As the pan-European STOXX Europe 600 Index rises, buoyed by easing geopolitical tensions and economic stimulus prospects, the European market presents a landscape of cautious optimism. In this context, penny stocks—despite their old-fashioned moniker—remain an intriguing investment area for those seeking opportunities in smaller or newer companies. By focusing on firms with strong financials and potential growth trajectories, investors can uncover promising opportunities among these often-overlooked stocks.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.55 | €80.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Maps (BIT:MAPS) | €3.50 | €46.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.80 | €59.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.65 | €17.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.38 | PLN11.8M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.475 | SEK2.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.54 | SEK215.37M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.125 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.994 | €33.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 328 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Banqup Group (ENXTBR:BANQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Banqup Group SA is a fintech company that develops and operates a cloud-based platform for administrative and financial services in Belgium and internationally, with a market cap of €130.33 million.

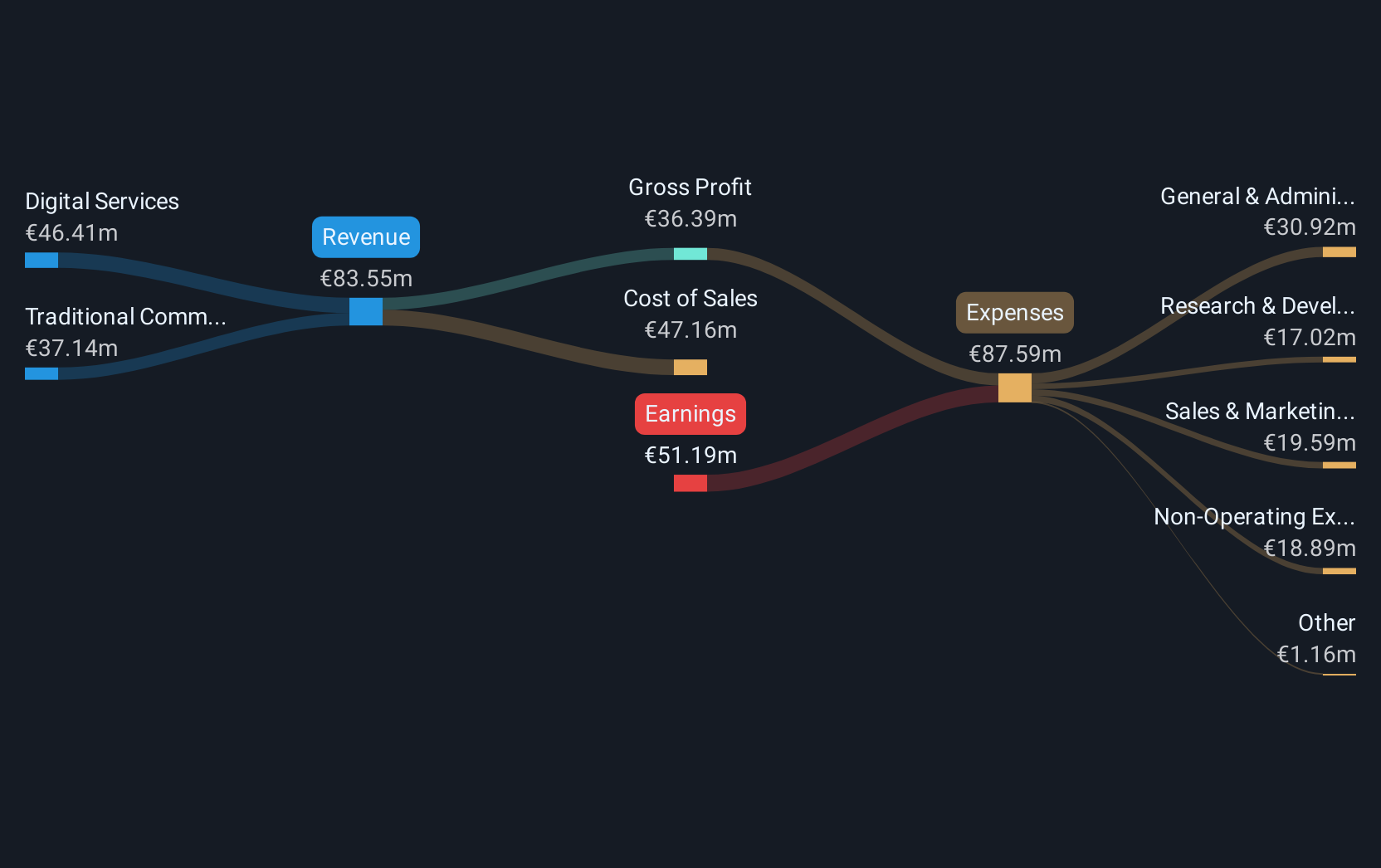

Operations: The company's revenue is derived from two main segments: Digital Services, contributing €46.41 million, and Traditional Communication Services, generating €37.14 million.

Market Cap: €130.33M

Banqup Group, a fintech company with a market cap of €130.33 million, is currently unprofitable and has seen its losses increase over the past five years. Despite this, it trades significantly below its estimated fair value and maintains a satisfactory net debt to equity ratio of 13.6%. The company's short-term assets exceed both its short-term and long-term liabilities, suggesting financial stability in the near term. However, recent auditor concerns about its ability to continue as a going concern highlight potential risks for investors considering this penny stock in Europe.

- Take a closer look at Banqup Group's potential here in our financial health report.

- Assess Banqup Group's future earnings estimates with our detailed growth reports.

Afarak Group (HLSE:AFAGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Afarak Group SE is involved in the extraction, processing, marketing, and trading of specialised metals across Finland, other EU countries, the United States, China, Africa, and globally with a market cap of €75.02 million.

Operations: The company's revenue is primarily derived from its Speciality Alloys segment, which generated €111.28 million, followed by the Ferro Alloys segment with €16.58 million.

Market Cap: €75.02M

Afarak Group SE, with a market cap of €75.02 million, is navigating challenges typical of penny stocks. Despite being unprofitable, it has successfully reduced its debt to equity ratio from 80.3% to 2% over five years and maintains more cash than total debt, indicating some financial resilience. The company's short-term assets (€57.8M) comfortably cover both its short-term (€17.9M) and long-term liabilities (€31.7M). However, negative operating cash flow raises concerns about debt coverage capabilities. Recent board changes may influence strategic direction as Afarak continues to manage high share price volatility and production fluctuations in its Speciality Alloys segment.

- Navigate through the intricacies of Afarak Group with our comprehensive balance sheet health report here.

- Evaluate Afarak Group's historical performance by accessing our past performance report.

Nexam Chemical Holding (OM:NEXAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nexam Chemical Holding AB (publ) develops solutions to enhance the properties and performance of plastics in Sweden, Europe, and internationally, with a market cap of SEK324.47 million.

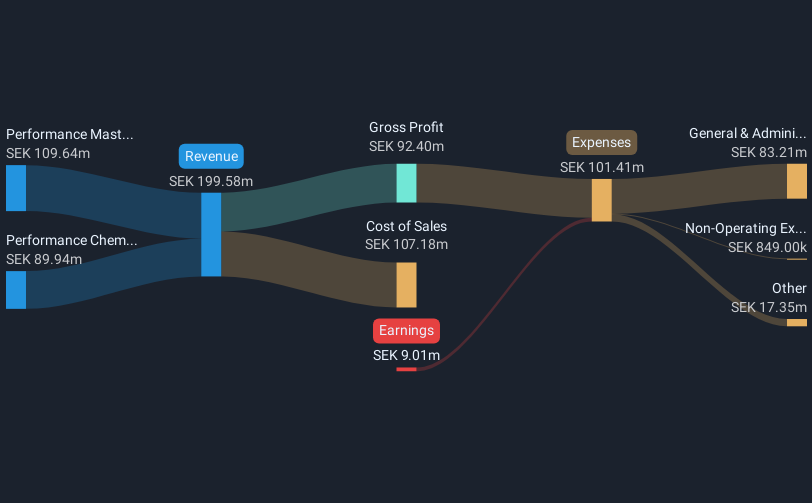

Operations: The company generates revenue through its Performance Masterbatch segment, amounting to SEK105.70 million, and Segment Adjustment, contributing SEK89.94 million.

Market Cap: SEK324.47M

Nexam Chemical Holding AB, with a market cap of SEK324.47 million, is experiencing typical penny stock volatility while showing potential through its innovative solutions in the plastics industry. Despite being unprofitable and reporting a net loss of SEK4.06 million for Q1 2025, Nexam has managed to reduce its debt to equity ratio from 30.4% to 10.8% over five years and maintains short-term assets (SEK76.7M) that exceed both short-term (SEK40.5M) and long-term liabilities (SEK11.4M). Recent commercial production by a key client using Nexam's additives highlights growing traction in the recycling sector, potentially enhancing future revenue streams despite current financial challenges.

- Click to explore a detailed breakdown of our findings in Nexam Chemical Holding's financial health report.

- Gain insights into Nexam Chemical Holding's future direction by reviewing our growth report.

Key Takeaways

- Unlock more gems! Our European Penny Stocks screener has unearthed 325 more companies for you to explore.Click here to unveil our expertly curated list of 328 European Penny Stocks.

- Curious About Other Options? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexam Chemical Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEXAM

Nexam Chemical Holding

Develops solutions that enhance properties and performance of plastics in Sweden, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives