- Sweden

- /

- Metals and Mining

- /

- OM:ALLEI

Alleima (OM:ALLEI) Margin Dip Tests Bullish Growth Narrative as Investors Eye Recovery

Reviewed by Simply Wall St

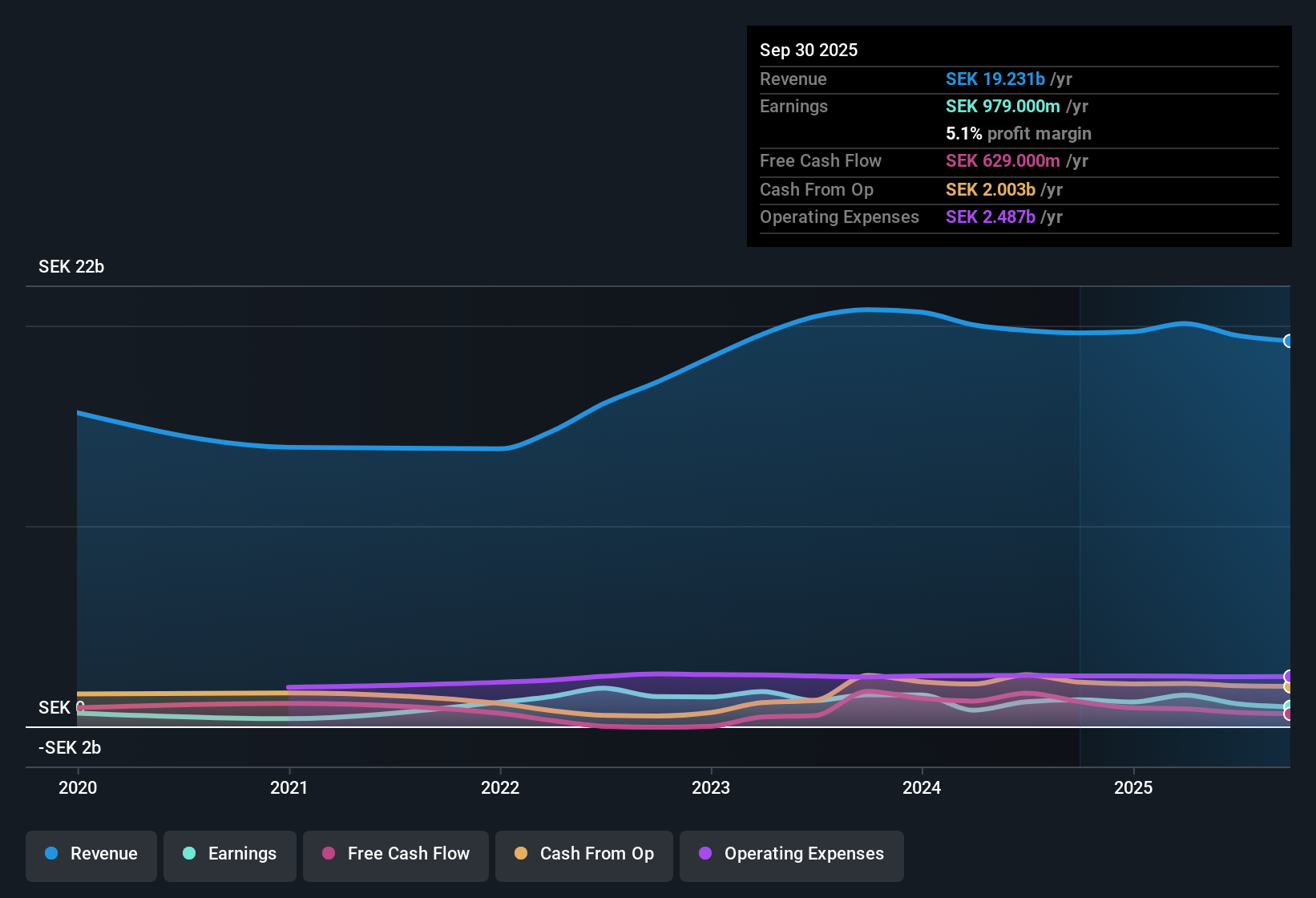

Alleima (OM:ALLEI) is forecasting earnings growth of 21.3% per year and revenue growth of 8.6% per year, both notably outpacing the Swedish market averages of 12.5% and 3.3% respectively. Still, the company’s net profit margin has edged down to 5.8% from 6.2% a year ago, while its five-year annual earnings growth has been just 3% and actually turned negative over the past year. With shares trading below estimated fair value by discounted cash flow calculations but showing a higher P/E than its peers, investors are closely watching for signs of margin recovery and sustained profitable growth.

See our full analysis for Alleima.Next up, we will stack these headline figures against the current market narratives to see which stories hold up and which ones face tough questions.

See what the community is saying about Alleima

Margin Expansion on the Horizon

- Analysts expect Alleima’s net profit margin to increase from 5.8% currently to 8.7% over the next three years, pointing to structural profitability improvements beyond recent results.

- According to the analysts' consensus view, the company’s strategic shift toward high-margin, specialized products and new technology is likely to strengthen margins as volumes recover and low value-add exposures diminish.

- Consensus highlights that as delayed customer investments return, especially in energy transition and medical segments, revenue and earnings should benefit from higher operating leverage.

- The focus on automation and specialty solutions supports earnings durability, making margin gains more resilient if market headwinds subside and demand rebounds.

- With current margin gains projected to accelerate, analysts are watching for operational improvements to confirm this margin recovery story, especially given the recent margin dip.

Consensus sees rising profitability, but keeping an eye on those high-margin bets could be crucial. See segment details and growth drivers in the full narrative. 📊 Read the full Alleima Consensus Narrative.

DCF Fair Value Signals Undervaluation

- Alleima’s share price is 79.6 SEK, trading at a 44% discount to its DCF fair value of 142.88 SEK, even while its P/E ratio of 17.6x is higher than sector and peer averages.

- Analysts' consensus view weighs this valuation gap against mixed signals:

- They note that although the valuation looks attractive on discounted cash flow, the above-average P/E ratio implies investors are already pricing in some growth optimism compared to peers, underscoring a “prove-it” period for management.

- Consensus also stresses that robust balance sheet and liquidity allow Alleima to maintain CapEx and R&D through downturns, reinforcing long-term appeal despite higher P/E multiples.

Resilient Revenue Outlook amid Sector Headwinds

- Despite sector risks, analysts estimate Alleima’s revenue will grow at 2.8% per year over the next three years, supported by ongoing order momentum in Oil & Gas, Nuclear, and Medical segments.

- According to the analysts' consensus view, persistent market challenges like FX volatility and delayed customer investments present hurdles, but the company’s exposure to long-term growth drivers (energy transition, infrastructure buildout) could help revenue normalize and rebound as cyclical headwinds subside.

- Consensus explains that order intake weakness in core industrial segments is expected to be temporary, with normalization driving future revenue catch-ups as policy uncertainty clears.

- Continued investment in new technologies, such as Kanthal’s hydrogen-compatible heaters, positions Alleima early for structural shifts, backing the growth narrative despite near-term pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Alleima on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to look at the figures from a different angle? You can shape your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alleima.

See What Else Is Out There

Alleima’s recent profit margin declines, uneven earnings growth, and a higher-than-average P/E highlight how short-term volatility can cloud long-term confidence.

If you value steady progress and want to avoid unpredictable swings, check out stable growth stocks screener (2094 results) to discover companies delivering reliable growth through all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALLEI

Alleima

Manufactures and sells stainless steels, special alloys, medical wires and components, and electric heating systems in Europe, North America, Asia, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives