Stable Margins and North American Gains Might Change the Case for Investing in Billerud (OM:BILL)

Reviewed by Sasha Jovanovic

- BillerudKorsnas reported stable EBITDA margins for Q2 2025 despite ongoing market challenges in Europe, with North America delivering strong performance and a very large year-over-year increase in operating cash flow.

- The company’s consideration of restructuring to support European profitability, alongside significant progress in its North American product portfolio, signals increased focus on operational improvement and market adaptation.

- Now, we’ll review how the company’s stable margins and North American strength may reshape Billerud’s investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Billerud Investment Narrative Recap

For Billerud shareholders, the core investment thesis centers on recovery in European packaging demand combined with ongoing execution of the North American product growth strategy. The recent report of stable EBITDA margins, strong North American results, and a sharp rise in operating cash flow may lessen immediate earnings pressure, but structural overcapacity and persistent weak demand in Europe remain the most important risks and could still limit margin recovery in the short term.

The accelerated progress in Billerud’s North American product portfolio stands out, especially in light of ongoing earnings headwinds in Europe. This announcement is particularly relevant because North America is becoming a larger contributor to earnings stability and future growth, even as the European market contends with challenging conditions and pricing pressure.

By contrast, investors should be aware that persistent structural overcapacity in Europe could still require more permanent restructuring or asset write-downs if...

Read the full narrative on Billerud (it's free!)

Billerud's outlook anticipates SEK44.7 billion in revenue and SEK1.9 billion in earnings by 2028. This assumes a 0.7% annual revenue decline and an earnings increase of SEK0.1 billion from current earnings of SEK1.8 billion.

Uncover how Billerud's forecasts yield a SEK102.60 fair value, a 25% upside to its current price.

Exploring Other Perspectives

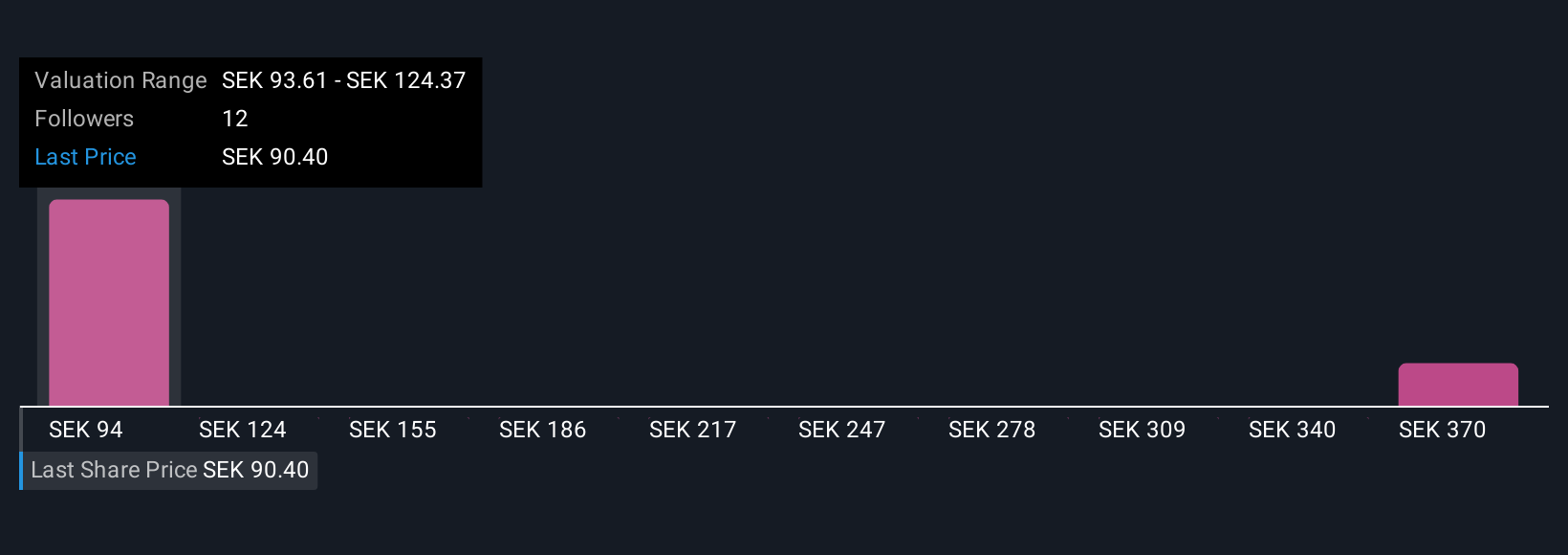

Simply Wall St Community members produced four fair value estimates for Billerud, ranging from SEK93.61 to SEK492.45. While some see wide upside, structural risks in European packaging markets could weigh on future results, explore these alternative views for a full picture of potential outcomes.

Explore 4 other fair value estimates on Billerud - why the stock might be worth over 5x more than the current price!

Build Your Own Billerud Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Billerud research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Billerud research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Billerud's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Billerud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILL

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives