Stock Analysis

Exploring Value Opportunities on the Swedish Exchange in July 2024

Reviewed by Simply Wall St

As global markets navigate through a period marked by rising trade tensions and shifting investment trends towards value and small-cap shares, the Swedish stock market presents unique opportunities for those seeking undervalued assets. Amidst these conditions, identifying stocks that demonstrate strong fundamentals yet are trading below their intrinsic values could offer potential for significant returns.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gränges (OM:GRNG) | SEK136.90 | SEK260.89 | 47.5% |

| Truecaller (OM:TRUE B) | SEK35.66 | SEK70.77 | 49.6% |

| Nordic Waterproofing Holding (OM:NWG) | SEK160.60 | SEK313.50 | 48.8% |

| Scandi Standard (OM:SCST) | SEK74.80 | SEK145.57 | 48.6% |

| TF Bank (OM:TFBANK) | SEK260.00 | SEK518.40 | 49.8% |

| RaySearch Laboratories (OM:RAY B) | SEK139.80 | SEK278.37 | 49.8% |

| Nordisk Bergteknik (OM:NORB B) | SEK17.00 | SEK31.02 | 45.2% |

| Humble Group (OM:HUMBLE) | SEK10.27 | SEK18.71 | 45.1% |

| Image Systems (OM:IS) | SEK1.465 | SEK2.85 | 48.6% |

| Bactiguard Holding (OM:BACTI B) | SEK69.40 | SEK132.12 | 47.5% |

We're going to check out a few of the best picks from our screener tool.

Billerud (OM:BILL)

Overview: Billerud AB (publ) is a global provider of paper and packaging materials, with a market capitalization of approximately SEK 26.69 billion.

Operations: The company generates revenue primarily from Europe and North America, with SEK 26.57 billion and SEK 10.96 billion respectively, alongside additional contributions from other solutions totaling SEK 2.84 billion.

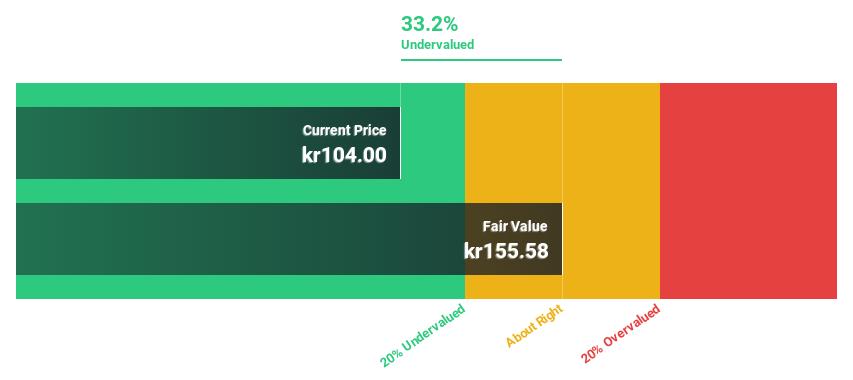

Estimated Discount To Fair Value: 35%

Billerud, with a recent rebound in earnings and an impressive forecast of 41.82% annual profit growth, appears undervalued based on cash flows. Trading at SEK107.3, significantly below the estimated fair value of SEK165.03, it presents a potential opportunity despite its challenges such as low return on equity projected at 8.3% in three years and a dividend coverage issue, with current dividends not well supported by earnings. Recent leadership changes and strategic shifts towards US packaging materials may influence future performance.

- Our earnings growth report unveils the potential for significant increases in Billerud's future results.

- Click to explore a detailed breakdown of our findings in Billerud's balance sheet health report.

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) specializes in developing and selling instruments, software, and reagents for analyzing blood and body fluids, operating both in Sweden and internationally, with a market capitalization of approximately SEK 6.14 billion.

Operations: The company generates SEK 708.28 million from its automated microscopy systems and reagents segment in the field of hematology.

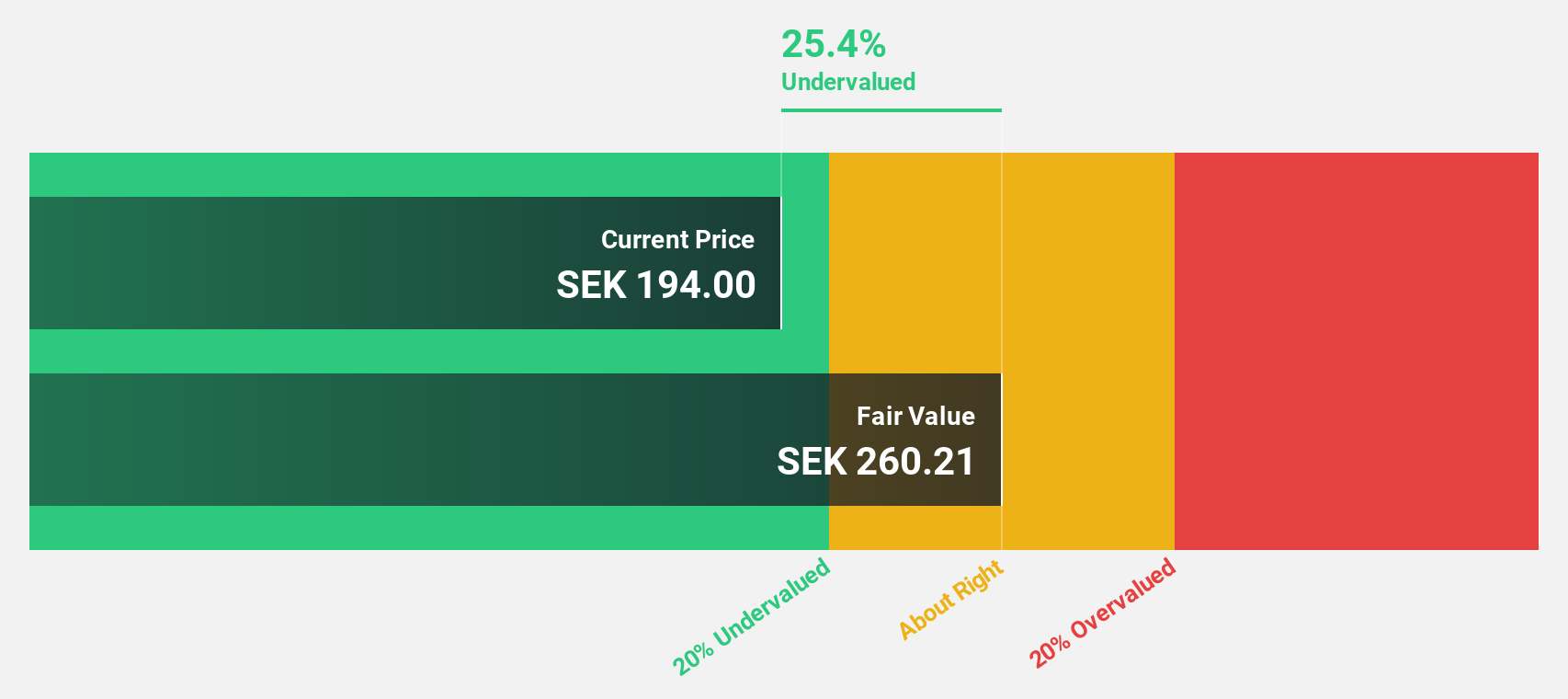

Estimated Discount To Fair Value: 20.8%

CellaVision, currently priced at SEK257.5, is assessed to be trading below its fair value of SEK325.33, marking a 20.8% undervaluation based on discounted cash flows. With earnings growth forecasted at 24.28% annually over the next three years—surpassing the Swedish market's expected 15%—and a robust projected return on equity of 23.8%, CellaVision demonstrates strong financial health and growth potential. However, its revenue growth estimate of 13.6% annually falls short of the high-growth benchmark but still outpaces the broader market forecast of 1%.

- In light of our recent growth report, it seems possible that CellaVision's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of CellaVision.

Scandi Standard (OM:SCST)

Overview: Scandi Standard AB (publ) is a producer and seller of chilled, frozen, and ready-to-eat chicken products across Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, and other European countries with a market capitalization of approximately SEK 4.89 billion.

Operations: The company generates revenue primarily through its Ready-To-Cook and Ready-To-Eat chicken products, with segments producing SEK 9.70 billion and SEK 2.61 billion respectively.

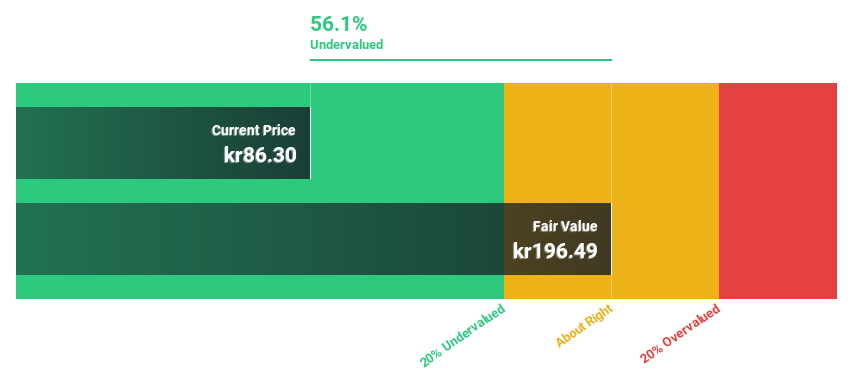

Estimated Discount To Fair Value: 48.6%

Scandi Standard, with a current price of SEK 74.8, is trading significantly below its calculated fair value of SEK 145.57, indicating a potential undervaluation based on cash flows. Despite this, the company's high debt levels and unstable dividend track record pose concerns. Recent financial agreements aim to refinance existing debts and support growth strategies, potentially improving financial flexibility. Earnings are expected to grow at an annual rate of 20.39%, outpacing the Swedish market forecast of 15% per year growth.

- According our earnings growth report, there's an indication that Scandi Standard might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Scandi Standard.

Seize The Opportunity

- Discover the full array of 47 Undervalued Swedish Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Billerud is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILL

Excellent balance sheet and good value.