If You Had Bought Polygiene AB (publ.) (STO:POLYG) Stock A Year Ago, You Could Pocket A 597% Gain Today

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you find (and hold) a big winner, you can markedly improve your finances. For example, the Polygiene AB (publ.) (STO:POLYG) share price is up a whopping 597% in the last year, a handsome return in a single year. And in the last month, the share price has gained 6.1%. We note that Polygiene AB (publ.) reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report. It is also impressive that the stock is up 248% over three years, adding to the sense that it is a real winner.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for Polygiene AB (publ.)

Polygiene AB (publ.) wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Polygiene AB (publ.)'s revenue grew by 22%. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 597% in the last year. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Polygiene AB (publ.).

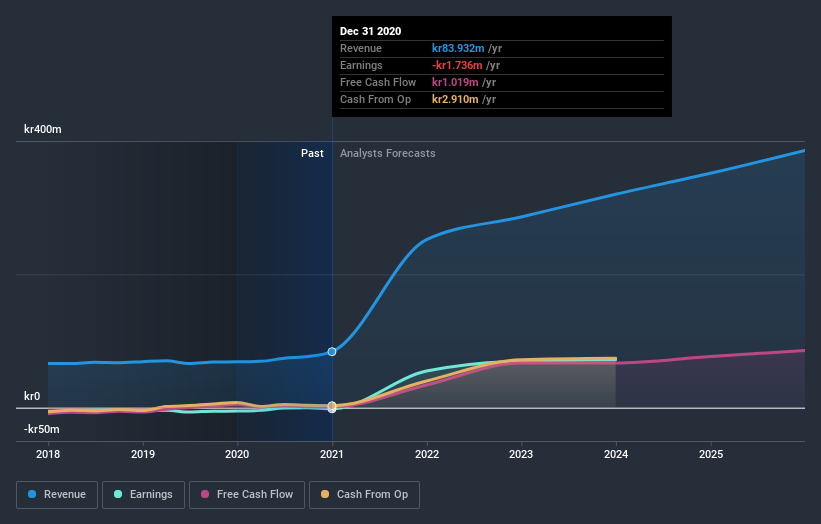

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Polygiene AB (publ.) will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Polygiene AB (publ.) shareholders have received a total shareholder return of 597% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 22% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Polygiene AB (publ.) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Polygiene AB (publ.) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:POLYG

Polygiene Group

Provides antimicrobial technologies for textiles and other hard surfaces in the Asia Pacific, Europe, the Middle East, Africa, the United States, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives