Should You Be Adding Polygiene Group (STO:POLYG) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Polygiene Group (STO:POLYG), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Polygiene Group

How Fast Is Polygiene Group Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Polygiene Group to have grown EPS from kr0.57 to kr1.96 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

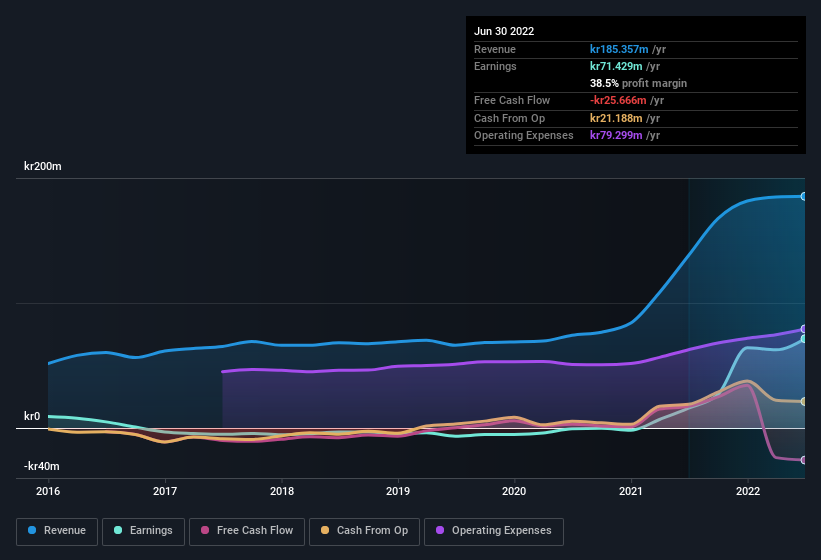

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Polygiene Group is growing revenues, and EBIT margins improved by 4.9 percentage points to 21%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Polygiene Group is no giant, with a market capitalisation of kr562m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Polygiene Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Polygiene Group insiders spent kr2.0m on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Independent Chairman of the Board Jonas Wollin who made the biggest single purchase, worth kr613k, paying kr30.71 per share.

Along with the insider buying, another encouraging sign for Polygiene Group is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at kr135m. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 24% of the company; visible skin in the game.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Polygiene Group's CEO, Ulrika Bjork, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under kr2.1b, like Polygiene Group, the median CEO pay is around kr2.6m.

Polygiene Group's CEO took home a total compensation package worth kr1.7m in the year leading up to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Polygiene Group To Your Watchlist?

Polygiene Group's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Polygiene Group belongs near the top of your watchlist. However, before you get too excited we've discovered 4 warning signs for Polygiene Group (2 are a bit unpleasant!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Polygiene Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:POLYG

Polygiene Group

Provides antimicrobial technologies for textiles and other hard surfaces in the Asia Pacific, Europe, the Middle East, Africa, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives