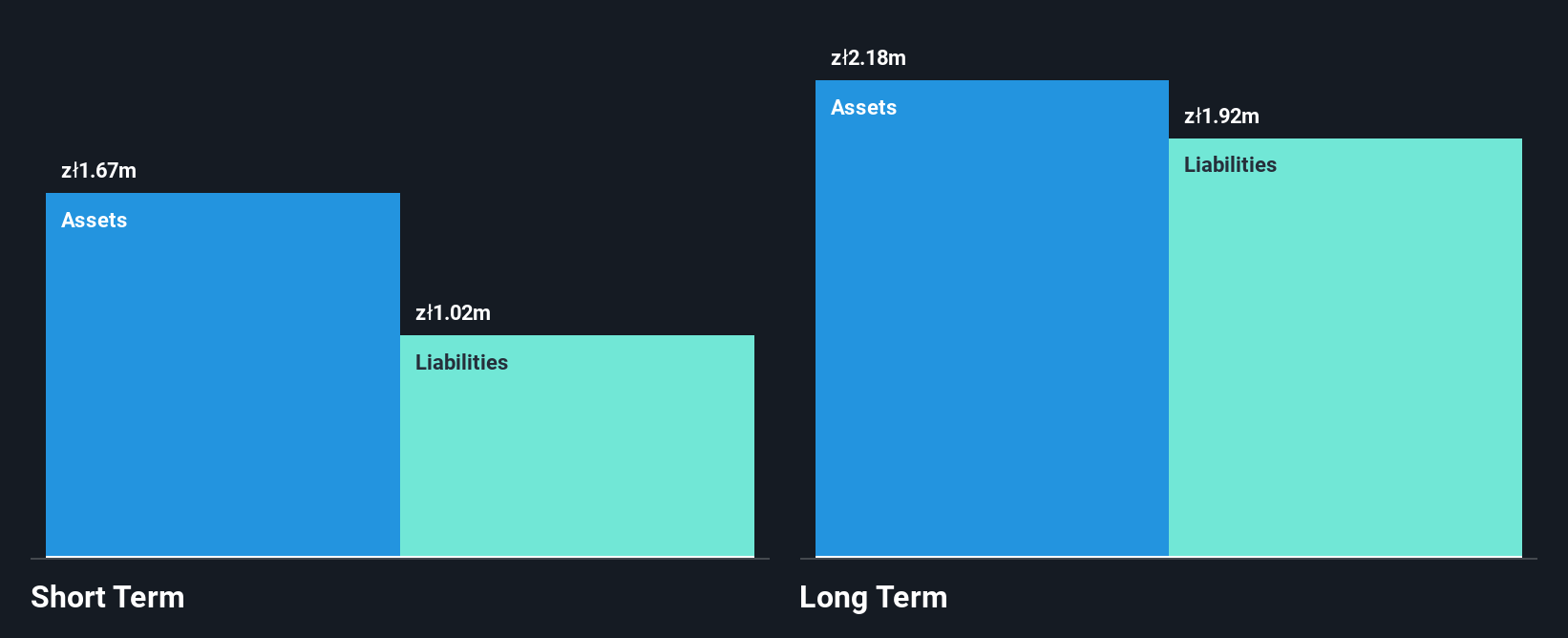

Corey Europe S.A., with a market cap of PLN27.89 million, remains pre-revenue, generating less than US$1 million in revenue from its microgrid solutions and energy products. Despite being unprofitable, the company has a positive free cash flow and sufficient cash runway for over three years. The debt-to-equity ratio has increased significantly over five years to 58.4%, but the net debt to equity remains satisfactory at 16.5%. Short-term assets cover short-term liabilities but fall short for long-term obligations. The board's average tenure is only 0.4 years, indicating an inexperienced leadership team amidst high share price volatility.

- Take a closer look at Corey Europe's potential here in our financial health report.

- Learn about Corey Europe's historical performance here.

Summing It All Up

- Unlock more gems! Our European Penny Stocks screener has unearthed 270 more companies for you to explore.Click here to unveil our expertly curated list of 273 European Penny Stocks.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:COR

Corey Europe

Manufactures and supplies microgrid solutions and energy products.

Adequate balance sheet with low risk.

Market Insights

Community Narratives