- Sweden

- /

- Commercial Services

- /

- OM:SECU B

3 Swedish Exchange Stocks Estimated To Be Undervalued By Up To 49.4%

Reviewed by Simply Wall St

As global markets react to the recent rate cuts by the U.S. Federal Reserve, European indices have shown mixed results with cautious optimism about future monetary policies. Amid this backdrop, investors are increasingly looking towards undervalued stocks that offer potential for significant returns. In Sweden's market, identifying stocks that are trading below their intrinsic value can be particularly rewarding given the current economic conditions. Here, we explore three Swedish exchange stocks estimated to be undervalued by up to 49.4%.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Concentric (OM:COIC) | SEK222.00 | SEK407.81 | 45.6% |

| Husqvarna (OM:HUSQ B) | SEK68.44 | SEK125.59 | 45.5% |

| Lindab International (OM:LIAB) | SEK282.00 | SEK524.47 | 46.2% |

| Nolato (OM:NOLA B) | SEK53.65 | SEK99.02 | 45.8% |

| Dometic Group (OM:DOM) | SEK57.80 | SEK106.43 | 45.7% |

| Securitas (OM:SECU B) | SEK131.15 | SEK259.15 | 49.4% |

| Nexam Chemical Holding (OM:NEXAM) | SEK4.00 | SEK7.94 | 49.6% |

| MilDef Group (OM:MILDEF) | SEK80.70 | SEK160.04 | 49.6% |

| BHG Group (OM:BHG) | SEK13.89 | SEK26.30 | 47.2% |

| Lyko Group (OM:LYKO A) | SEK118.40 | SEK217.23 | 45.5% |

Let's uncover some gems from our specialized screener.

Securitas (OM:SECU B)

Overview: Securitas AB (publ) provides security services across North America, Europe, Latin America, Africa, the Middle East, Asia, and Australia with a market cap of SEK75.14 billion.

Operations: The company's revenue segments include Securitas North America at SEK63.72 billion, Security Services Europe (including Mobile & Monitoring) at SEK68.62 billion, and Securitas Ibero-America at SEK14.67 billion.

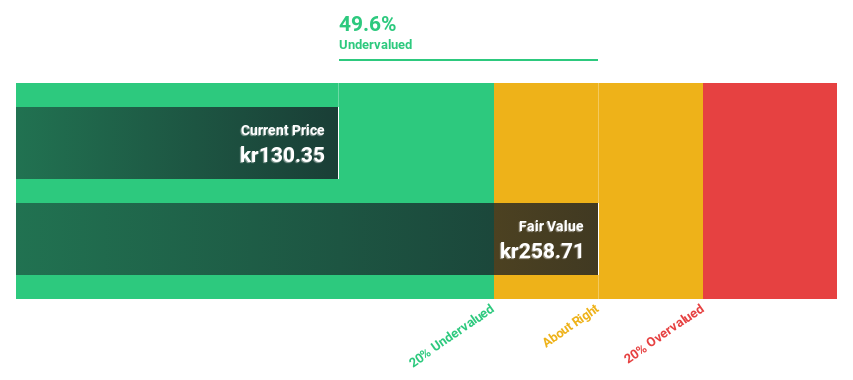

Estimated Discount To Fair Value: 49.4%

Securitas AB's recent earnings report for Q2 2024 shows a solid performance with sales of SEK 40.64 billion and net income of SEK 1.31 billion, reflecting growth from the previous year. The stock is trading at SEK 131.15, significantly below its estimated fair value of SEK 259.15, indicating it is undervalued based on discounted cash flows (DCF). Despite lower profit margins and unsustainable dividends, its forecasted annual earnings growth of over 41% suggests strong future potential.

- The growth report we've compiled suggests that Securitas' future prospects could be on the up.

- Take a closer look at Securitas' balance sheet health here in our report.

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) is a global provider of architecture and engineering consultancy services with a market cap of SEK62.76 billion.

Operations: Sweco's revenue segments include Sweco UK (SEK1.47 billion), Sweco Norway (SEK3.50 billion), Sweco Sweden (SEK8.74 billion), Sweco Belgium (SEK3.97 billion), Sweco Denmark (SEK3.24 billion), Sweco Finland (SEK3.67 billion), Sweco Netherlands (SEK3.00 billion) and Sweco Germany & Central Europe (SEK2.71 billion).

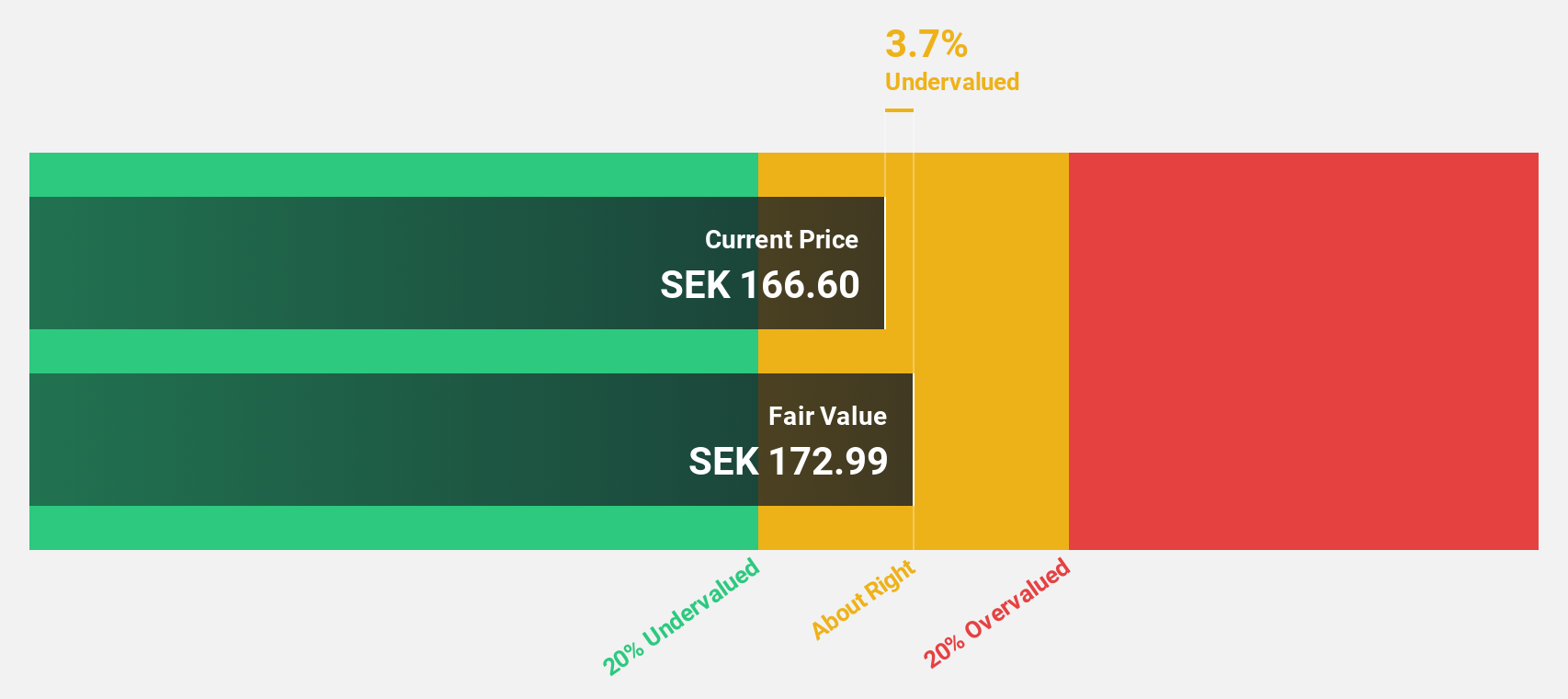

Estimated Discount To Fair Value: 25.8%

Sweco AB's Q2 2024 earnings report shows strong performance with sales of SEK 8.08 billion and net income of SEK 540 million, up from SEK 7.25 billion and SEK 357 million a year ago. The stock trades at SEK 174.4, significantly below the estimated fair value of SEK 235.07, suggesting undervaluation based on discounted cash flows (DCF). Additionally, Sweco secured a major contract worth about SEK 400 million for expanding the East Coast Line between Uppsala and Stockholm, enhancing its future revenue prospects.

- In light of our recent growth report, it seems possible that Sweco's financial performance will exceed current levels.

- Navigate through the intricacies of Sweco with our comprehensive financial health report here.

Xvivo Perfusion (OM:XVIVO)

Overview: Xvivo Perfusion AB (publ) is a medical technology company that develops and markets machines and perfusion solutions for assessing and maintaining organs pending transplantation, with a market cap of SEK15.73 billion.

Operations: Xvivo Perfusion AB's revenue segments are comprised of Services (SEK83.39 million), Thoracic (SEK451.49 million), and Abdominal (SEK163.85 million).

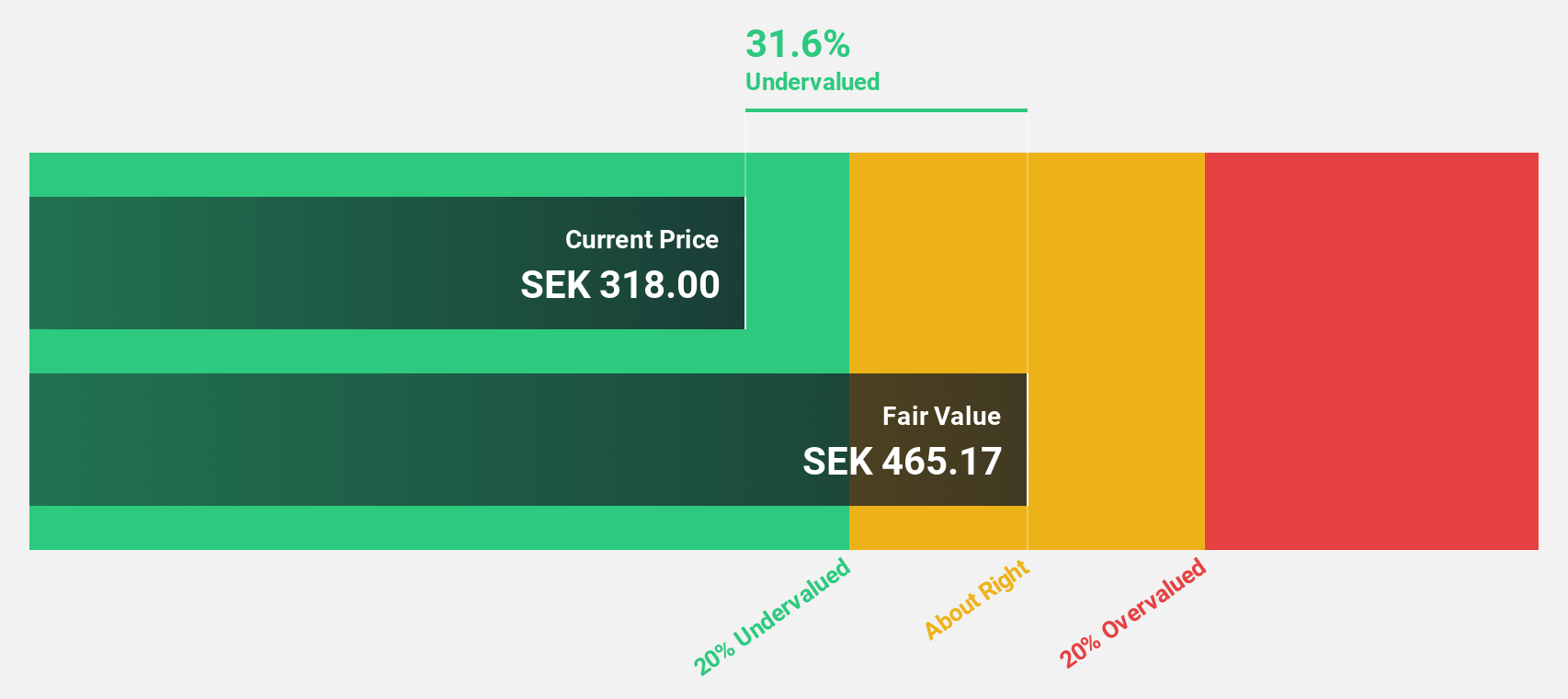

Estimated Discount To Fair Value: 38.3%

Xvivo Perfusion's Q2 2024 earnings report highlights a robust performance with sales of SEK 210.35 million, up from SEK 154.57 million a year ago, and net income rising to SEK 27.19 million from SEK 6.89 million. Trading at SEK 499.5, the stock is significantly undervalued compared to its estimated fair value of SEK 809.42 based on discounted cash flows (DCF). Earnings and revenue are forecasted to grow faster than the Swedish market over the next three years despite a modest return on equity projection of 10.5%.

- Upon reviewing our latest growth report, Xvivo Perfusion's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Xvivo Perfusion with our detailed financial health report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 43 Undervalued Swedish Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECU B

Securitas

Provides security services in North America, Europe, Latin America, Africa, the Middle East, Asia, and Australia.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives