- Sweden

- /

- Metals and Mining

- /

- NGM:SOSI

Sotkamo Silver AB Just Reported, And Analysts Assigned A kr4.20 Price Target

It's been a sad week for Sotkamo Silver AB (NGM:SOSI), who've watched their investment drop 10% to kr3.91 in the week since the company reported its yearly result. Results look to have been somewhat negative - revenue fell 3.9% short of analyst estimates at kr198m, although statutory losses were somewhat better. The per-share loss was kr0.75, 200% smaller than analysts were expecting prior to the result. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see analysts' latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Sotkamo Silver

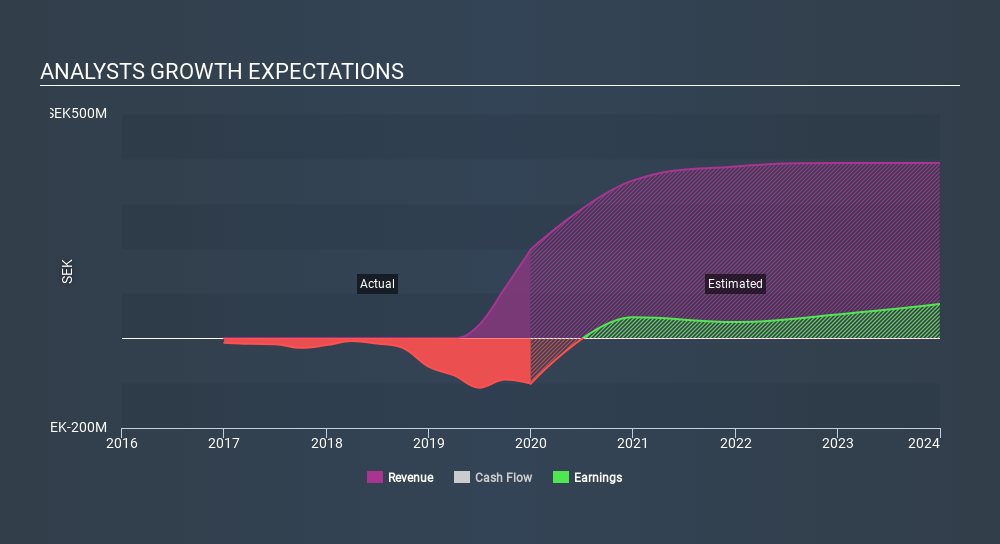

After the latest results, the sole analyst covering Sotkamo Silver are now predicting revenues of kr352.0m in 2020. If met, this would reflect a huge 78% improvement in sales compared to the last 12 months. Sotkamo Silver is also expected to turn profitable, with statutory earnings of kr0.35 per share. In the lead-up to this report, analysts had been modelling revenues of kr358.0m and earnings per share (EPS) of kr0.46 in 2020. So there's definitely been a decline in analyst sentiment after the latest results, noting the large cut to new EPS forecasts.

It might be a surprise to learn that the consensus price target fell 7.7% to kr4.20, with analysts clearly linking lower forecast earnings to the performance of the stock price.

In addition, we can look to Sotkamo Silver's past performance and see whether business is expected to improve, and if the company is expected to perform better than wider market. We would highlight that Sotkamo Silver's revenue growth is expected to slow, with forecast 78% increase next year well below the historical 157%p.a. growth over the last three years. Juxtapose this against the other companies in the market with analyst coverage, which are forecast to grow their revenues (in aggregate) 3.1% next year. So it's pretty clear that, while Sotkamo Silver's revenue growth is expected to slow, it's still expected to grow faster than the market itself.

The Bottom Line

The biggest concern with the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Sotkamo Silver. Fortunately, analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - and our data does suggest that Sotkamo Silver's revenues are expected to grow faster than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by the latest results, leading to a lower estimate of Sotkamo Silver's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Sotkamo Silver. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

You can also view our analysis of Sotkamo Silver's balance sheet, and whether we think Sotkamo Silver is carrying too much debt, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NGM:SOSI

Sotkamo Silver

A mining and ore prospecting company, develops and utilizes mineral deposits in the Kainuu region in Finland.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives