- Sweden

- /

- Metals and Mining

- /

- OM:SSAB A

3 Swedish Dividend Stocks Yielding Up To 9.9%

Reviewed by Simply Wall St

The Swedish stock market has been navigating a complex landscape, influenced by global economic shifts and recent monetary policy decisions. Despite these challenges, dividend stocks in Sweden continue to offer attractive yields for investors seeking stable income streams. In this article, we will explore three Swedish dividend stocks yielding up to 9.9%. A good dividend stock typically combines strong financial health with consistent payout history, making it a reliable choice in today's fluctuating market conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.47% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.92% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.60% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.77% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.58% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.04% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.85% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.43% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.75% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.04% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

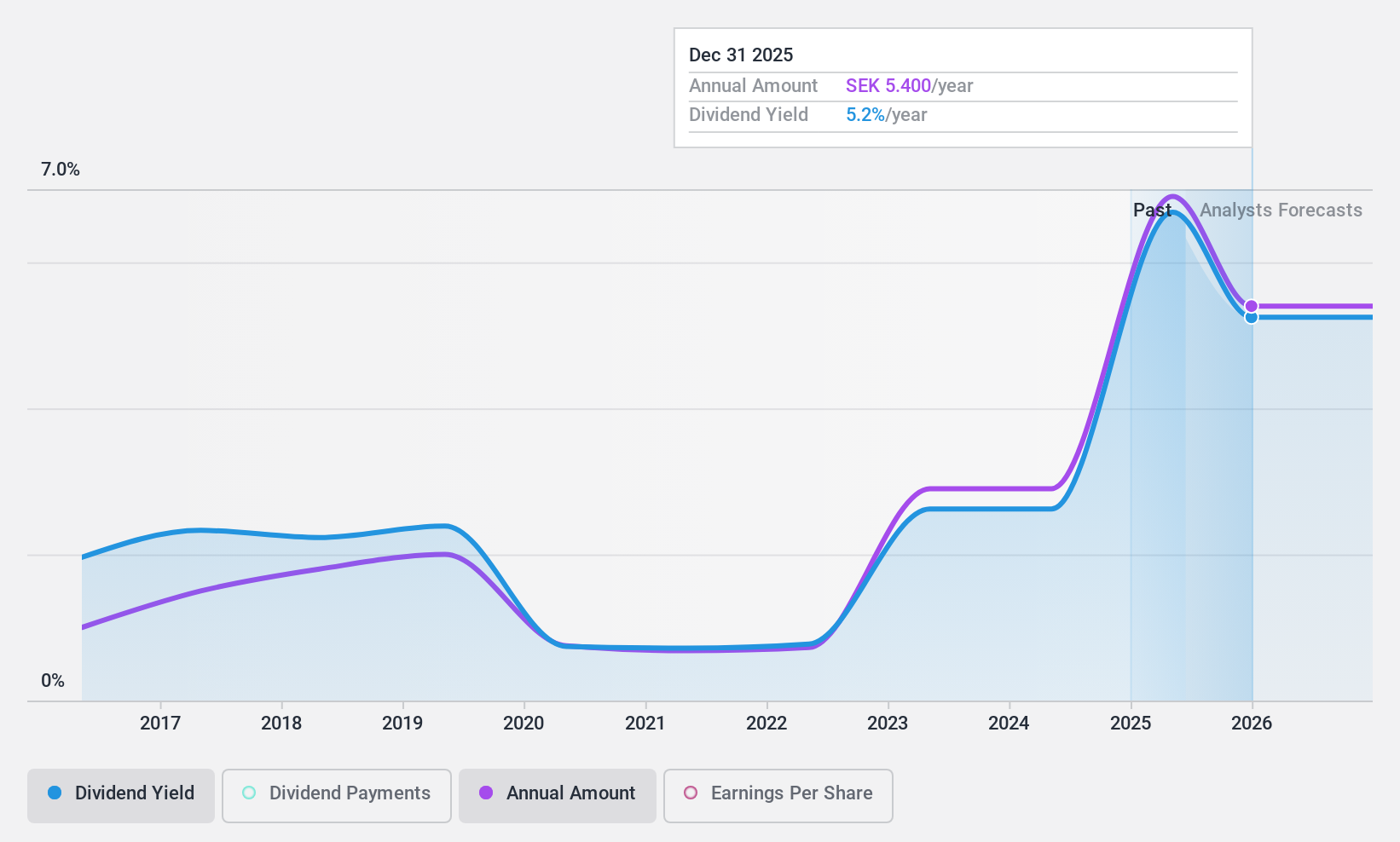

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that provides probiotic products worldwide and has a market cap of SEK11.30 billion.

Operations: BioGaia AB (publ) generates revenue primarily from its Pediatrics segment, which accounts for SEK1072.93 million, and its Adult Health segment, contributing SEK288.68 million.

Dividend Yield: 6.2%

BioGaia's dividend yield of 6.18% places it among the top 25% of dividend payers in Sweden, yet its sustainability is questionable. Despite a decade-long increase in dividends, they are not well covered by free cash flow, with a high cash payout ratio of 193.8%. Recent earnings show promising growth, with Q2 sales at SEK 384.12 million and net income at SEK 111.01 million, but significant insider selling raises concerns about future stability.

- Get an in-depth perspective on BioGaia's performance by reading our dividend report here.

- The valuation report we've compiled suggests that BioGaia's current price could be quite moderate.

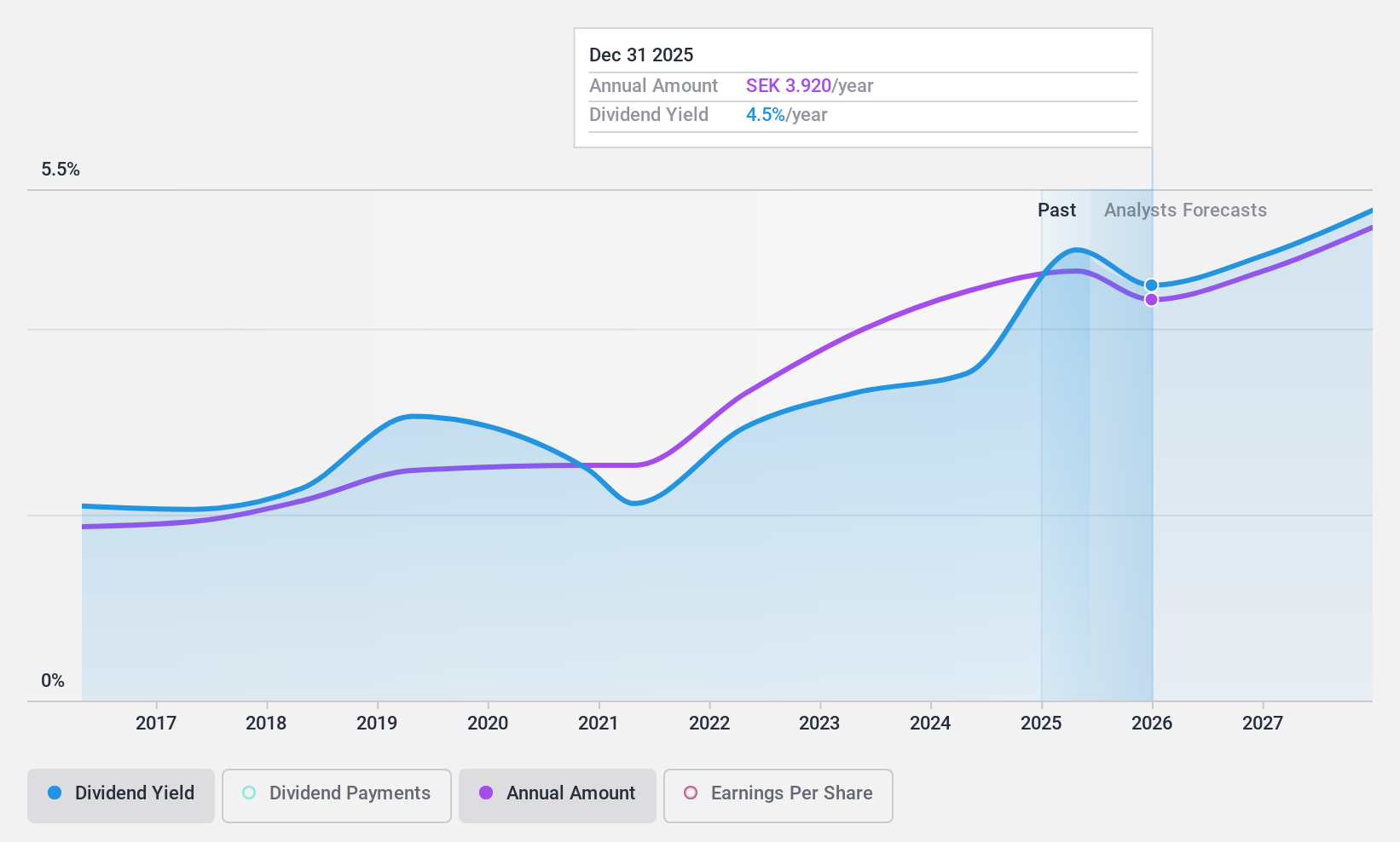

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) develops, manufactures, and sells various polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia with a market cap of SEK36.54 billion.

Operations: HEXPOL AB (publ) generates revenue primarily from HEXPOL Compounding (SEK20.18 billion) and HEXPOL Engineered Products (SEK1.61 billion).

Dividend Yield: 3.8%

HEXPOL offers a stable dividend yield of 3.77%, although it falls below the top 25% of Swedish dividend payers. Dividends have been consistently growing and are well-covered by both earnings (55.4% payout ratio) and cash flows (57.8% cash payout ratio). Recent earnings showed a slight decline, with Q2 sales at SEK 5.45 billion and net income at SEK 654 million, reflecting minor year-over-year decreases in financial performance.

- Take a closer look at HEXPOL's potential here in our dividend report.

- Our expertly prepared valuation report HEXPOL implies its share price may be lower than expected.

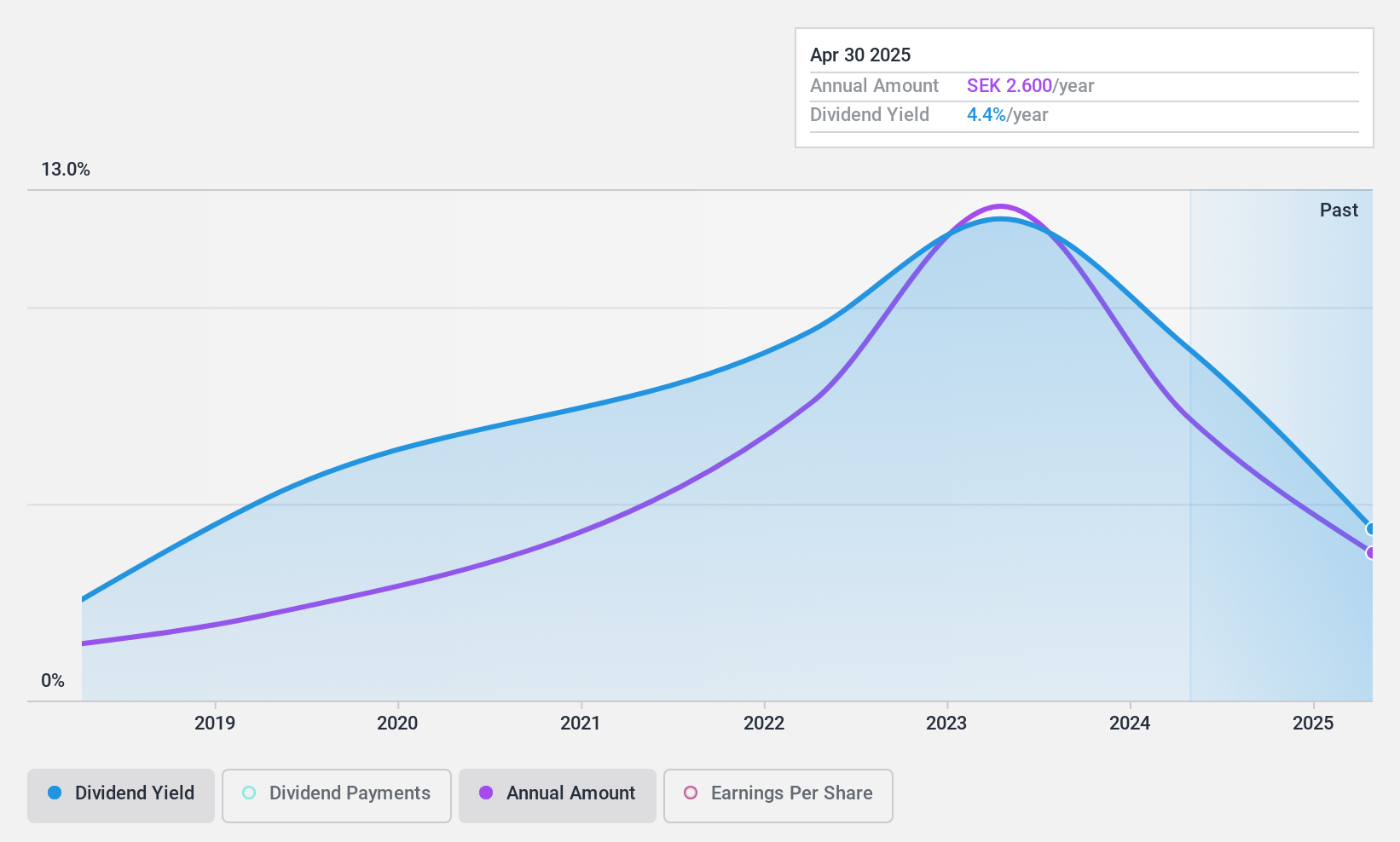

SSAB (OM:SSAB A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SSAB AB (publ) produces and sells steel products in Sweden, Finland, the rest of Europe, the United States, and internationally with a market cap of SEK49.28 billion.

Operations: SSAB AB (publ) generates revenue from several segments, including SSAB Europe (SEK43.44 billion), SSAB Americas (SEK26.81 billion), SSAB Special Steels (SEK30.49 billion), Tibnor (SEK12.50 billion), and Ruukki Construction (SEK5.41 billion).

Dividend Yield: 9.9%

SSAB's dividend yield stands out at 9.92%, ranking in the top 25% of Swedish dividend payers. However, its dividend history has been volatile and unreliable over the past six years. Despite this, dividends are well-covered by both earnings (48.7% payout ratio) and cash flows (49.5% cash payout ratio). Recent financial performance showed a decline with Q2 sales at SEK 28.28 billion and net income at SEK 2.42 billion, reflecting lower year-over-year results.

- Click to explore a detailed breakdown of our findings in SSAB's dividend report.

- Upon reviewing our latest valuation report, SSAB's share price might be too pessimistic.

Where To Now?

- Investigate our full lineup of 22 Top Swedish Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SSAB A

SSAB

Engages in the production and sale of steel products in Sweden, Finland, the Rest of Europe, the United States, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives