- Sweden

- /

- Metals and Mining

- /

- NGM:SOSI

Sotkamo Silver AB's (NGM:SOSI) 48% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Sotkamo Silver AB (NGM:SOSI) shares have been powering on, with a gain of 48% in the last thirty days. The annual gain comes to 171% following the latest surge, making investors sit up and take notice.

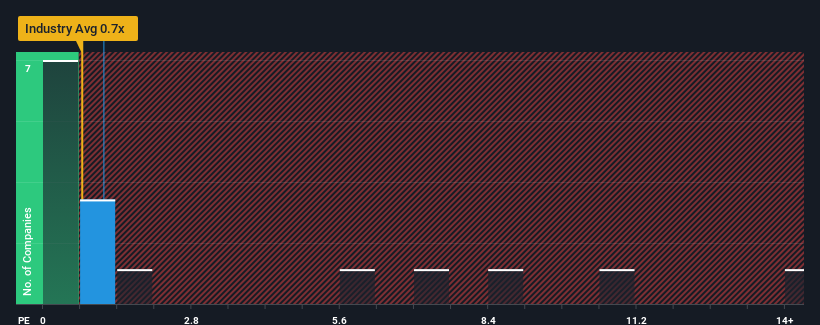

In spite of the firm bounce in price, it's still not a stretch to say that Sotkamo Silver's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in Sweden, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sotkamo Silver

How Has Sotkamo Silver Performed Recently?

Sotkamo Silver certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Sotkamo Silver's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Sotkamo Silver?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sotkamo Silver's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.8% last year. The latest three year period has also seen a 9.2% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.1% each year during the coming three years according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 215% per year, which is noticeably more attractive.

With this in mind, we find it intriguing that Sotkamo Silver's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Sotkamo Silver's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Sotkamo Silver's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 3 warning signs for Sotkamo Silver you should be aware of, and 1 of them is a bit concerning.

If these risks are making you reconsider your opinion on Sotkamo Silver, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Sotkamo Silver, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:SOSI

Sotkamo Silver

A mining and ore prospecting company, develops and utilizes mineral deposits in the Kainuu region in Finland.

Good value with reasonable growth potential.

Market Insights

Community Narratives