Stock Analysis

- Sweden

- /

- Healthtech

- /

- OM:RAY B

Swedish Growth Companies With Insider Ownership As High As 26%

Reviewed by Simply Wall St

As global markets exhibit mixed performances with a notable pivot towards value and small-cap stocks, the Swedish market remains a point of interest for those looking at growth companies with substantial insider ownership. In Sweden, where high insider ownership can signal strong confidence in company prospects, analyzing such stocks could be particularly relevant in the current economic climate.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| Sileon (OM:SILEON) | 20.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

We're going to check out a few of the best picks from our screener tool.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RaySearch Laboratories AB, a medical technology company based in Sweden, specializes in developing software solutions for cancer treatment across various global regions and has a market capitalization of approximately SEK 4.79 billion.

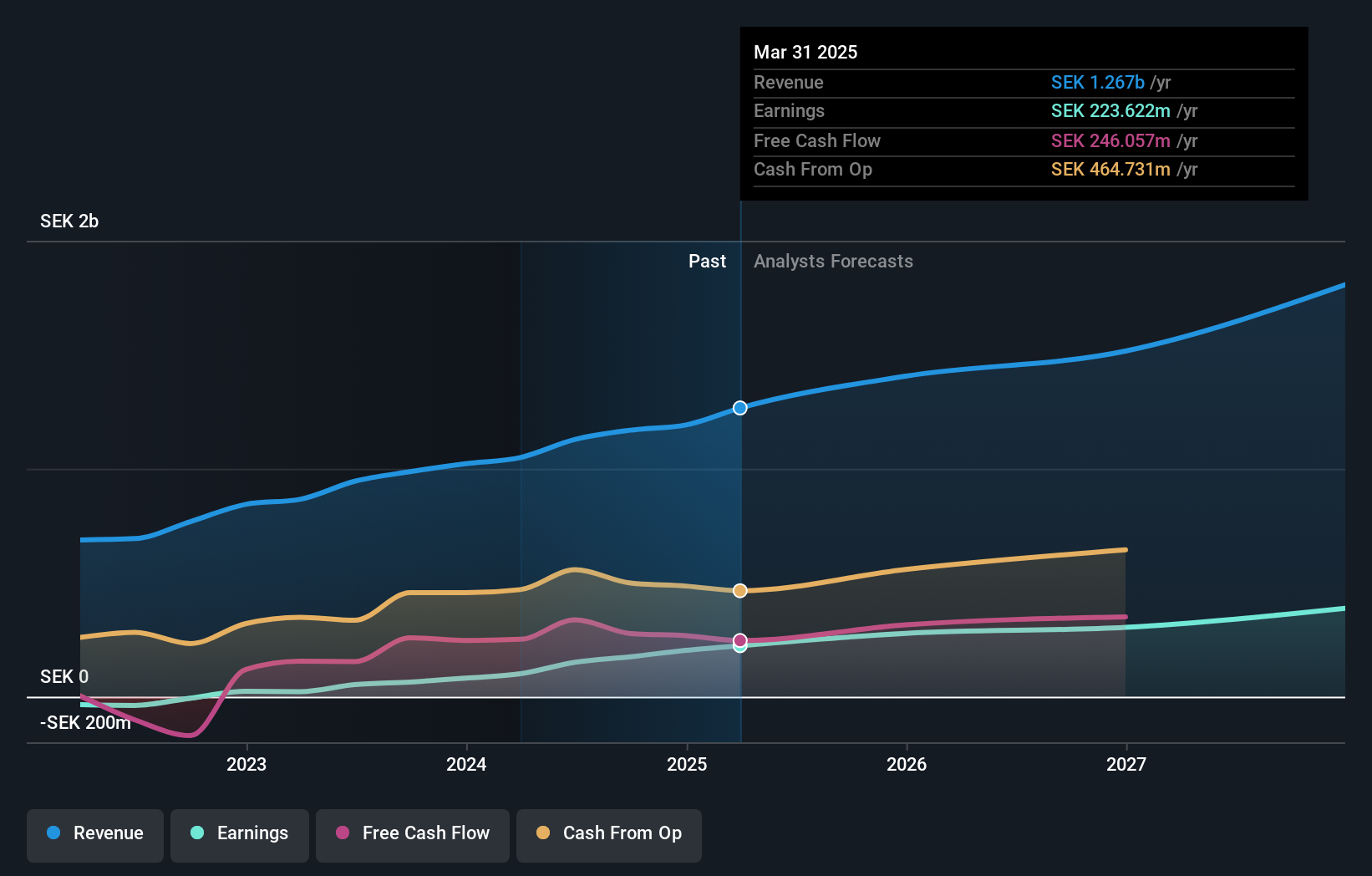

Operations: The company generates its revenue primarily from healthcare software, totaling SEK 1.05 billion.

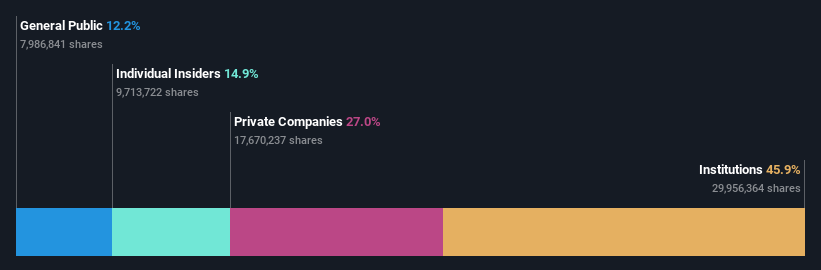

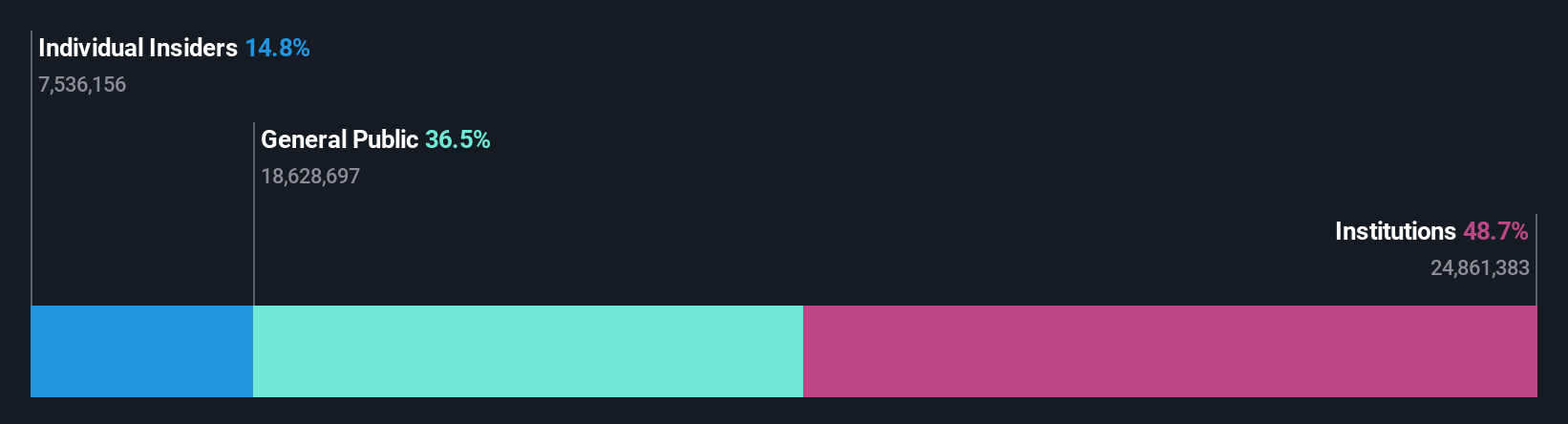

Insider Ownership: 24.1%

RaySearch Laboratories, a Swedish company with high insider ownership, recently launched RayStation® 2024B, enhancing radiation therapy efficiency through automated clinical workflows. This innovation follows their strategic alliance with C-RAD to integrate surface scanning technologies into treatment planning. Financially, RaySearch reported a significant earnings increase in Q1 2024 and is expected to continue robust growth with projected annual earnings expansion of 33.62%. However, it trades at a substantial discount to its estimated fair value.

- Get an in-depth perspective on RaySearch Laboratories' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report RaySearch Laboratories implies its share price may be lower than expected.

Scandi Standard (OM:SCST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Scandi Standard AB (publ) specializes in the production and sale of chilled, frozen, and ready-to-eat chicken products across Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom and other European countries with a market capitalization of SEK 4.89 billion.

Operations: The company generates revenue primarily through its ready-to-cook chicken products, which brought in SEK 9.70 billion, and its ready-to-eat offerings, contributing SEK 2.61 billion.

Insider Ownership: 14.5%

Scandi Standard, a Swedish growth company with substantial insider buying over the past three months, demonstrates promising financial maneuvers with its recent SEK 3.20 billion sustainability-linked bank loan aimed at bolstering long-term growth. Despite a slight dip in quarterly sales and earnings, the firm is positioned for significant earnings growth of 20.4% annually over the next three years, outpacing the broader Swedish market's expectations. However, its high debt levels and unstable dividend track record suggest cautious optimism is warranted.

- Click to explore a detailed breakdown of our findings in Scandi Standard's earnings growth report.

- Our valuation report here indicates Scandi Standard may be undervalued.

Surgical Science Sweden (OM:SUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Surgical Science Sweden AB, with a market cap of SEK 6.53 billion, specializes in developing and marketing virtual reality simulators for evidence-based medical training across Europe, North and South America, and Asia.

Operations: The company generates revenue primarily through two segments: Industry/OEM at SEK 387.52 million and Educational Products at SEK 454.50 million.

Insider Ownership: 26.6%

Surgical Science Sweden, amidst executive changes with Tom Englund set to become CEO, is trading at a very large discount to its estimated fair value. While its return on equity is expected to remain low at 6.2%, earnings are projected to grow by 27% annually over the next three years, outstripping the Swedish market's 15%. However, revenue growth forecasts of 17.2% per year slightly lag behind the high-growth benchmark but still surpass the broader market's expectation of 1%.

- Unlock comprehensive insights into our analysis of Surgical Science Sweden stock in this growth report.

- Our comprehensive valuation report raises the possibility that Surgical Science Sweden is priced lower than what may be justified by its financials.

Make It Happen

- Embark on your investment journey to our 93 Fast Growing Swedish Companies With High Insider Ownership selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether RaySearch Laboratories is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer care in the Americas, Europe, Africa, the Asia-Pacific, and the Middle East.

Flawless balance sheet with reasonable growth potential.