Polygiene Group AB (STO:POLYG) Shares Fly 31% But Investors Aren't Buying For Growth

Despite an already strong run, Polygiene Group AB (STO:POLYG) shares have been powering on, with a gain of 31% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.4% in the last twelve months.

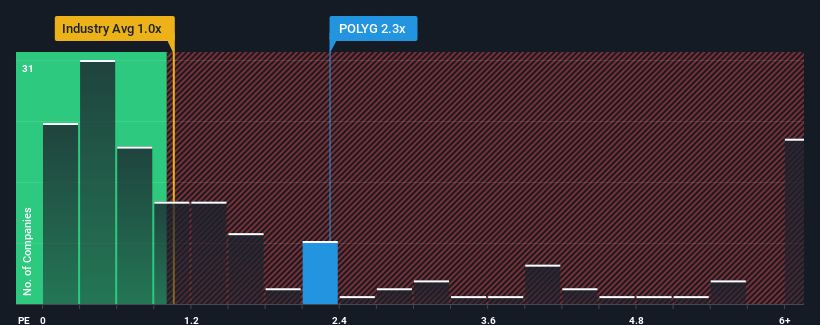

Even after such a large jump in price, Polygiene Group's price-to-sales (or "P/S") ratio of 2.3x might still make it look like a buy right now compared to the Chemicals industry in Sweden, where around half of the companies have P/S ratios above 3.5x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Polygiene Group

What Does Polygiene Group's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Polygiene Group's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Polygiene Group will help you uncover what's on the horizon.How Is Polygiene Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Polygiene Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. Still, the latest three year period has seen an excellent 59% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 10% per annum during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 33% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Polygiene Group's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Polygiene Group's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Polygiene Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Polygiene Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:POLYG

Polygiene Group

Provides antimicrobial technologies for textiles and other hard surfaces in the Asia Pacific, Europe, the Middle East, Africa, the United States, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026