Exploring 3 European Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

In recent weeks, the European market has shown resilience, with the STOXX Europe 600 Index climbing 2.11% on strong corporate earnings and optimism surrounding geopolitical developments. Amidst these broader market movements, small-cap stocks in Europe present intriguing opportunities for investors who are keen to explore companies that may be trading below their perceived value. Identifying promising small-cap stocks often involves looking at those with solid fundamentals and insider buying activity, which can signal confidence in a company's potential despite current economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kitwave Group | 12.2x | 0.3x | 48.34% | ★★★★★☆ |

| Instabank | 10.3x | 3.0x | 22.65% | ★★★★★☆ |

| Sabre Insurance Group | 9.3x | 1.7x | -14.42% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 3.07% | ★★★★☆☆ |

| CVS Group | 45.3x | 1.3x | 37.86% | ★★★★☆☆ |

| Stelrad Group | 40.6x | 0.7x | 38.98% | ★★★☆☆☆ |

| A.G. BARR | 19.5x | 1.8x | 46.17% | ★★★☆☆☆ |

| SmartCraft | 43.0x | 7.7x | 34.19% | ★★★☆☆☆ |

| Hoist Finance | 10.4x | 2.1x | 17.93% | ★★★☆☆☆ |

| Karnov Group | 217.7x | 4.6x | 33.55% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

