- Sweden

- /

- Medical Equipment

- /

- OM:XVIVO

XVIVO Perfusion (OM:XVIVO) Margin Dip Challenges Bullish Growth Narrative Despite 26.8% Revenue Outlook

Reviewed by Simply Wall St

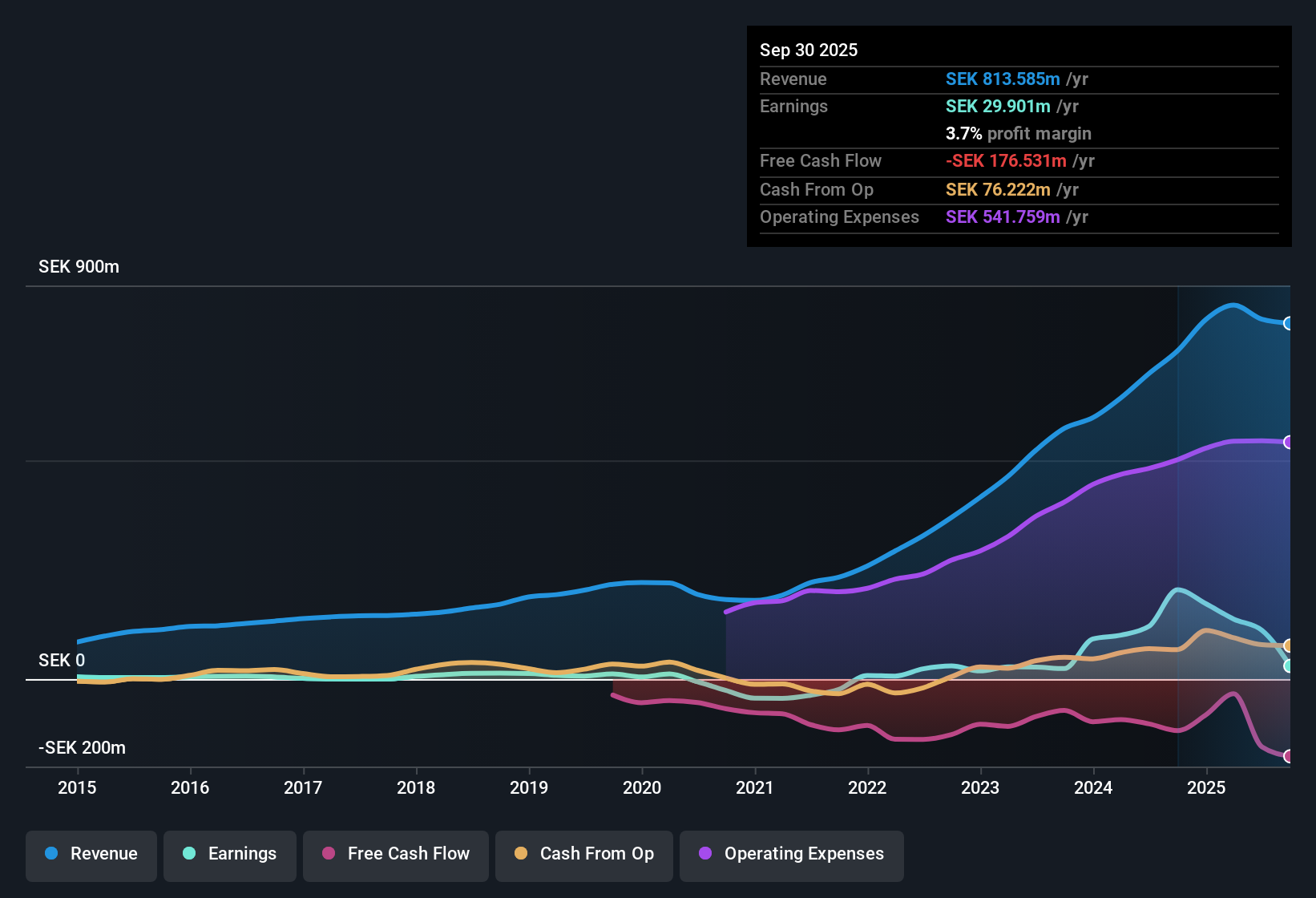

XVIVO Perfusion (OM:XVIVO) posted a promising outlook, with revenue forecast to climb 26.8% per year and earnings expected to surge 78.3% annually. Both figures are pacing well ahead of the Swedish market averages. However, current net profit margins of 13.5% have slipped from last year's 17.3%, signaling some recent pressure. Over the past five years, the company has transitioned to profitability, recording a brisk 71% annual earnings growth. Investors are likely focused on these robust growth projections, even as traditional valuation metrics show the shares trading at a premium compared to peers.

See our full analysis for Xvivo Perfusion.Next, we will see how these results measure up against the narratives widely held by the Simply Wall St community, highlighting where the numbers support the story and where they might contradict the prevailing views.

See what the community is saying about Xvivo Perfusion

Strategic Approvals Propel North American Growth

- Regulatory wins in the U.S. and Canada create fresh revenue streams, with potential for major share gains as XVIVO's liver and heart technologies enter these markets.

- Analysts’ consensus view frames these approvals as game-changers that align with management’s ambitious plan to grow revenue 26.8% annually, topping Sweden's market rate of 3.6%.

- Expansion into Canada following liver and kidney product authorizations could add significant scale, backing analyst assumptions for SEK 1.8 billion in revenue by 2028.

- Consensus narrative notes, however, that execution risks from regulatory delays or production bottlenecks could restrain growth if unresolved.

See how the community is weighing up these expansion milestones and the big growth outlook. 📊 Read the full Xvivo Perfusion Consensus Narrative.

Margins Set for Improvement, but Still Under Pressure

- Gross margin in the Abdominal segment is targeted to reach 70% by 2027, building from current profit margins of 13.5%. This remains below last year’s margin of 17.3%.

- According to the analysts’ consensus view, efforts to increase scale and improve margins reinforce the growth drive, yet these efforts are shadowed by the observed margin dip.

- Analysts highlight initiatives in production and service delivery as key paths back toward margin expansion in the coming years.

- Still, recent margin compression confirms that scaling ambitions face real operational headwinds, which tempers near-term optimism.

Valuation Premium Tied to Future Delivery

- XVIVO's P/E ratio of 51.6x trades above the European medical equipment industry average of 29.5x and the peer average of 51.2x. This signals a clear growth premium reflected in the SEK 182.4 share price.

- Consensus narrative observes that with analysts’ price target of 327.6 compared to a current price of 182.4, the stock’s upside relies on XVIVO meeting aggressive growth and profit targets.

- Valuation only looks reasonable if the company closes the gap between current and forecast margins and sustains its large revenue trajectory.

- If margin gains falter or U.S. expansion stalls, today’s premium could appear stretched compared to industry averages.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Xvivo Perfusion on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your outlook in just a few minutes and shape the narrative your way with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Xvivo Perfusion.

See What Else Is Out There

While XVIVO Perfusion’s ambitious growth targets fuel a valuation premium, compressing margins and execution risks make the outlook less certain for near-term investors.

If you want to focus on companies trading at fairer prices relative to their growth potential, discover opportunities right now with these 876 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:XVIVO

Xvivo Perfusion

A medical technology company, develops and markets machines and perfusion solutions for assessing usable organs and maintains in optimal condition pending transplantation in Sweden.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives