Not Many Are Piling Into Polygiene Group AB (STO:POLYG) Stock Yet As It Plummets 25%

Polygiene Group AB (STO:POLYG) shares have had a horrible month, losing 25% after a relatively good period beforehand. The last month has meant the stock is now only up 3.4% during the last year.

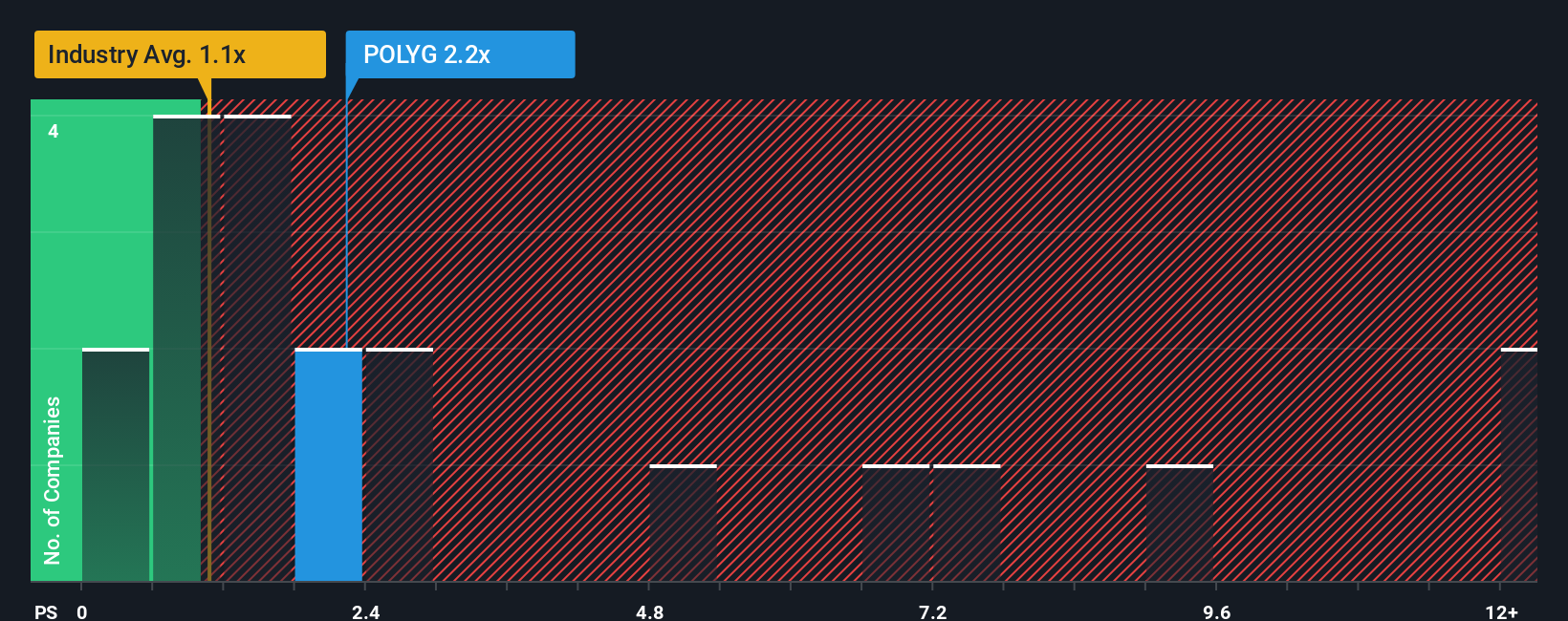

Even after such a large drop in price, it's still not a stretch to say that Polygiene Group's price-to-sales (or "P/S") ratio of 2.2x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Sweden, where the median P/S ratio is around 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Polygiene Group

How Has Polygiene Group Performed Recently?

Recent times haven't been great for Polygiene Group as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Polygiene Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Polygiene Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Polygiene Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.0% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 4.8%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Polygiene Group's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Polygiene Group looks to be in line with the rest of the Chemicals industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Polygiene Group's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Polygiene Group (1 doesn't sit too well with us!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:POLYG

Polygiene Group

Provides antimicrobial technologies for textiles and other hard surfaces in the Asia Pacific, Europe, the Middle East, Africa, the United States, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026