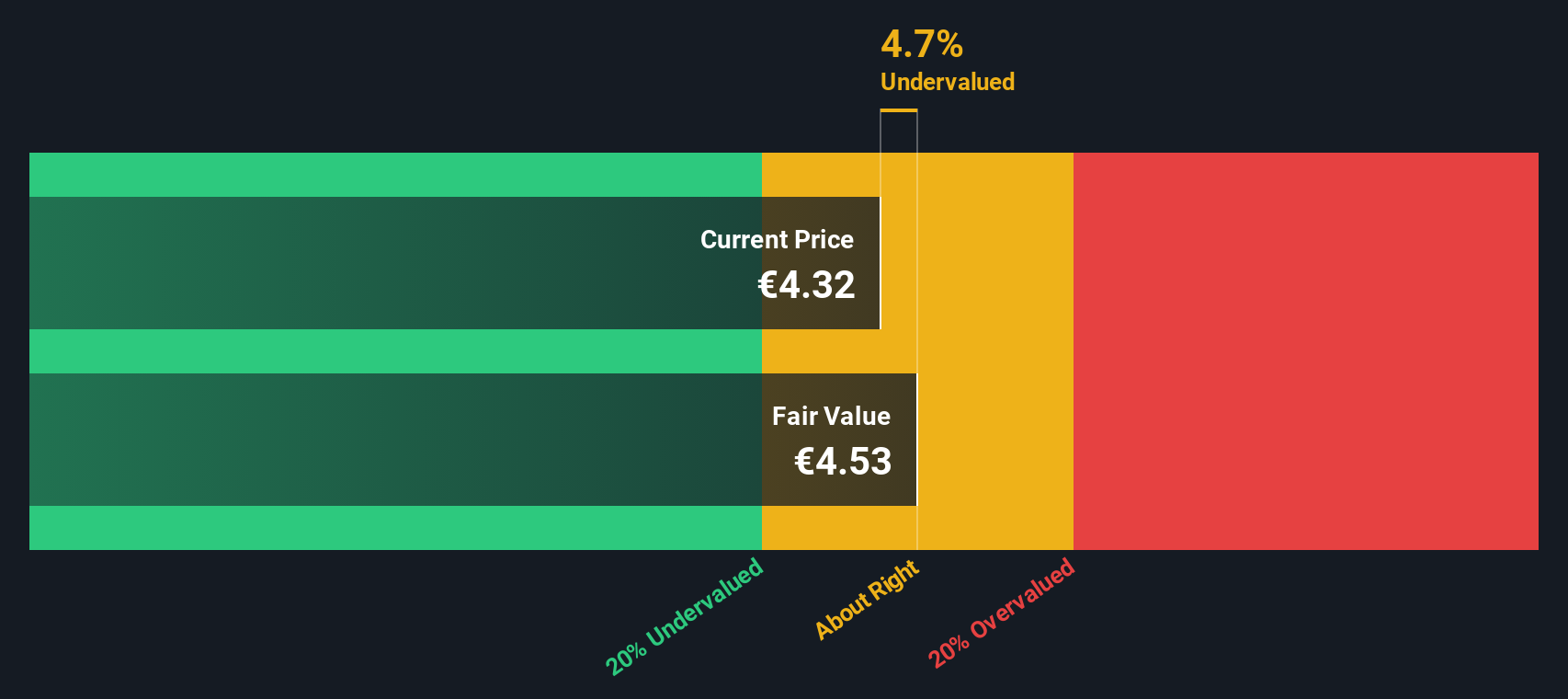

Ariston Holding (BIT:ARIS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ariston Holding is a company engaged in the production and distribution of burners, components, and thermal comfort products with a market capitalization of €4.29 billion.

Operations: The primary revenue stream comes from Thermal Comfort, contributing €2.48 billion, while Burners and Components add €89.20 million and €83.30 million, respectively. The gross profit margin has shown fluctuations, reaching 40.52% in December 2023 before slightly decreasing to 39.82% by June 2025. Operating expenses have been a significant cost factor, with General & Administrative expenses consistently being the largest component within operating costs across the periods analyzed.

PE: 17.2x

Ariston Holding, a small European company, recently showcased insider confidence with share purchases in early 2025. Despite a volatile share price over the past three months and reliance on external borrowing, Ariston's financials reveal potential. Their half-year earnings report for June 30, 2025, showed sales of €1.3 billion and a net income turnaround to €58.7 million from a previous loss. Earnings per share rose to €0.16 from last year's loss of €0.09, indicating promising growth prospects amidst industry challenges.

- Unlock comprehensive insights into our analysis of Ariston Holding stock in this valuation report.

Gain insights into Ariston Holding's past trends and performance with our Past report.

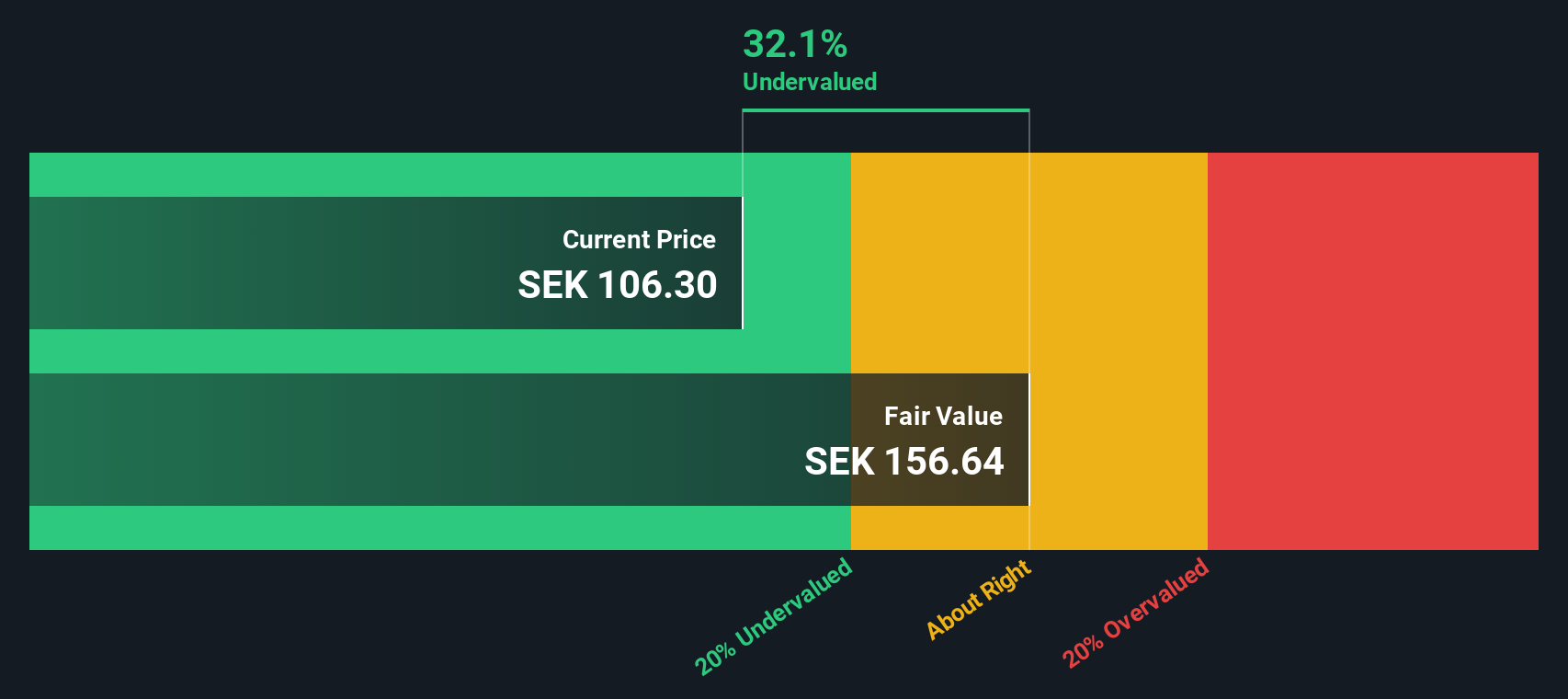

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BioGaia is a Swedish company specializing in the development and sale of probiotic products, with a market cap of SEK 10.97 billion.

Operations: BioGaia generates its revenue primarily from the Pediatrics and Adult Health segments, with Pediatrics being the larger contributor. The company's cost of goods sold (COGS) has shown variability over time, impacting its gross profit margins, which have fluctuated around 73% in recent periods. Operating expenses are significant and include substantial allocations to sales and marketing as well as research and development efforts.

PE: 33.2x

BioGaia, a dynamic player in the European market, is seeing insider confidence with recent share purchases. Despite a decrease in profit margins from 29.3% to 19.9%, earnings are projected to grow by 22.33% annually. The company recently launched BioGaia New Sciences, venturing into the burgeoning skin microbiome sector valued at US$1.03 billion in 2024 and expected to surge further by 2032. This strategic expansion aligns with increasing consumer interest in science-backed skincare solutions, potentially bolstering BioGaia's growth trajectory despite current financial challenges.

- Delve into the full analysis valuation report here for a deeper understanding of BioGaia.

Review our historical performance report to gain insights into BioGaia's's past performance.

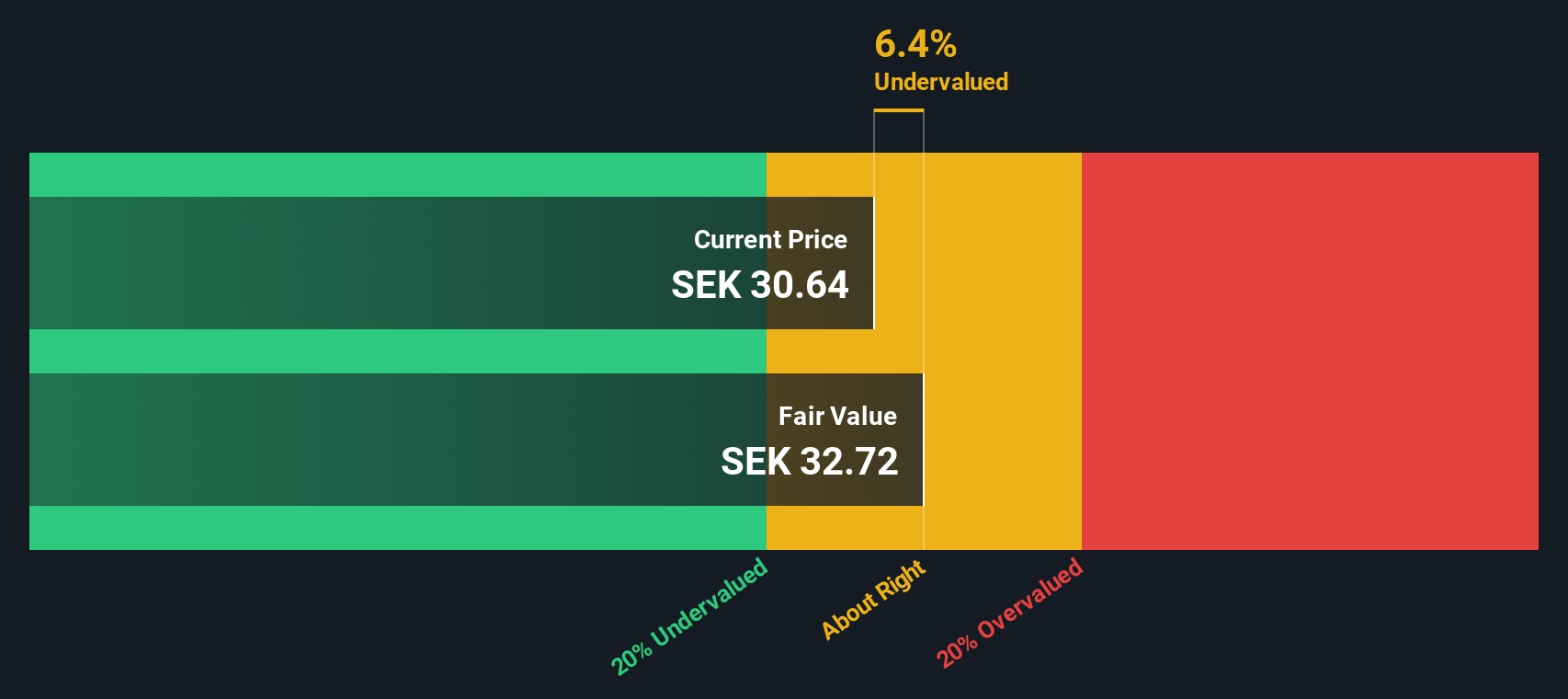

Vimian Group (OM:VIMIAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vimian Group operates in the animal health sector, focusing on Medtech, Diagnostics, Specialty Pharma, and Veterinary Services with a market cap of €1.73 billion.

Operations: Vimian Group generates revenue primarily from Specialty Pharma (€178.2 million), Medtech (€142.1 million), and Veterinary Services (€61.6 million). The company reported a gross profit margin of 69.03% as of June 2025, reflecting the efficiency in managing its cost of goods sold relative to sales. Operating expenses, including significant general and administrative costs, impact net income levels across reporting periods.

PE: 65.2x

Vimian Group, a European small-cap company, recently reported second-quarter sales of €104.3 million, up from €91 million the previous year. Their net income increased to €8.3 million from €4.9 million, reflecting potential growth opportunities despite recent leadership changes with an interim CEO and new executive appointments. Insider confidence is evident as they have been purchasing shares over the past months, signaling belief in future prospects amid evolving company strategies and reclassified share structures for incentives.

Summing It All Up

- Click this link to deep-dive into the 48 companies within our Undervalued European Small Caps With Insider Buying screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ARIS

Ariston Holding

Through its subsidiaries, produces and distributes hot water and space heating solutions in the Netherlands, Germany, Italy, Switzerland, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives