Billerud (OM:BILL) Margin Rebound Driven by SEK544M One-Off Gain Spurs Quality Debate

Reviewed by Simply Wall St

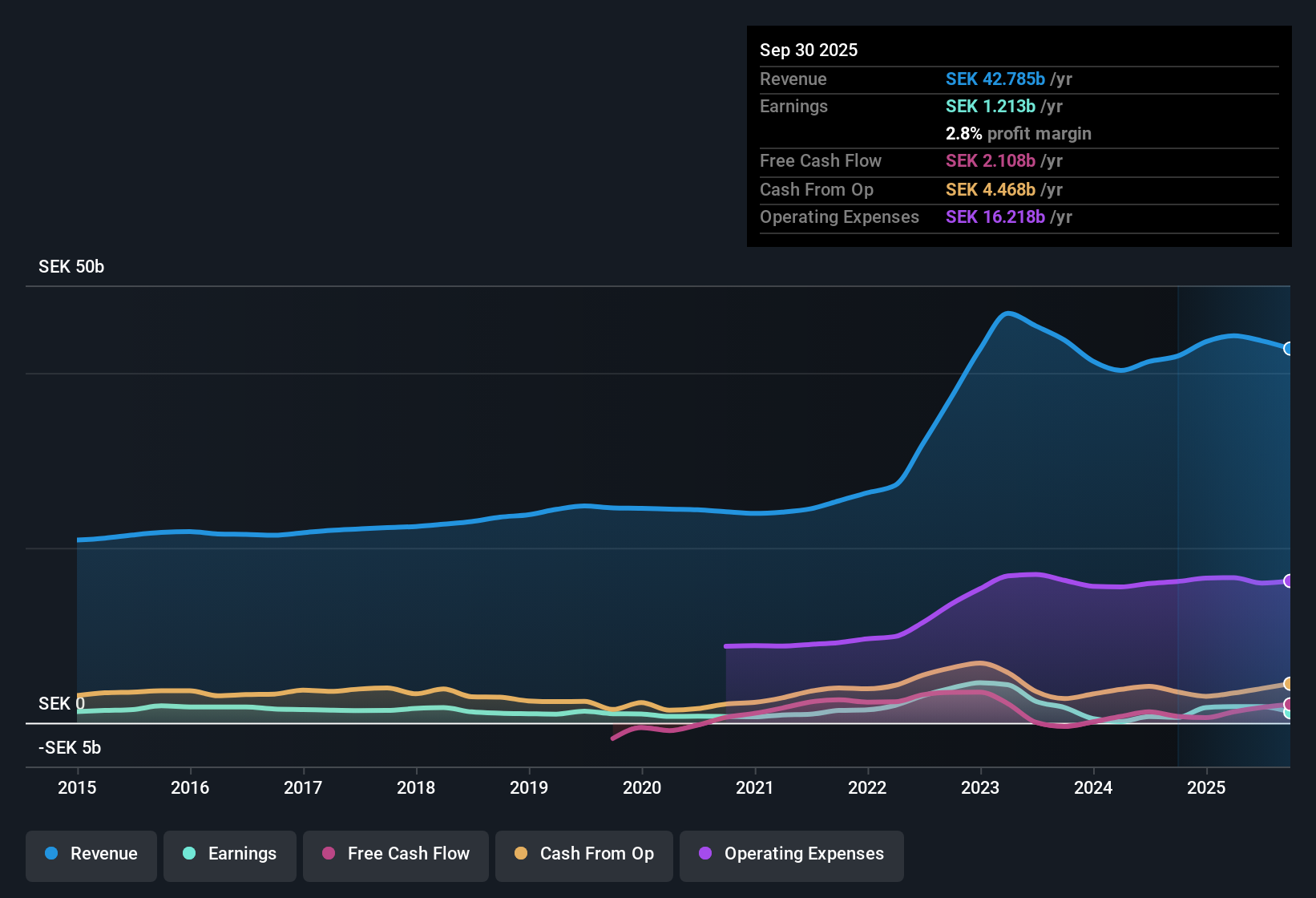

Billerud (OM:BILL) posted net profit margins of 2.8%, up from last year's 1.5%, with earnings growth of 98.5% over the past twelve months. This marks a sharp turnaround from a five-year annual decline of 0.6%. While revenue is projected to inch up 1% per year, which trails the Swedish market's expected 3.9%, the company forecasts a robust 40.6% annual rise in earnings, outpacing the market’s 12.6% rate. Investors will be focused on whether this accelerating profitability can sustain the momentum, especially with a premium valuation and the quality of earnings in the spotlight.

See our full analysis for Billerud.Next, we’ll compare these headline numbers to the narratives investors follow most closely, highlighting where the story matches up or doesn’t.

See what the community is saying about Billerud

Margins Backed by One-Off Gain

- Billerud reported a SEK544.0 million one-off gain, a material contributor to the recent margin improvement and a factor to watch for repeatability in future periods.

- Analysts' consensus view highlights that while operational efficiencies and cost reductions are expected to support margin stability, the presence of such a large one-off gain this year raises questions about the sustainability of margins at the current level.

- Consensus notes margins are forecast to remain at 4.2% over the next three years. This stability depends on recurring operational improvements rather than non-core gains.

- Bears continue to flag that heavy reliance on non-operating gains could make the quality of earnings volatile if these items are not repeated, putting margin expansion at risk.

- Consensus narrative argues bulls and bears both watch for margin quality shifts this year, as the headline number partially reflects one-off items rather than purely improved underlying profitability.

- Analysts' consensus see structural cost cuts as a partial counterbalance, but warn the headline margin may not persist without more operational evidence.

Pace of Forecast Profit Growth

- Forecasts call for Billerud’s earnings to climb 40.6% annually, well ahead of the Swedish market’s expected 12.6% rate. If these projections hold, it signals a dramatic turnaround story.

- According to the analysts' consensus view, much of this ambitious profit growth stems not from topline revenue expansion, which is forecast at only 1% annually, but from a combination of cost management, premium product mix, and increased operating efficiency.

- Consensus further asserts that access to new high-value packaging markets and recurring long-term contracts is central to delivering this profit surge, especially in the U.S. and Asia.

- However, consensus cautions persistence of weak demand and increased competition could limit realization of these upbeat profit projections, meaning actual growth could diverge from the optimistic forecasts.

Valuation Premium Versus Peers

- At a current price-to-earnings ratio of 11.8x, Billerud trades at a premium to the broader packaging industry, which is also at 11.8x. Consensus analysts expect the company to reach 15.9x on 2028 projected earnings, a notable valuation stretch if growth does not meet high hopes.

- Consensus narrative points out the company is flagged as undervalued using discounted cash flow, but is more expensive than peers on earnings multiples, setting up a debate over what matters most for investors.

- While consensus highlights a DCF fair value at 401.24 SEK, far above both the 101.8 consensus analyst price target and today’s 90.4 share price, analysts are divided, with targets ranging from 84.0 up to 119.0.

- This valuation gap leads consensus to emphasize the need for investors to scrutinize not just profit potential, but also the foundation and durability of those profits versus sector norms.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Billerud on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Put your viewpoint into a clear narrative and shape the story in just a few minutes. Do it your way.

A great starting point for your Billerud research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Billerud’s margins rely on one-off gains and weak top-line growth, which casts doubt on the sustainability of its recent profit surge and valuation premium.

If you want companies showing more consistent revenue and earnings growth, focus on steady performers by using stable growth stocks screener (2099 results) built for reliability through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Billerud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILL

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives