Arla Plast AB's (STO:ARPL) Share Price Boosted 31% But Its Business Prospects Need A Lift Too

Despite an already strong run, Arla Plast AB (STO:ARPL) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 65% in the last year.

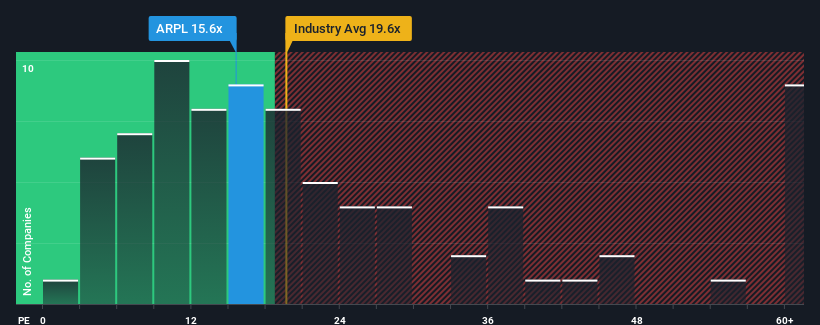

In spite of the firm bounce in price, Arla Plast may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.6x, since almost half of all companies in Sweden have P/E ratios greater than 24x and even P/E's higher than 42x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Arla Plast has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Arla Plast

How Is Arla Plast's Growth Trending?

In order to justify its P/E ratio, Arla Plast would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 101% gain to the company's bottom line. Still, incredibly EPS has fallen 13% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 13% over the next year. With the market predicted to deliver 28% growth , that's a disappointing outcome.

In light of this, it's understandable that Arla Plast's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Arla Plast's P/E

The latest share price surge wasn't enough to lift Arla Plast's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Arla Plast's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Arla Plast (1 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ARPL

Arla Plast

Through its subsidiaries, manufactures, sells, and distributes extruded plastic sheets in Sweden, Germany, the Czech Republic, Poland, rest of Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives