There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for AIK Fotboll (NGM:AIK B) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for AIK Fotboll

How Long Is AIK Fotboll's Cash Runway?

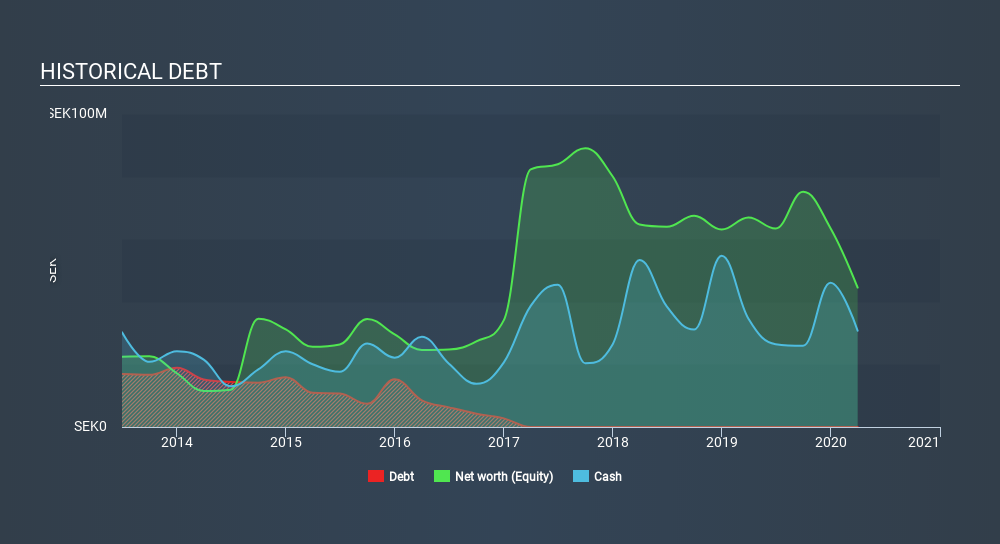

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When AIK Fotboll last reported its balance sheet in March 2020, it had zero debt and cash worth kr31m. Looking at the last year, the company burnt through kr3.8m. That means it had a cash runway of about 8.1 years as of March 2020. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Well Is AIK Fotboll Growing?

Happily, AIK Fotboll is travelling in the right direction when it comes to its cash burn, which is down 79% over the last year. But it was a bit disconcerting to see operating revenue down 13% in that time. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how AIK Fotboll has developed its business over time by checking this visualization of its revenue and earnings history.

How Easily Can AIK Fotboll Raise Cash?

While AIK Fotboll seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

AIK Fotboll has a market capitalisation of kr37m and burnt through kr3.8m last year, which is 10% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About AIK Fotboll's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way AIK Fotboll is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. While its falling revenue wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 2 warning signs for AIK Fotboll that investors should know when investing in the stock.

Of course AIK Fotboll may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NGM:AIK B

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives