- Sweden

- /

- Medical Equipment

- /

- OM:VIMIAN

3 European Growth Companies Insiders Are Heavily Investing In

Reviewed by Simply Wall St

As European markets navigate a mixed landscape marked by dovish signals from the U.S. Federal Reserve and fluctuating industrial outputs, investors are increasingly focusing on growth companies with strong insider ownership as potential opportunities. In this context, stocks with high insider investment can be appealing, suggesting confidence from those closest to the company's operations amid broader economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.9% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 39.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

Here we highlight a subset of our preferred stocks from the screener.

Oryzon Genomics (BME:ORY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oryzon Genomics S.A. is a clinical stage biopharmaceutical company focused on developing epigenetics-based therapeutics for cancer and CNS disorders, with a market cap of €256.67 million.

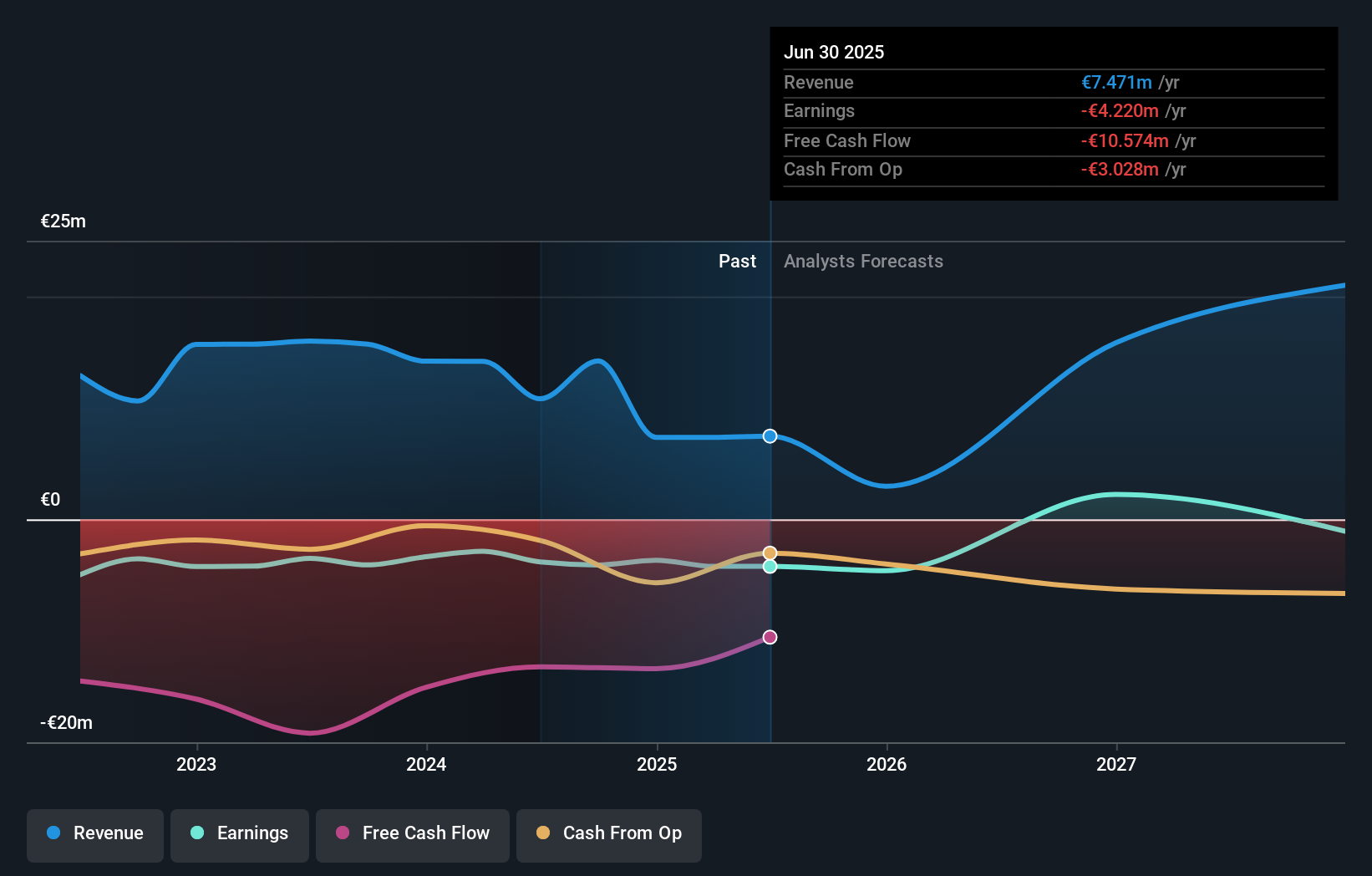

Operations: The company generates revenue from its biotechnology segment, amounting to €7.47 million.

Insider Ownership: 15.3%

Earnings Growth Forecast: 58.9% p.a.

Oryzon Genomics, with high insider ownership, is poised for significant growth as its revenue is forecast to rise by 56% annually, outpacing the Spanish market. The company aims to become profitable within three years despite recent shareholder dilution and volatile share prices. Recent FDA feedback on vafidemstat's Phase III protocol in BPD highlights ongoing advancements in their CNS-focused pipeline. Additionally, EMA approval for iadademstat's trial in sickle cell disease underscores Oryzon's expanding therapeutic scope.

- Unlock comprehensive insights into our analysis of Oryzon Genomics stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Oryzon Genomics shares in the market.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB operates in the global animal health industry and has a market cap of SEK17.25 billion.

Operations: Vimian Group AB generates revenue through its global operations in the animal health industry.

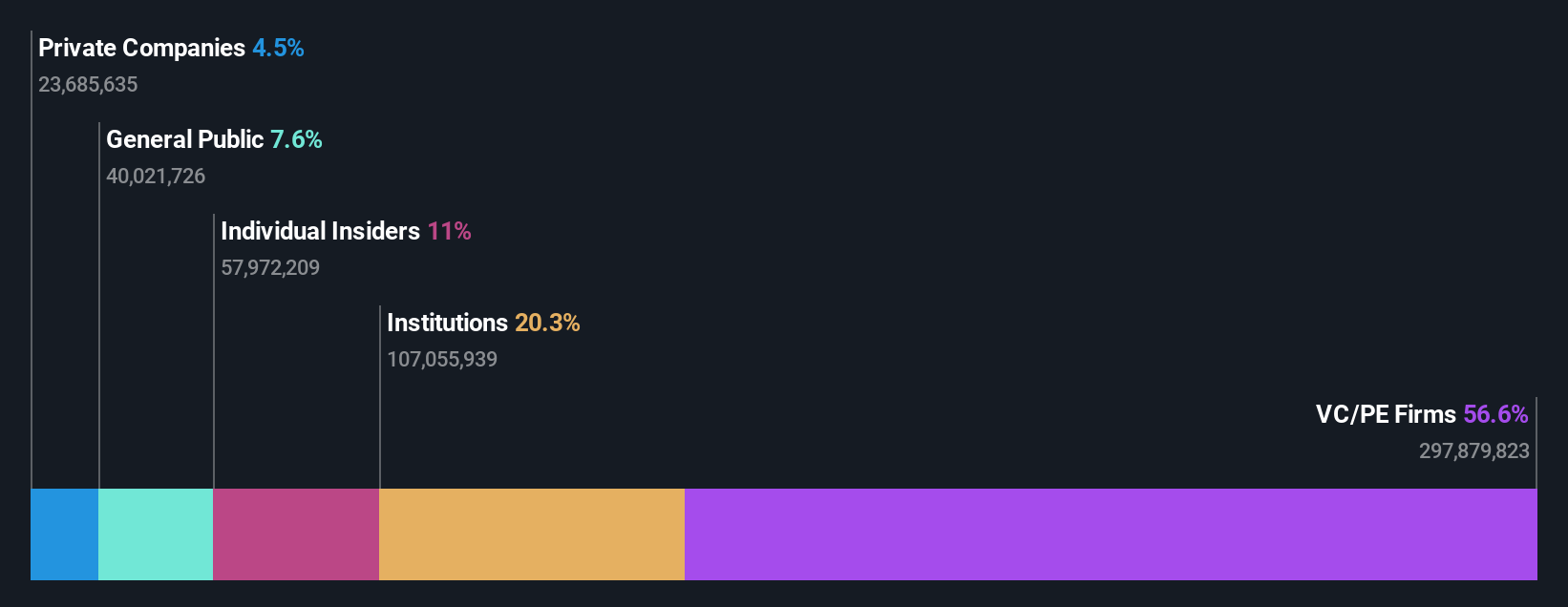

Insider Ownership: 12.7%

Earnings Growth Forecast: 34.2% p.a.

Vimian Group, benefiting from high insider ownership, has shown robust earnings growth of 132.6% over the past year and forecasts suggest a continued annual profit increase of 34.2%, surpassing Swedish market expectations. Recent financial results revealed a net income of €6.8 million for Q3 2025, reversing last year's loss. Despite revenue growth projections being modest at 9.6% annually, insiders have been actively buying shares recently, indicating confidence in the company's future prospects.

- Dive into the specifics of Vimian Group here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Vimian Group is priced higher than what may be justified by its financials.

Gruvaktiebolaget Viscaria (OM:VISC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gruvaktiebolaget Viscaria is involved in the exploration and evaluation of mineral resources in Sweden, with a market cap of SEK2.40 billion.

Operations: The company generates revenue of SEK330.80 million from its activities in the evaluation of mineral resources.

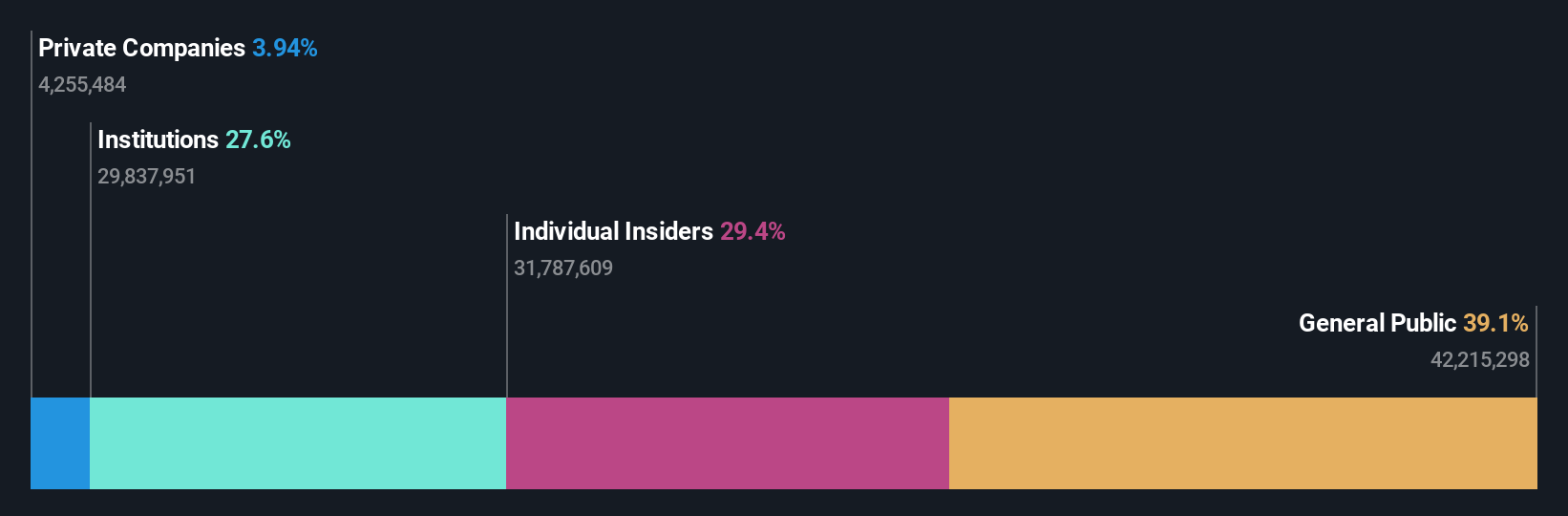

Insider Ownership: 29.4%

Earnings Growth Forecast: 66.2% p.a.

Gruvaktiebolaget Viscaria is experiencing significant insider confidence with more shares bought than sold recently. Despite current losses, the company is projected to achieve profitability within three years, with revenue expected to grow 60.2% annually, outpacing the Swedish market. Recent financial activities include a SEK 750 million equity offering and a substantial debt financing package for the Viscaria Project in Kiruna, highlighting strategic moves for future growth despite recent earnings declines.

- Navigate through the intricacies of Gruvaktiebolaget Viscaria with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Gruvaktiebolaget Viscaria is trading beyond its estimated value.

Next Steps

- Navigate through the entire inventory of 193 Fast Growing European Companies With High Insider Ownership here.

- Contemplating Other Strategies? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIMIAN

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives